CGI (TSE:GIB.A - Get Free Report) NYSE: GIB had its price objective decreased by TD Securities from C$190.00 to C$145.00 in a research report issued on Friday,BayStreet.CA reports. The firm currently has a "buy" rating on the stock. TD Securities' target price would indicate a potential upside of 13.71% from the company's previous close.

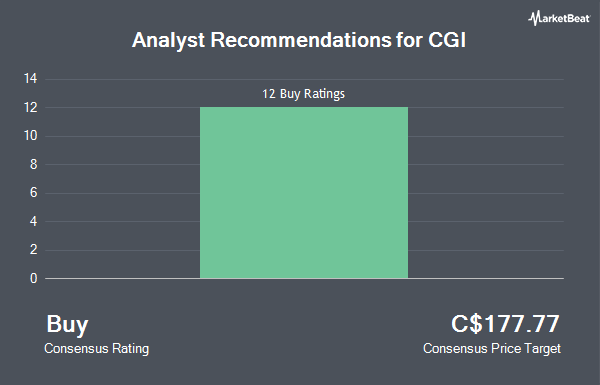

Other research analysts have also recently issued research reports about the stock. CIBC cut their target price on shares of CGI from C$183.00 to C$180.00 in a report on Monday, July 21st. Royal Bank Of Canada decreased their price objective on shares of CGI from C$185.00 to C$175.00 and set an "outperform" rating for the company in a research note on Thursday, July 31st. Finally, Desjardins dropped their target price on shares of CGI from C$173.00 to C$166.00 and set a "buy" rating for the company in a report on Tuesday, July 29th. Eight investment analysts have rated the stock with a Buy rating, According to MarketBeat, CGI presently has a consensus rating of "Buy" and an average price target of C$174.90.

Check Out Our Latest Report on CGI

CGI Stock Performance

Shares of TSE GIB.A traded up C$1.57 during midday trading on Friday, hitting C$127.52. 228,063 shares of the company's stock were exchanged, compared to its average volume of 442,248. The firm has a market capitalization of C$28.43 billion, a PE ratio of 16.89, a price-to-earnings-growth ratio of 2.24 and a beta of 0.37. CGI has a 12 month low of C$121.69 and a 12 month high of C$175.35. The company has a quick ratio of 0.97, a current ratio of 1.16 and a debt-to-equity ratio of 34.24. The company's 50 day moving average price is C$130.70 and its 200 day moving average price is C$139.72.

About CGI

(

Get Free Report)

Founded in 1976, CGI is among the largest independent IT and business consulting services firms in the world. With 91,000 consultants and professionals across the globe, CGI delivers an end-to-end portfolio of capabilities, from strategic IT and business consulting to systems integration, managed IT and business process services and intellectual property solutions.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CGI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CGI wasn't on the list.

While CGI currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.