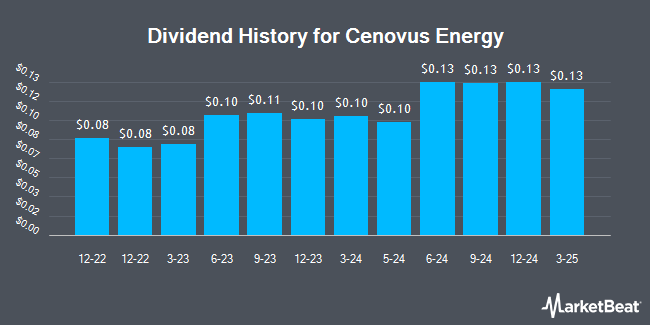

Cenovus Energy Inc (NYSE:CVE - Get Free Report) TSE: CVE announced a quarterly dividend on Thursday, July 31st. Shareholders of record on Monday, September 15th will be paid a dividend of 0.20 per share by the oil and gas company on Monday, September 29th. This represents a c) annualized dividend and a yield of 4.6%. The ex-dividend date is Monday, September 15th.

Cenovus Energy has a payout ratio of 55.2% indicating that its dividend is sufficiently covered by earnings. Equities research analysts expect Cenovus Energy to earn $1.91 per share next year, which means the company should continue to be able to cover its $0.58 annual dividend with an expected future payout ratio of 30.4%.

Cenovus Energy Stock Performance

Shares of CVE traded up $0.09 during midday trading on Thursday, reaching $17.53. The stock had a trading volume of 8,672,592 shares, compared to its average volume of 12,512,959. The firm has a 50 day simple moving average of $15.49 and a 200-day simple moving average of $13.96. Cenovus Energy has a one year low of $10.23 and a one year high of $18.61. The firm has a market cap of $31.52 billion, a PE ratio of 17.34 and a beta of 0.99. The company has a current ratio of 1.32, a quick ratio of 0.78 and a debt-to-equity ratio of 0.24.

Cenovus Energy (NYSE:CVE - Get Free Report) TSE: CVE last announced its quarterly earnings data on Thursday, July 31st. The oil and gas company reported $0.33 EPS for the quarter, beating analysts' consensus estimates of $0.14 by $0.19. Cenovus Energy had a net margin of 5.18% and a return on equity of 9.06%. The company had revenue of $10.66 billion during the quarter, compared to the consensus estimate of $10.64 billion. During the same quarter last year, the firm posted $0.62 EPS. The company's quarterly revenue was down 12.6% on a year-over-year basis. As a group, sell-side analysts anticipate that Cenovus Energy will post 1.49 EPS for the current year.

About Cenovus Energy

(

Get Free Report)

Cenovus Energy Inc, together with its subsidiaries, develops, produces, refines, transports, and markets crude oil, natural gas, and refined petroleum products in Canada and internationally. The company operates through Oil Sands, Conventional, Offshore, Canadian Refining, and U.S. Refining segments.

Read More

Before you consider Cenovus Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cenovus Energy wasn't on the list.

While Cenovus Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.