Equities research analysts at Lifesci Capital began coverage on shares of Candel Therapeutics (NASDAQ:CADL - Get Free Report) in a research report issued on Tuesday,Benzinga reports. The firm set an "outperform" rating and a $16.00 price target on the stock. Lifesci Capital's price target suggests a potential upside of 185.71% from the stock's previous close.

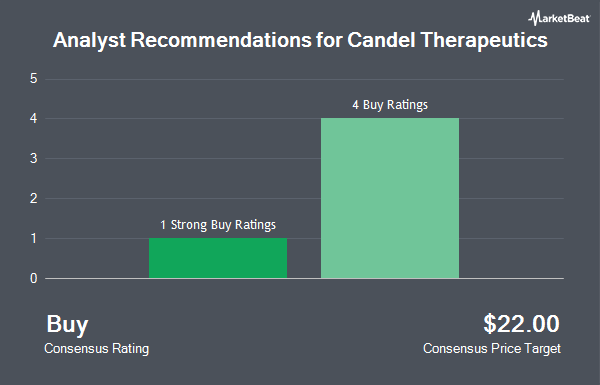

Several other research firms have also issued reports on CADL. Bank of America lowered shares of Candel Therapeutics from a "buy" rating to a "neutral" rating and dropped their price target for the stock from $13.00 to $7.00 in a research report on Wednesday, September 3rd. Weiss Ratings reissued a "sell (d-)" rating on shares of Candel Therapeutics in a research report on Wednesday, October 8th. HC Wainwright reissued a "buy" rating and issued a $23.00 price target on shares of Candel Therapeutics in a research report on Monday, September 29th. Wall Street Zen raised shares of Candel Therapeutics from a "sell" rating to a "hold" rating in a research report on Saturday, September 20th. Finally, Brookline Capital Management raised shares of Candel Therapeutics to a "strong-buy" rating in a research report on Wednesday, July 9th. One analyst has rated the stock with a Strong Buy rating, four have given a Buy rating, one has assigned a Hold rating and one has given a Sell rating to the company. Based on data from MarketBeat.com, Candel Therapeutics has a consensus rating of "Moderate Buy" and an average target price of $19.20.

Read Our Latest Analysis on Candel Therapeutics

Candel Therapeutics Stock Performance

Shares of CADL traded up $0.06 during trading hours on Tuesday, reaching $5.60. 174,954 shares of the company traded hands, compared to its average volume of 993,708. The stock's fifty day moving average is $5.54 and its 200 day moving average is $5.49. The stock has a market cap of $307.41 million, a P/E ratio of -8.11 and a beta of -0.94. The company has a debt-to-equity ratio of 0.01, a quick ratio of 7.04 and a current ratio of 7.04. Candel Therapeutics has a 1-year low of $3.79 and a 1-year high of $14.60.

Candel Therapeutics (NASDAQ:CADL - Get Free Report) last announced its quarterly earnings data on Thursday, August 14th. The company reported ($0.09) EPS for the quarter, beating analysts' consensus estimates of ($0.17) by $0.08. Equities research analysts anticipate that Candel Therapeutics will post -1.47 earnings per share for the current fiscal year.

Institutional Trading of Candel Therapeutics

Several large investors have recently added to or reduced their stakes in the company. Acorn Capital Advisors LLC grew its stake in Candel Therapeutics by 19.9% during the second quarter. Acorn Capital Advisors LLC now owns 2,580,517 shares of the company's stock worth $13,057,000 after buying an additional 428,265 shares during the last quarter. Geode Capital Management LLC grew its stake in shares of Candel Therapeutics by 31.5% during the second quarter. Geode Capital Management LLC now owns 903,970 shares of the company's stock valued at $4,575,000 after purchasing an additional 216,509 shares during the last quarter. Halter Ferguson Financial Inc. grew its stake in shares of Candel Therapeutics by 12.0% during the second quarter. Halter Ferguson Financial Inc. now owns 776,516 shares of the company's stock valued at $3,929,000 after purchasing an additional 83,363 shares during the last quarter. Tanager Wealth Management LLP bought a new stake in shares of Candel Therapeutics during the second quarter valued at approximately $995,000. Finally, HB Wealth Management LLC grew its stake in shares of Candel Therapeutics by 8.0% during the first quarter. HB Wealth Management LLC now owns 94,300 shares of the company's stock valued at $533,000 after purchasing an additional 7,000 shares during the last quarter. 13.93% of the stock is owned by institutional investors.

About Candel Therapeutics

(

Get Free Report)

Candel Therapeutics, Inc, a clinical stage biopharmaceutical company, engages in the development immunotherapies for the cancer patients. It develops CAN-2409, which is in Phase II clinical trials for the treatment of pancreatic cancer; Phase III clinical trials for the treatment of prostate cancer; and Phase II clinical trials for the treatment of lung cancer, as well as has completed Phase Ib/II clinical trials for the treatment of high-grade glioma.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Candel Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Candel Therapeutics wasn't on the list.

While Candel Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.