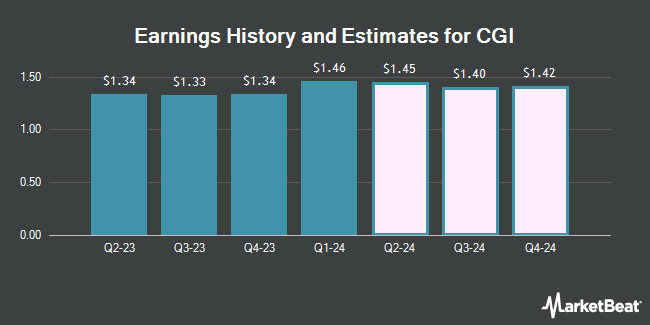

CGI Group, Inc. (NYSE:GIB - Free Report) TSE: GIB.A - Analysts at National Bank Financial lifted their FY2025 EPS estimates for CGI Group in a research note issued to investors on Wednesday, July 30th. National Bank Financial analyst R. Tse now anticipates that the technology company will post earnings per share of $6.04 for the year, up from their previous forecast of $6.00. The consensus estimate for CGI Group's current full-year earnings is $5.79 per share. National Bank Financial also issued estimates for CGI Group's Q4 2025 earnings at $1.54 EPS.

Several other research analysts also recently commented on GIB. Royal Bank Of Canada dropped their price objective on shares of CGI Group from $185.00 to $175.00 and set an "outperform" rating for the company in a report on Thursday, July 31st. UBS Group dropped their price objective on shares of CGI Group from $112.00 to $105.00 and set a "neutral" rating for the company in a report on Thursday, July 31st. Two investment analysts have rated the stock with a hold rating, two have issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, CGI Group presently has a consensus rating of "Moderate Buy" and a consensus price target of $148.25.

View Our Latest Stock Report on CGI Group

CGI Group Price Performance

Shares of GIB traded up $0.97 during trading hours on Friday, reaching $97.94. 281,278 shares of the stock traded hands, compared to its average volume of 276,722. The company's 50-day moving average price is $104.10 and its two-hundred day moving average price is $106.29. CGI Group has a 52-week low of $92.85 and a 52-week high of $122.79. The company has a market cap of $21.83 billion, a P/E ratio of 18.10, a price-to-earnings-growth ratio of 1.76 and a beta of 0.72. The company has a current ratio of 1.27, a quick ratio of 0.94 and a debt-to-equity ratio of 0.35.

CGI Group (NYSE:GIB - Get Free Report) TSE: GIB.A last issued its quarterly earnings results on Wednesday, July 30th. The technology company reported $1.52 earnings per share for the quarter, topping the consensus estimate of $1.51 by $0.01. The business had revenue of $3 billion for the quarter, compared to analysts' expectations of $4.01 billion. CGI Group had a net margin of 11.01% and a return on equity of 18.53%. The company's revenue was up 11.4% compared to the same quarter last year. During the same quarter last year, the company posted $1.91 EPS.

CGI Group Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, September 19th. Shareholders of record on Friday, August 15th will be issued a $0.1086 dividend. This is an increase from CGI Group's previous quarterly dividend of $0.11. This represents a $0.43 dividend on an annualized basis and a dividend yield of 0.4%. The ex-dividend date of this dividend is Friday, August 15th. CGI Group's dividend payout ratio is 8.13%.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently made changes to their positions in the stock. Vontobel Holding Ltd. grew its position in CGI Group by 1.7% during the first quarter. Vontobel Holding Ltd. now owns 6,135 shares of the technology company's stock valued at $613,000 after buying an additional 100 shares during the period. Townsquare Capital LLC grew its position in CGI Group by 3.7% during the first quarter. Townsquare Capital LLC now owns 2,870 shares of the technology company's stock valued at $287,000 after buying an additional 102 shares during the period. First Affirmative Financial Network grew its position in CGI Group by 3.8% during the first quarter. First Affirmative Financial Network now owns 2,905 shares of the technology company's stock valued at $290,000 after buying an additional 106 shares during the period. Ameriprise Financial Inc. grew its position in shares of CGI Group by 0.9% in the fourth quarter. Ameriprise Financial Inc. now owns 12,619 shares of the technology company's stock valued at $1,380,000 after purchasing an additional 115 shares during the period. Finally, Manhattan West Asset Management LLC grew its position in shares of CGI Group by 0.5% in the fourth quarter. Manhattan West Asset Management LLC now owns 25,425 shares of the technology company's stock valued at $2,779,000 after purchasing an additional 126 shares during the period. Hedge funds and other institutional investors own 66.68% of the company's stock.

CGI Group Company Profile

(

Get Free Report)

CGI Inc, together with its subsidiaries, provides information technology (IT) and business process services. Its services include the business and strategic IT consulting, systems integration, and software solutions. The company also provides application development, modernization and maintenance, holistic enterprise digitization, automation, hybrid and cloud management, and business process services; intellectual property-based solutions; business consulting; managed IT services; and IT infrastructure services.

Featured Articles

Before you consider CGI Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CGI Group wasn't on the list.

While CGI Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.