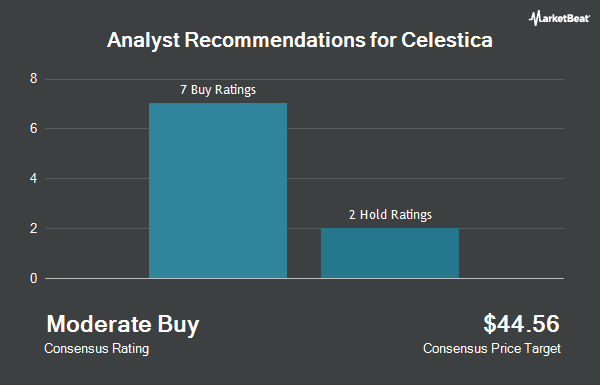

Celestica Inc. (NYSE:CLS - Get Free Report) TSE: CLS has been given a consensus recommendation of "Buy" by the twelve ratings firms that are presently covering the firm, MarketBeat reports. One equities research analyst has rated the stock with a hold rating, nine have given a buy rating and two have issued a strong buy rating on the company. The average 1 year price target among brokers that have issued a report on the stock in the last year is $116.64.

CLS has been the subject of several recent analyst reports. Argus decreased their price objective on shares of Celestica from $150.00 to $120.00 and set a "buy" rating for the company in a report on Tuesday, April 29th. BMO Capital Markets reissued an "outperform" rating and set a $130.00 price target (up from $118.00) on shares of Celestica in a report on Thursday, May 22nd. BNP Paribas raised shares of Celestica to a "strong-buy" rating in a report on Wednesday. Royal Bank of Canada restated an "outperform" rating and issued a $120.00 price objective on shares of Celestica in a research report on Monday, April 28th. Finally, Wall Street Zen cut shares of Celestica from a "buy" rating to a "hold" rating in a research report on Thursday, May 22nd.

Read Our Latest Analysis on CLS

Institutional Trading of Celestica

Several large investors have recently modified their holdings of the stock. Rothschild Investment LLC purchased a new position in Celestica during the 1st quarter worth $26,000. ORG Partners LLC bought a new stake in shares of Celestica during the 1st quarter worth $29,000. Peregrine Capital Management LLC bought a new stake in shares of Celestica during the 4th quarter worth $30,000. Center for Financial Planning Inc. bought a new stake in shares of Celestica during the 1st quarter worth $30,000. Finally, Pinpoint Asset Management Ltd raised its stake in shares of Celestica by 109.6% during the 4th quarter. Pinpoint Asset Management Ltd now owns 348 shares of the technology company's stock worth $32,000 after purchasing an additional 182 shares during the period. Institutional investors and hedge funds own 67.38% of the company's stock.

Celestica Price Performance

NYSE CLS traded down $5.55 on Wednesday, reaching $125.18. The company's stock had a trading volume of 2,716,202 shares, compared to its average volume of 3,304,142. Celestica has a twelve month low of $40.25 and a twelve month high of $144.27. The company has a debt-to-equity ratio of 0.49, a quick ratio of 0.87 and a current ratio of 1.47. The stock has a market cap of $14.47 billion, a PE ratio of 33.47 and a beta of 1.74. The firm's 50 day moving average is $101.77 and its two-hundred day moving average is $101.09.

Celestica (NYSE:CLS - Get Free Report) TSE: CLS last released its quarterly earnings data on Thursday, April 24th. The technology company reported $1.20 earnings per share for the quarter, beating the consensus estimate of $1.10 by $0.10. The firm had revenue of $2.65 billion for the quarter, compared to analyst estimates of $2.56 billion. Celestica had a net margin of 4.61% and a return on equity of 23.34%. The company's revenue for the quarter was up 19.9% compared to the same quarter last year. During the same quarter in the prior year, the business earned $0.83 EPS. As a group, sell-side analysts predict that Celestica will post 4.35 EPS for the current year.

Celestica Company Profile

(

Get Free ReportCelestica Inc provides supply chain solutions in North America, Europe, and Asia. It operates through two segments: Advanced Technology Solutions, and Connectivity & Cloud Solutions. The company offers a range of product manufacturing and related supply chain services, including design and development, new product introduction, engineering services, component sourcing, electronics manufacturing and assembly, testing, complex mechanical assembly, systems integration, precision machining, order fulfillment, logistics, asset management, product licensing, and after-market repair and return services.

Further Reading

Before you consider Celestica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Celestica wasn't on the list.

While Celestica currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.