Canadian Tire (TSE:CTC.A - Get Free Report) had its price target cut by equities research analysts at TD Securities from C$184.00 to C$183.00 in a research report issued on Wednesday,BayStreet.CA reports. The brokerage currently has a "hold" rating on the stock. TD Securities' price objective points to a potential upside of 8.32% from the company's previous close.

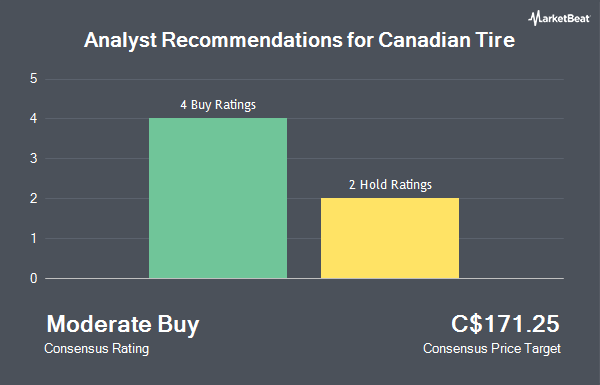

Other research analysts have also recently issued research reports about the company. Scotiabank boosted their price target on Canadian Tire from C$145.00 to C$150.00 and gave the stock an "underperform" rating in a research note on Friday, August 8th. Desjardins upped their price objective on Canadian Tire from C$175.00 to C$195.00 and gave the company a "buy" rating in a research report on Tuesday, August 5th. National Bankshares reduced their price objective on Canadian Tire from C$204.00 to C$190.00 and set a "sector perform" rating for the company in a research report on Friday, August 8th. Finally, BMO Capital Markets cut Canadian Tire from an "outperform" rating to a "market perform" rating and reduced their price objective for the company from C$191.00 to C$175.00 in a research report on Friday, August 8th. Two investment analysts have rated the stock with a Buy rating, four have given a Hold rating and one has issued a Sell rating to the company. According to MarketBeat, the company has an average rating of "Hold" and an average target price of C$173.11.

Read Our Latest Research Report on Canadian Tire

Canadian Tire Stock Up 0.1%

Shares of CTC.A stock traded up C$0.17 during mid-day trading on Wednesday, hitting C$168.94. The company's stock had a trading volume of 35,530 shares, compared to its average volume of 297,509. Canadian Tire has a 52-week low of C$139.50 and a 52-week high of C$194.39. The business has a 50-day moving average price of C$169.83 and a 200 day moving average price of C$168.44. The company has a debt-to-equity ratio of 173.58, a quick ratio of 1.15 and a current ratio of 1.79. The stock has a market cap of C$9.13 billion, a price-to-earnings ratio of 12.35, a PEG ratio of 0.35 and a beta of 1.01.

About Canadian Tire

(

Get Free Report)

Canadian Tire Corporation, Limited, TSX: CTC.A TSX: CTC or 'CTC', is a group of companies that includes a Retail segment, a Financial Services division and CT REIT. Our retail business is led by Canadian Tire, which was founded in 1922 and provides Canadians with products for life in Canada across its Living, Playing, Fixing, Automotive and Seasonal & Gardening divisions.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Canadian Tire, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian Tire wasn't on the list.

While Canadian Tire currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.