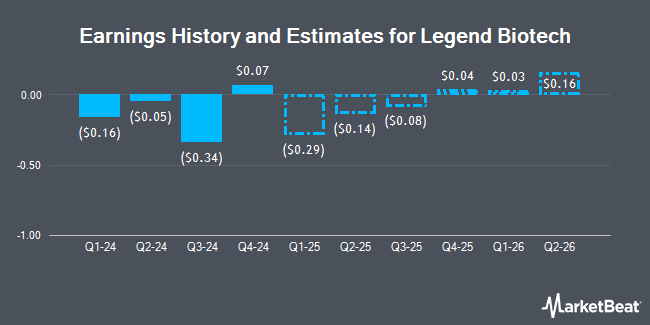

Legend Biotech Corporation Sponsored ADR (NASDAQ:LEGN - Free Report) - Research analysts at Cantor Fitzgerald issued their FY2025 EPS estimates for shares of Legend Biotech in a note issued to investors on Monday, August 4th. Cantor Fitzgerald analyst E. Schmidt anticipates that the company will post earnings of ($0.42) per share for the year. Cantor Fitzgerald has a "Strong-Buy" rating on the stock. The consensus estimate for Legend Biotech's current full-year earnings is ($1.31) per share. Cantor Fitzgerald also issued estimates for Legend Biotech's FY2026 earnings at $0.24 EPS.

Legend Biotech (NASDAQ:LEGN - Get Free Report) last issued its earnings results on Tuesday, May 13th. The company reported ($0.07) EPS for the quarter, beating the consensus estimate of ($0.40) by $0.33. The company had revenue of $195.05 million during the quarter, compared to analysts' expectations of $190.83 million. Legend Biotech had a negative net margin of 29.95% and a negative return on equity of 21.19%. The business's revenue for the quarter was up 107.8% compared to the same quarter last year. During the same period in the previous year, the company earned ($0.16) EPS.

LEGN has been the subject of several other reports. Truist Financial dropped their price objective on Legend Biotech from $88.00 to $71.00 and set a "buy" rating for the company in a research report on Wednesday, May 14th. Royal Bank Of Canada reissued an "outperform" rating and issued a $84.00 target price on shares of Legend Biotech in a report on Tuesday, April 22nd. UBS Group set a $54.00 price target on shares of Legend Biotech and gave the company a "buy" rating in a report on Wednesday, July 2nd. Morgan Stanley reiterated an "overweight" rating and set a $81.00 price objective (up from $80.00) on shares of Legend Biotech in a research report on Thursday, July 10th. Finally, Johnson Rice restated a "buy" rating on shares of Legend Biotech in a research report on Thursday, July 17th. One investment analyst has rated the stock with a hold rating, nine have assigned a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Buy" and a consensus target price of $73.33.

View Our Latest Stock Analysis on Legend Biotech

Legend Biotech Price Performance

NASDAQ LEGN traded down $0.43 on Wednesday, hitting $37.00. 1,177,655 shares of the company's stock were exchanged, compared to its average volume of 1,294,470. The stock has a 50-day moving average of $37.25 and a 200-day moving average of $35.18. The stock has a market cap of $6.80 billion, a price-to-earnings ratio of -62.71 and a beta of 0.26. Legend Biotech has a 52 week low of $27.34 and a 52 week high of $59.62. The company has a current ratio of 5.20, a quick ratio of 5.07 and a debt-to-equity ratio of 0.30.

Hedge Funds Weigh In On Legend Biotech

Several institutional investors and hedge funds have recently added to or reduced their stakes in LEGN. JPMorgan Chase & Co. raised its position in shares of Legend Biotech by 176.0% during the fourth quarter. JPMorgan Chase & Co. now owns 998,016 shares of the company's stock worth $32,475,000 after acquiring an additional 636,390 shares during the last quarter. Geode Capital Management LLC raised its holdings in Legend Biotech by 5.0% during the 4th quarter. Geode Capital Management LLC now owns 519,474 shares of the company's stock worth $16,808,000 after purchasing an additional 24,610 shares during the last quarter. Prudential PLC lifted its position in shares of Legend Biotech by 47.5% in the 4th quarter. Prudential PLC now owns 39,566 shares of the company's stock worth $1,287,000 after purchasing an additional 12,744 shares during the period. Resona Asset Management Co. Ltd. acquired a new position in shares of Legend Biotech in the 4th quarter worth approximately $568,000. Finally, Aviva PLC boosted its stake in shares of Legend Biotech by 3.6% in the 4th quarter. Aviva PLC now owns 48,300 shares of the company's stock valued at $1,572,000 after purchasing an additional 1,700 shares during the last quarter. 70.89% of the stock is currently owned by institutional investors and hedge funds.

About Legend Biotech

(

Get Free Report)

Legend Biotech Corporation, a clinical-stage biopharmaceutical company, through its subsidiaries, engages in the discovery, development, manufacturing, and commercialization of novel cell therapies for oncology and other indications in the United States, China, and internationally. Its lead product candidate, LCAR- B38M, is a chimeric antigen receptor for the treatment of multiple myeloma (MM).

Featured Articles

Before you consider Legend Biotech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Legend Biotech wasn't on the list.

While Legend Biotech currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.