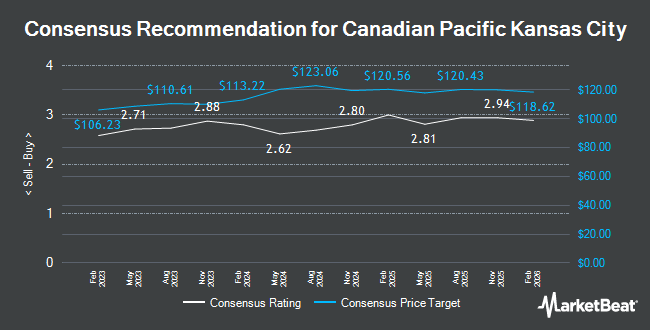

Canadian Pacific Kansas City (TSE:CP - Free Report) NYSE: CP had its price objective lowered by CIBC from C$124.00 to C$122.00 in a report released on Thursday morning,BayStreet.CA reports. CIBC currently has an outperform rating on the stock.

A number of other analysts have also commented on the company. Raymond James Financial increased their price objective on Canadian Pacific Kansas City from C$115.00 to C$120.00 and gave the company an "outperform" rating in a research note on Thursday, July 17th. The Goldman Sachs Group lowered Canadian Pacific Kansas City from a "strong-buy" rating to a "hold" rating in a research note on Monday, June 2nd. Royal Bank Of Canada decreased their price target on Canadian Pacific Kansas City from C$122.00 to C$121.00 and set an "outperform" rating on the stock in a research note on Thursday, May 1st. UBS Group raised their price target on Canadian Pacific Kansas City from C$113.00 to C$116.00 in a research note on Thursday, May 1st. Finally, Scotiabank raised their price target on Canadian Pacific Kansas City from C$115.00 to C$120.00 in a research note on Thursday, July 10th. One equities research analyst has rated the stock with a sell rating, two have issued a hold rating, ten have given a buy rating and four have given a strong buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Buy" and a consensus target price of C$119.46.

Check Out Our Latest Research Report on Canadian Pacific Kansas City

Canadian Pacific Kansas City Price Performance

Shares of CP traded down C$1.34 during trading hours on Thursday, reaching C$100.56. 1,609,193 shares of the company traded hands, compared to its average volume of 1,617,576. The company has a quick ratio of 0.42, a current ratio of 0.53 and a debt-to-equity ratio of 49.64. The stock has a market capitalization of C$93.99 billion, a PE ratio of 26.55, a price-to-earnings-growth ratio of 2.32 and a beta of 0.79. Canadian Pacific Kansas City has a fifty-two week low of C$94.60 and a fifty-two week high of C$119.20. The stock has a fifty day simple moving average of C$109.20 and a 200 day simple moving average of C$107.74.

Canadian Pacific Kansas City Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Monday, October 27th. Investors of record on Friday, September 26th will be given a dividend of $0.228 per share. This represents a $0.91 annualized dividend and a yield of 0.9%. Canadian Pacific Kansas City's dividend payout ratio (DPR) is presently 20.06%.

Insider Activity

In related news, Senior Officer Maeghan Dawn Albiston sold 12,950 shares of the business's stock in a transaction that occurred on Tuesday, May 27th. The stock was sold at an average price of C$112.04, for a total transaction of C$1,450,853.25. Also, Senior Officer John Kenneth Brooks sold 37,420 shares of the business's stock in a transaction that occurred on Wednesday, May 28th. The stock was sold at an average price of C$111.43, for a total value of C$4,169,691.14. Insiders sold a total of 343,599 shares of company stock worth $38,107,437 in the last ninety days. 0.03% of the stock is currently owned by company insiders.

About Canadian Pacific Kansas City

(

Get Free Report)

Canadian Pacific is a CAD 8 billion Class-1 railroads operating on more than 12,500 miles of track across most of Canada and into parts of the Midwestern and Northeastern United States. It is the second-smallest Class I railroad by revenue and route miles. In 2021, CP hauled shipments of grain (22% of freight revenue), intermodal containers (22%), energy products (like crude and frac sand), chemicals, and plastics (20%) coal (8%), fertilizer and potash (10%), automotive products (5%), and a diverse mix of other merchandise.

See Also

Before you consider Canadian Pacific Kansas City, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian Pacific Kansas City wasn't on the list.

While Canadian Pacific Kansas City currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.