Cascades (TSE:CAS - Free Report) had its target price raised by TD Securities from C$9.50 to C$10.00 in a research note published on Friday,BayStreet.CA reports. The brokerage currently has a hold rating on the stock.

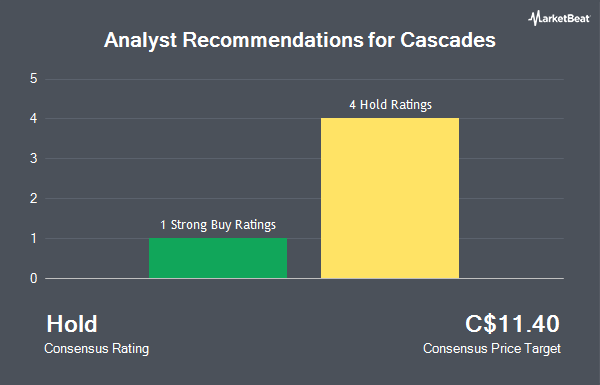

Several other research analysts have also commented on the stock. National Bankshares lowered their price objective on shares of Cascades from C$14.00 to C$11.00 and set a "sector perform" rating for the company in a research note on Thursday, April 24th. Royal Bank Of Canada raised their price objective on shares of Cascades from C$10.00 to C$11.00 and gave the company a "sector perform" rating in a research note on Friday, August 8th. Finally, CIBC lowered their price objective on shares of Cascades from C$13.00 to C$10.00 and set a "neutral" rating for the company in a research note on Tuesday, April 22nd. Five investment analysts have rated the stock with a hold rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the company presently has a consensus rating of "Hold" and an average price target of C$11.33.

Check Out Our Latest Research Report on Cascades

Cascades Trading Down 0.5%

CAS stock traded down C$0.05 during mid-day trading on Friday, hitting C$9.88. 4,511 shares of the company were exchanged, compared to its average volume of 246,171. The company has a quick ratio of 0.86, a current ratio of 1.22 and a debt-to-equity ratio of 121.37. The firm has a market capitalization of C$999.37 million, a P/E ratio of -13.32, a PEG ratio of 0.56 and a beta of 0.15. The business has a fifty day simple moving average of C$9.20 and a 200-day simple moving average of C$9.84. Cascades has a 12-month low of C$8.30 and a 12-month high of C$13.42.

Cascades Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, September 4th. Investors of record on Thursday, September 4th will be given a $0.12 dividend. This represents a $0.48 dividend on an annualized basis and a yield of 4.9%. The ex-dividend date is Thursday, August 21st. Cascades's dividend payout ratio (DPR) is -64.73%.

Insider Transactions at Cascades

In related news, Director Alain Lemaire sold 74,608 shares of Cascades stock in a transaction on Monday, June 2nd. The shares were sold at an average price of C$8.90, for a total value of C$664,011.20. Also, Senior Officer Maryse Fernet sold 10,054 shares of Cascades stock in a transaction on Wednesday, June 11th. The shares were sold at an average price of C$9.35, for a total transaction of C$94,004.90. Insiders sold a total of 119,911 shares of company stock worth $1,068,804 over the last quarter. 23.78% of the stock is currently owned by corporate insiders.

Cascades Company Profile

(

Get Free Report)

Cascades Inc, along with its subsidiaries, produces, converts and markets packaging and tissue products composed mainly of recycled fibres. The company is organized into four main business segments: Containerboard, Boxboard Europe, Specialty Products (which constitutes packaging products), and Tissue Papers.

Further Reading

Before you consider Cascades, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cascades wasn't on the list.

While Cascades currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.