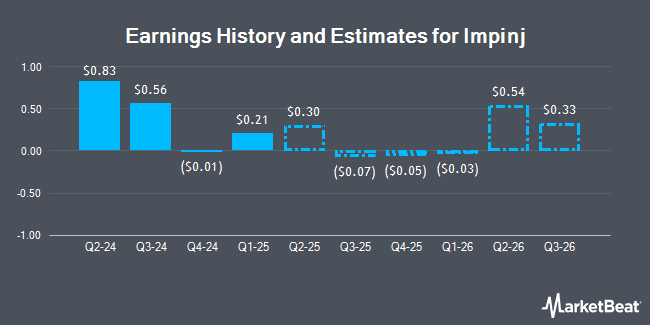

Impinj, Inc. (NASDAQ:PI - Free Report) - Analysts at Cantor Fitzgerald boosted their FY2025 EPS estimates for Impinj in a report released on Thursday, July 31st. Cantor Fitzgerald analyst T. Jensen now expects that the company will post earnings of $0.05 per share for the year, up from their previous estimate of ($0.19). Cantor Fitzgerald has a "Overweight" rating and a $158.00 price objective on the stock. The consensus estimate for Impinj's current full-year earnings is ($0.47) per share. Cantor Fitzgerald also issued estimates for Impinj's FY2026 earnings at $0.45 EPS.

Impinj (NASDAQ:PI - Get Free Report) last posted its quarterly earnings data on Wednesday, July 30th. The company reported $0.80 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.72 by $0.08. Impinj had a net margin of 0.18% and a return on equity of 8.14%. The company had revenue of $97.89 million for the quarter, compared to the consensus estimate of $93.78 million. During the same quarter in the previous year, the firm posted $0.83 EPS. The business's revenue was down 4.5% compared to the same quarter last year.

A number of other brokerages have also issued reports on PI. Susquehanna upped their target price on shares of Impinj from $130.00 to $140.00 and gave the stock a "positive" rating in a research report on Tuesday, July 22nd. Needham & Company LLC increased their price objective on shares of Impinj from $115.00 to $165.00 and gave the company a "buy" rating in a report on Thursday, July 31st. Evercore ISI increased their price objective on shares of Impinj from $99.00 to $117.00 and gave the company an "outperform" rating in a report on Thursday, April 24th. Finally, Piper Sandler increased their price objective on shares of Impinj from $140.00 to $180.00 and gave the company an "overweight" rating in a report on Thursday, July 31st. One analyst has rated the stock with a sell rating, one has given a hold rating and six have assigned a buy rating to the company. According to data from MarketBeat, Impinj currently has an average rating of "Moderate Buy" and a consensus price target of $163.29.

View Our Latest Report on PI

Impinj Price Performance

NASDAQ PI traded down $4.39 on Monday, reaching $155.58. The company's stock had a trading volume of 276,886 shares, compared to its average volume of 646,972. The firm has a market cap of $4.53 billion, a PE ratio of 15,486.39 and a beta of 1.74. The business has a 50-day moving average price of $118.39 and a 200 day moving average price of $105.72. Impinj has a 52 week low of $60.85 and a 52 week high of $239.88. The company has a current ratio of 11.64, a quick ratio of 8.44 and a debt-to-equity ratio of 1.51.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently bought and sold shares of PI. Los Angeles Capital Management LLC grew its holdings in shares of Impinj by 207.6% in the second quarter. Los Angeles Capital Management LLC now owns 6,965 shares of the company's stock worth $774,000 after purchasing an additional 4,701 shares during the last quarter. Bank of Montreal Can boosted its holdings in Impinj by 5.6% in the second quarter. Bank of Montreal Can now owns 3,907 shares of the company's stock valued at $434,000 after acquiring an additional 207 shares in the last quarter. Amalgamated Bank boosted its holdings in Impinj by 1.1% in the second quarter. Amalgamated Bank now owns 6,670 shares of the company's stock valued at $741,000 after acquiring an additional 74 shares in the last quarter. Emerald Advisers LLC boosted its holdings in Impinj by 3.8% in the second quarter. Emerald Advisers LLC now owns 157,919 shares of the company's stock valued at $17,540,000 after acquiring an additional 5,770 shares in the last quarter. Finally, Quaker Wealth Management LLC boosted its holdings in Impinj by 200.0% in the second quarter. Quaker Wealth Management LLC now owns 300 shares of the company's stock valued at $33,000 after acquiring an additional 600 shares in the last quarter.

Impinj Company Profile

(

Get Free Report)

Impinj, Inc operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. Its platform wirelessly connects items and delivers data about the connected items to business and consumer applications. The company's platform comprises endpoint ICs, a miniature radios-on-a-chip that attaches to a host item and includes a number to identify the item.

See Also

Before you consider Impinj, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Impinj wasn't on the list.

While Impinj currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.