Palo Alto Networks (NASDAQ:PANW - Get Free Report)'s stock had its "overweight" rating restated by investment analysts at Cantor Fitzgerald in a research report issued to clients and investors on Friday,Benzinga reports. They currently have a $223.00 target price on the network technology company's stock. Cantor Fitzgerald's price target points to a potential upside of 28.49% from the company's previous close.

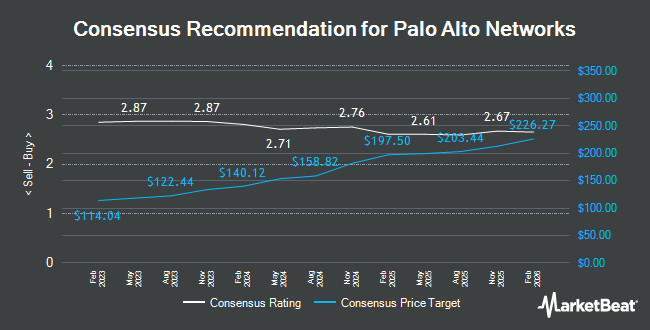

Several other equities research analysts have also issued reports on PANW. Barclays dropped their price objective on shares of Palo Alto Networks from $213.00 to $210.00 and set an "overweight" rating for the company in a research report on Wednesday, May 21st. Roth Capital assumed coverage on shares of Palo Alto Networks in a research note on Thursday, May 15th. They set a "neutral" rating and a $210.00 price objective on the stock. Northland Securities reduced their price objective on shares of Palo Alto Networks from $210.00 to $177.00 and set a "market perform" rating on the stock in a research note on Wednesday, May 21st. UBS Group set a $185.00 price target on shares of Palo Alto Networks and gave the stock a "neutral" rating in a research report on Tuesday. Finally, Guggenheim restated a "sell" rating and issued a $130.00 price target on shares of Palo Alto Networks in a research report on Wednesday, May 21st. Two equities research analysts have rated the stock with a sell rating, thirteen have assigned a hold rating and twenty-seven have assigned a buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $217.01.

Read Our Latest Stock Report on Palo Alto Networks

Palo Alto Networks Stock Performance

Shares of PANW opened at $173.55 on Friday. The company has a market capitalization of $115.72 billion, a price-to-earnings ratio of 99.17, a PEG ratio of 4.20 and a beta of 0.94. The company's 50 day simple moving average is $192.45 and its 200 day simple moving average is $186.52. Palo Alto Networks has a 1 year low of $144.15 and a 1 year high of $210.39.

Palo Alto Networks (NASDAQ:PANW - Get Free Report) last issued its quarterly earnings results on Tuesday, May 20th. The network technology company reported $0.80 EPS for the quarter, topping the consensus estimate of $0.77 by $0.03. Palo Alto Networks had a net margin of 13.95% and a return on equity of 19.48%. The firm had revenue of $2.29 billion during the quarter, compared to analyst estimates of $2.28 billion. During the same quarter in the prior year, the business posted $0.66 earnings per share. Palo Alto Networks's revenue for the quarter was up 15.3% compared to the same quarter last year. Equities analysts expect that Palo Alto Networks will post 1.76 EPS for the current fiscal year.

Insider Transactions at Palo Alto Networks

In other Palo Alto Networks news, EVP Nir Zuk sold 100,000 shares of Palo Alto Networks stock in a transaction that occurred on Friday, August 1st. The shares were sold at an average price of $172.80, for a total value of $17,280,000.00. Following the completion of the sale, the executive vice president directly owned 3,143,516 shares in the company, valued at $543,199,564.80. The trade was a 3.08% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, EVP Dipak Golechha sold 5,000 shares of Palo Alto Networks stock in a transaction that occurred on Monday, June 23rd. The shares were sold at an average price of $201.85, for a total transaction of $1,009,250.00. Following the completion of the sale, the executive vice president owned 101,135 shares of the company's stock, valued at $20,414,099.75. This trade represents a 4.71% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 669,248 shares of company stock valued at $126,423,337. Insiders own 2.50% of the company's stock.

Institutional Trading of Palo Alto Networks

A number of institutional investors and hedge funds have recently modified their holdings of the company. Curi Capital LLC lifted its stake in shares of Palo Alto Networks by 15.1% in the second quarter. Curi Capital LLC now owns 227,334 shares of the network technology company's stock worth $46,522,000 after buying an additional 29,829 shares during the last quarter. Benjamin Edwards Inc. lifted its stake in shares of Palo Alto Networks by 23.8% in the second quarter. Benjamin Edwards Inc. now owns 54,392 shares of the network technology company's stock worth $11,131,000 after buying an additional 10,470 shares during the last quarter. BI Asset Management Fondsmaeglerselskab A S lifted its stake in shares of Palo Alto Networks by 86.3% in the second quarter. BI Asset Management Fondsmaeglerselskab A S now owns 47,160 shares of the network technology company's stock worth $9,651,000 after buying an additional 21,850 shares during the last quarter. Byrne Financial Freedom LLC lifted its stake in shares of Palo Alto Networks by 6.2% in the second quarter. Byrne Financial Freedom LLC now owns 4,129 shares of the network technology company's stock worth $845,000 after buying an additional 241 shares during the last quarter. Finally, Brevan Howard Capital Management LP increased its position in Palo Alto Networks by 598.0% during the second quarter. Brevan Howard Capital Management LP now owns 32,776 shares of the network technology company's stock worth $6,707,000 after acquiring an additional 28,080 shares during the period. 79.82% of the stock is currently owned by institutional investors and hedge funds.

About Palo Alto Networks

(

Get Free Report)

Palo Alto Networks, Inc provides cybersecurity solutions worldwide. The company offers firewall appliances and software; and Panorama, a security management solution for the global control of network security platform as a virtual or a physical appliance. It also provides subscription services covering the areas of threat prevention, malware and persistent threat, URL filtering, laptop and mobile device protection, DNS security, Internet of Things security, SaaS security API, and SaaS security inline, as well as threat intelligence, and data loss prevention.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Palo Alto Networks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Palo Alto Networks wasn't on the list.

While Palo Alto Networks currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.