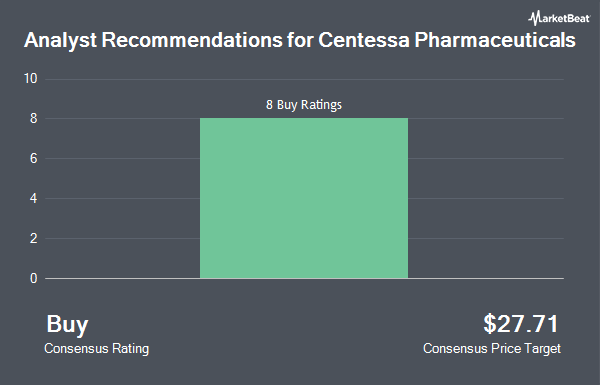

Centessa Pharmaceuticals PLC Sponsored ADR (NASDAQ:CNTA - Get Free Report) has earned an average rating of "Buy" from the ten ratings firms that are currently covering the stock, Marketbeat.com reports. Ten analysts have rated the stock with a buy rating. The average 12 month price target among analysts that have updated their coverage on the stock in the last year is $27.89.

CNTA has been the subject of a number of research analyst reports. Chardan Capital began coverage on shares of Centessa Pharmaceuticals in a report on Thursday, May 8th. They issued a "buy" rating and a $30.00 price target for the company. Morgan Stanley reissued an "overweight" rating and set a $27.00 price target on shares of Centessa Pharmaceuticals in a research report on Friday, March 7th. Oppenheimer started coverage on shares of Centessa Pharmaceuticals in a report on Thursday, May 8th. They issued an "outperform" rating and a $6.00 target price on the stock. Guggenheim reaffirmed a "buy" rating and set a $28.00 price target on shares of Centessa Pharmaceuticals in a research note on Wednesday, March 26th. Finally, Needham & Company LLC started coverage on shares of Centessa Pharmaceuticals in a research report on Wednesday, May 28th. They issued a "buy" rating and a $35.00 price objective for the company.

Get Our Latest Analysis on CNTA

Insider Buying and Selling

In other Centessa Pharmaceuticals news, CEO Saurabh Saha sold 14,656 shares of Centessa Pharmaceuticals stock in a transaction that occurred on Monday, April 21st. The shares were sold at an average price of $12.29, for a total transaction of $180,122.24. Following the transaction, the chief executive officer now directly owns 261,361 shares of the company's stock, valued at $3,212,126.69. The trade was a 5.31% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, Director Arjun Goyal acquired 44,939 shares of Centessa Pharmaceuticals stock in a transaction on Thursday, May 15th. The shares were bought at an average price of $12.24 per share, for a total transaction of $550,053.36. Following the purchase, the director now owns 44,939 shares of the company's stock, valued at $550,053.36. This represents a ∞ increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last quarter, insiders sold 152,398 shares of company stock valued at $1,945,852. Insiders own 7.09% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently made changes to their positions in the company. JPMorgan Chase & Co. lifted its holdings in Centessa Pharmaceuticals by 40.1% in the 4th quarter. JPMorgan Chase & Co. now owns 190,385 shares of the company's stock worth $3,189,000 after buying an additional 54,482 shares in the last quarter. Wellington Management Group LLP increased its position in shares of Centessa Pharmaceuticals by 14.4% during the fourth quarter. Wellington Management Group LLP now owns 115,107 shares of the company's stock worth $1,928,000 after acquiring an additional 14,494 shares during the last quarter. Franklin Resources Inc. lifted its stake in shares of Centessa Pharmaceuticals by 0.3% in the fourth quarter. Franklin Resources Inc. now owns 2,308,546 shares of the company's stock worth $38,668,000 after acquiring an additional 6,000 shares in the last quarter. Geode Capital Management LLC boosted its holdings in Centessa Pharmaceuticals by 1.2% in the fourth quarter. Geode Capital Management LLC now owns 57,257 shares of the company's stock valued at $959,000 after purchasing an additional 660 shares during the last quarter. Finally, Trexquant Investment LP grew its stake in Centessa Pharmaceuticals by 52.8% during the 4th quarter. Trexquant Investment LP now owns 261,184 shares of the company's stock valued at $4,375,000 after purchasing an additional 90,233 shares in the last quarter. 82.01% of the stock is currently owned by hedge funds and other institutional investors.

Centessa Pharmaceuticals Stock Performance

CNTA traded up $1.20 during trading on Friday, hitting $14.20. The stock had a trading volume of 1,411,051 shares, compared to its average volume of 724,203. The firm has a market capitalization of $1.90 billion, a P/E ratio of -7.85 and a beta of 1.48. The company has a debt-to-equity ratio of 0.28, a quick ratio of 14.37 and a current ratio of 14.37. Centessa Pharmaceuticals has a twelve month low of $8.46 and a twelve month high of $19.09. The company's 50-day moving average price is $12.72 and its 200 day moving average price is $14.79.

Centessa Pharmaceuticals (NASDAQ:CNTA - Get Free Report) last issued its quarterly earnings results on Monday, May 12th. The company reported ($0.20) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.35) by $0.15. On average, equities research analysts forecast that Centessa Pharmaceuticals will post -1.6 EPS for the current fiscal year.

About Centessa Pharmaceuticals

(

Get Free ReportCentessa Pharmaceuticals plc, a clinical-stage pharmaceutical company, discovers, develops, and delivers medicines for patients. Its products pipeline includes SerpinPC, an activated protein C inhibitor for the treatment of hemophilia A and B; and ORX750, an orally administered OX2R agonist for the treatment of narcolepsy and other sleep disorders.

Featured Articles

Before you consider Centessa Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Centessa Pharmaceuticals wasn't on the list.

While Centessa Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.