Vaxcyte, Inc. (NASDAQ:PCVX - Free Report) - Research analysts at Cantor Fitzgerald cut their FY2025 EPS estimates for shares of Vaxcyte in a research report issued to clients and investors on Thursday, August 7th. Cantor Fitzgerald analyst C. Gould now forecasts that the company will post earnings per share of ($5.50) for the year, down from their prior forecast of ($5.10). Cantor Fitzgerald has a "Overweight" rating on the stock. The consensus estimate for Vaxcyte's current full-year earnings is ($4.21) per share. Cantor Fitzgerald also issued estimates for Vaxcyte's FY2026 earnings at ($7.28) EPS.

Separately, Cowen reaffirmed a "buy" rating on shares of Vaxcyte in a report on Thursday, August 7th. Ten analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the stock presently has an average rating of "Buy" and a consensus price target of $136.50.

Get Our Latest Report on PCVX

Vaxcyte Price Performance

NASDAQ PCVX traded up $0.02 on Monday, hitting $31.57. The company had a trading volume of 422,155 shares, compared to its average volume of 1,786,168. The company has a market capitalization of $4.10 billion, a PE ratio of -7.66 and a beta of 1.21. The company's fifty day moving average price is $34.18 and its 200-day moving average price is $47.48. Vaxcyte has a 12-month low of $27.66 and a 12-month high of $121.06.

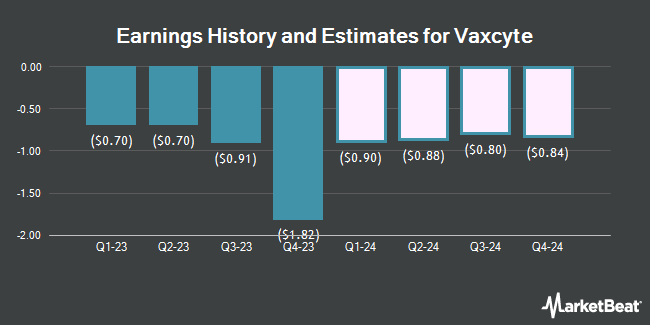

Vaxcyte (NASDAQ:PCVX - Get Free Report) last released its earnings results on Wednesday, August 6th. The company reported ($1.22) EPS for the quarter, missing analysts' consensus estimates of ($1.12) by ($0.10). During the same period in the prior year, the business posted ($1.10) EPS.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently modified their holdings of the company. Wells Fargo & Company MN lifted its position in Vaxcyte by 53.7% in the fourth quarter. Wells Fargo & Company MN now owns 72,275 shares of the company's stock valued at $5,916,000 after buying an additional 25,257 shares during the last quarter. Rhumbline Advisers lifted its position in Vaxcyte by 5.5% in the first quarter. Rhumbline Advisers now owns 181,230 shares of the company's stock valued at $6,843,000 after buying an additional 9,416 shares during the last quarter. Parallel Advisors LLC lifted its position in Vaxcyte by 203.6% in the first quarter. Parallel Advisors LLC now owns 1,597 shares of the company's stock valued at $61,000 after buying an additional 1,071 shares during the last quarter. Envestnet Asset Management Inc. lifted its position in Vaxcyte by 12.5% in the fourth quarter. Envestnet Asset Management Inc. now owns 55,083 shares of the company's stock valued at $4,509,000 after buying an additional 6,121 shares during the last quarter. Finally, Barclays PLC lifted its position in Vaxcyte by 19.1% in the fourth quarter. Barclays PLC now owns 254,885 shares of the company's stock valued at $20,865,000 after buying an additional 40,932 shares during the last quarter. Institutional investors and hedge funds own 96.78% of the company's stock.

Vaxcyte Company Profile

(

Get Free Report)

Vaxcyte, Inc, a clinical-stage biotechnology vaccine company, develops novel protein vaccines to prevent or treat bacterial infectious diseases. Its lead vaccine candidate is VAX-24, a 24-valent investigational pneumococcal conjugate vaccine for the prevention of invasive pneumococcal disease. The company also develops VAX-31 to protect against emerging strains and to help address antibiotic resistance; VAX-A1, a novel conjugate vaccine candidate to prevent disease caused by Group A Streptococcus; VAX-PG, a novel protein vaccine candidate targeting keystone pathogen responsible for periodontitis; and VAX-GI to prevent Shigella, a bacterial illness.

Read More

Before you consider Vaxcyte, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vaxcyte wasn't on the list.

While Vaxcyte currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.