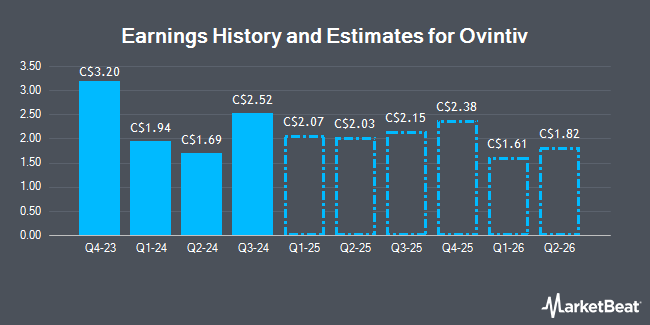

Ovintiv Inc. (TSE:OVV - Free Report) - Stock analysts at Capital One Financial reduced their FY2025 earnings per share estimates for Ovintiv in a research report issued on Wednesday, October 15th. Capital One Financial analyst P. Johnston now anticipates that the company will post earnings per share of $5.80 for the year, down from their previous estimate of $6.44. The consensus estimate for Ovintiv's current full-year earnings is $5.66 per share. Capital One Financial also issued estimates for Ovintiv's Q4 2025 earnings at $1.14 EPS, Q1 2026 earnings at $1.42 EPS, Q2 2026 earnings at $1.50 EPS, Q3 2026 earnings at $1.57 EPS, Q4 2026 earnings at $1.61 EPS and FY2026 earnings at $6.12 EPS.

Several other equities analysts also recently commented on the company. TD Cowen raised Ovintiv to a "strong-buy" rating in a research report on Monday, July 7th. The Goldman Sachs Group raised shares of Ovintiv from a "hold" rating to a "strong-buy" rating in a research note on Tuesday, July 1st. Roth Capital raised shares of Ovintiv to a "hold" rating in a research note on Monday. Finally, Royal Bank Of Canada upgraded shares of Ovintiv from a "hold" rating to a "moderate buy" rating in a report on Wednesday. Four research analysts have rated the stock with a Strong Buy rating, one has given a Buy rating and one has given a Hold rating to the company's stock. According to data from MarketBeat, Ovintiv presently has an average rating of "Strong Buy".

Check Out Our Latest Stock Report on OVV

Ovintiv Trading Down 2.2%

OVV stock opened at C$51.21 on Friday. Ovintiv has a twelve month low of C$42.35 and a twelve month high of C$66.67. The company has a quick ratio of 0.51, a current ratio of 0.52 and a debt-to-equity ratio of 63.59. The firm's fifty day simple moving average is C$56.17 and its two-hundred day simple moving average is C$53.49. The stock has a market capitalization of C$13.16 billion, a price-to-earnings ratio of 22.56, a price-to-earnings-growth ratio of 0.05 and a beta of 0.91.

Ovintiv Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Monday, September 29th. Stockholders of record on Monday, September 29th were paid a $0.30 dividend. The ex-dividend date was Monday, September 15th. This represents a $1.20 dividend on an annualized basis and a dividend yield of 2.3%. Ovintiv's dividend payout ratio is presently 52.86%.

Ovintiv Company Profile

(

Get Free Report)

Ovintiv Inc is a leading North American exploration and production (E&P) company focused on developing its high-quality, multi-basin portfolio. Ovintiv works to safely produce crude oil and natural gas-products that make modern life possible for all. The Company is focused on creating long-term shareholder value while contributing to the strength and sustainability of the communities where it operates.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ovintiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ovintiv wasn't on the list.

While Ovintiv currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.