CECO Environmental (NASDAQ:CECO - Get Free Report) had its price objective upped by stock analysts at Needham & Company LLC from $34.00 to $44.00 in a note issued to investors on Tuesday,Benzinga reports. The brokerage presently has a "buy" rating on the stock. Needham & Company LLC's price objective points to a potential downside of 2.50% from the stock's previous close.

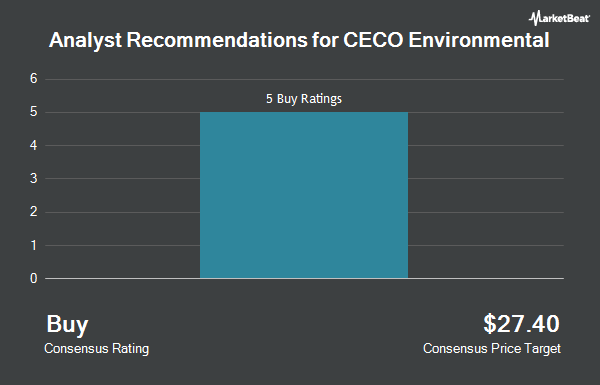

Separately, HC Wainwright raised their target price on shares of CECO Environmental from $33.00 to $55.00 and gave the stock a "buy" rating in a report on Wednesday. Six equities research analysts have rated the stock with a buy rating, According to MarketBeat.com, the company has a consensus rating of "Buy" and a consensus target price of $49.20.

Get Our Latest Research Report on CECO

CECO Environmental Price Performance

NASDAQ CECO traded up $0.18 on Tuesday, reaching $45.13. The company's stock had a trading volume of 887,920 shares, compared to its average volume of 360,976. CECO Environmental has a twelve month low of $17.57 and a twelve month high of $46.07. The company has a debt-to-equity ratio of 0.78, a quick ratio of 1.13 and a current ratio of 1.34. The stock has a market cap of $1.59 billion, a PE ratio of 31.56, a PEG ratio of 2.63 and a beta of 1.39. The firm's 50 day moving average is $30.62 and its two-hundred day moving average is $26.55.

CECO Environmental (NASDAQ:CECO - Get Free Report) last issued its quarterly earnings results on Tuesday, July 29th. The company reported $0.24 earnings per share for the quarter, beating analysts' consensus estimates of $0.20 by $0.04. CECO Environmental had a net margin of 7.99% and a return on equity of 10.00%. The company had revenue of $185.39 million during the quarter, compared to the consensus estimate of $178.66 million. As a group, sell-side analysts predict that CECO Environmental will post 0.67 EPS for the current year.

Insider Transactions at CECO Environmental

In other news, Director Jason Dezwirek sold 70,000 shares of the company's stock in a transaction dated Wednesday, July 30th. The stock was sold at an average price of $42.75, for a total value of $2,992,500.00. Following the transaction, the director owned 230,000 shares in the company, valued at $9,832,500. This represents a 23.33% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director Claudio A. Mannarino sold 20,000 shares of the company's stock in a transaction dated Wednesday, July 30th. The shares were sold at an average price of $41.51, for a total value of $830,200.00. Following the completion of the transaction, the director owned 77,589 shares in the company, valued at $3,220,719.39. This represents a 20.49% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 120,000 shares of company stock worth $5,128,900 in the last quarter. 16.90% of the stock is owned by corporate insiders.

Hedge Funds Weigh In On CECO Environmental

Large investors have recently made changes to their positions in the business. Farther Finance Advisors LLC increased its holdings in shares of CECO Environmental by 224.7% in the 2nd quarter. Farther Finance Advisors LLC now owns 1,445 shares of the company's stock valued at $41,000 after purchasing an additional 1,000 shares during the period. Mackenzie Financial Corp acquired a new position in CECO Environmental in the fourth quarter worth approximately $56,000. Heck Capital Advisors LLC acquired a new position in CECO Environmental in the fourth quarter worth approximately $74,000. Caption Management LLC acquired a new position in CECO Environmental in the first quarter worth approximately $182,000. Finally, XTX Topco Ltd acquired a new position in CECO Environmental in the first quarter worth approximately $217,000. Institutional investors and hedge funds own 68.08% of the company's stock.

CECO Environmental Company Profile

(

Get Free Report)

CECO Environmental Corp. provides critical solutions in industrial air quality, industrial water treatment, and energy transition solutions worldwide. It operates in two segments: Engineered Systems and Industrial Process Solutions. The company engineers, designs, manufactures, and installs non-metallic expansion joints and flow control products, including rubber expansion joints, ducting expansion joints, and industrial pinch and duck bill valves; membrane-based industrial water and wastewater treatment systems; and provides dust and fume extraction solutions comprising consultation, design, manufacturing, installation, and service, as well as water and wastewater treatment solutions.

Recommended Stories

Before you consider CECO Environmental, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CECO Environmental wasn't on the list.

While CECO Environmental currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.