PTC Therapeutics, Inc. (NASDAQ:PTCT - Free Report) - Research analysts at Cantor Fitzgerald cut their FY2026 EPS estimates for PTC Therapeutics in a note issued to investors on Tuesday, July 29th. Cantor Fitzgerald analyst K. Kluska now anticipates that the biopharmaceutical company will earn ($4.36) per share for the year, down from their prior forecast of ($3.22). Cantor Fitzgerald has a "Overweight" rating and a $120.00 price target on the stock. The consensus estimate for PTC Therapeutics' current full-year earnings is ($4.52) per share.

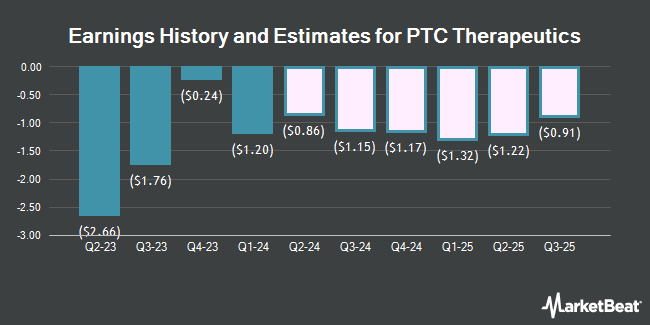

PTC Therapeutics (NASDAQ:PTCT - Get Free Report) last announced its quarterly earnings data on Tuesday, May 6th. The biopharmaceutical company reported $10.04 earnings per share for the quarter, topping analysts' consensus estimates of $0.85 by $9.19. The business had revenue of $1.18 billion for the quarter, compared to analysts' expectations of $437.16 million. PTC Therapeutics had a net margin of 33.56% and a negative return on equity of 78.56%. The business's revenue was down 9.6% compared to the same quarter last year. During the same quarter in the prior year, the company earned ($1.20) earnings per share.

A number of other equities research analysts have also recently commented on the stock. Wells Fargo & Company increased their price target on shares of PTC Therapeutics from $74.00 to $78.00 and gave the company an "overweight" rating in a report on Tuesday, July 29th. Robert W. Baird cut their target price on shares of PTC Therapeutics from $70.00 to $66.00 and set an "outperform" rating for the company in a research report on Wednesday, May 7th. Truist Financial lifted their price target on shares of PTC Therapeutics from $80.00 to $86.00 and gave the stock a "buy" rating in a research note on Tuesday, July 29th. UBS Group lifted their target price on shares of PTC Therapeutics from $71.00 to $80.00 and gave the company a "buy" rating in a research note on Tuesday, July 29th. Finally, Wall Street Zen cut shares of PTC Therapeutics from a "strong-buy" rating to a "buy" rating in a research note on Friday, May 16th. One equities research analyst has rated the stock with a sell rating, four have issued a hold rating, ten have issued a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, PTC Therapeutics has a consensus rating of "Moderate Buy" and an average target price of $69.38.

Read Our Latest Analysis on PTCT

PTC Therapeutics Stock Performance

Shares of NASDAQ:PTCT traded up $0.40 during trading on Thursday, reaching $52.53. 589,989 shares of the stock traded hands, compared to its average volume of 1,051,339. The stock has a 50-day moving average of $49.21 and a two-hundred day moving average of $48.79. PTC Therapeutics has a 52-week low of $29.01 and a 52-week high of $58.38. The stock has a market cap of $4.16 billion, a P/E ratio of 8.04 and a beta of 0.54.

Institutional Investors Weigh In On PTC Therapeutics

Several large investors have recently added to or reduced their stakes in the stock. Sterling Capital Management LLC lifted its position in shares of PTC Therapeutics by 424.4% in the 4th quarter. Sterling Capital Management LLC now owns 645 shares of the biopharmaceutical company's stock worth $29,000 after purchasing an additional 522 shares during the period. Quantbot Technologies LP lifted its position in PTC Therapeutics by 545.5% during the first quarter. Quantbot Technologies LP now owns 652 shares of the biopharmaceutical company's stock valued at $33,000 after acquiring an additional 551 shares during the last quarter. PNC Financial Services Group Inc. increased its stake in PTC Therapeutics by 84.2% during the 1st quarter. PNC Financial Services Group Inc. now owns 700 shares of the biopharmaceutical company's stock valued at $36,000 after purchasing an additional 320 shares in the last quarter. GAMMA Investing LLC increased its stake in PTC Therapeutics by 86.3% during the 1st quarter. GAMMA Investing LLC now owns 952 shares of the biopharmaceutical company's stock valued at $49,000 after purchasing an additional 441 shares in the last quarter. Finally, BI Asset Management Fondsmaeglerselskab A S acquired a new position in PTC Therapeutics during the 1st quarter valued at approximately $61,000.

Insider Activity

In other PTC Therapeutics news, VP Mark Elliott Boulding sold 1,929 shares of the business's stock in a transaction dated Thursday, May 15th. The shares were sold at an average price of $46.18, for a total value of $89,081.22. Following the completion of the sale, the vice president directly owned 103,901 shares of the company's stock, valued at $4,798,148.18. The trade was a 1.82% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CFO Pierre Gravier sold 2,516 shares of the business's stock in a transaction dated Tuesday, July 15th. The shares were sold at an average price of $49.46, for a total transaction of $124,441.36. Following the completion of the sale, the chief financial officer directly owned 71,920 shares of the company's stock, valued at approximately $3,557,163.20. This trade represents a 3.38% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 5,328 shares of company stock worth $254,158 over the last quarter. 5.50% of the stock is currently owned by insiders.

About PTC Therapeutics

(

Get Free Report)

PTC Therapeutics, Inc, a biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines to patients with rare disorders in the United States and internationally. The company offers Translarna and Emflaza for the treatment of Duchenne muscular dystrophy; Upstaza to treat aromatic l-amino acid decarboxylas (AADC) deficiency, a central nervous system disorder; Tegsedi and Waylivra for the treatment of rare diseases; and Evrysdi to treat spinal muscular atrophy (SMA) in adults and children.

See Also

Before you consider PTC Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PTC Therapeutics wasn't on the list.

While PTC Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.