Charter Communications (NASDAQ:CHTR - Get Free Report) had its price objective reduced by KeyCorp from $500.00 to $430.00 in a research report issued on Friday,Benzinga reports. The brokerage presently has an "overweight" rating on the stock. KeyCorp's price objective points to a potential upside of 59.49% from the company's previous close.

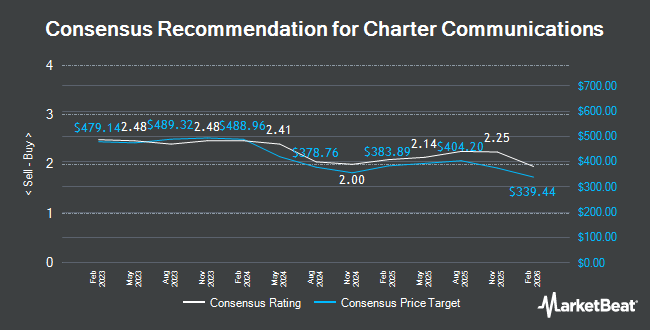

CHTR has been the subject of a number of other research reports. Wells Fargo & Company assumed coverage on Charter Communications in a research note on Thursday, August 21st. They issued an "equal weight" rating and a $300.00 target price for the company. Wolfe Research raised Charter Communications from an "underperform" rating to a "peer perform" rating in a research note on Friday, June 20th. Barclays lowered their target price on Charter Communications from $341.00 to $275.00 and set an "underweight" rating for the company in a research note on Monday, July 28th. The Goldman Sachs Group assumed coverage on Charter Communications in a research note on Tuesday, September 2nd. They issued a "sell" rating and a $223.00 target price for the company. Finally, UBS Group dropped their target price on shares of Charter Communications from $425.00 to $355.00 and set a "neutral" rating for the company in a report on Monday, July 28th. Eight research analysts have rated the stock with a Buy rating, eight have assigned a Hold rating and four have given a Sell rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Hold" and an average target price of $385.76.

Read Our Latest Stock Report on CHTR

Charter Communications Stock Down 2.0%

Shares of NASDAQ:CHTR opened at $269.61 on Friday. Charter Communications has a 52-week low of $251.80 and a 52-week high of $437.06. The firm has a fifty day moving average of $267.90 and a 200 day moving average of $343.22. The firm has a market capitalization of $36.83 billion, a PE ratio of 7.38, a price-to-earnings-growth ratio of 0.61 and a beta of 1.05. The company has a debt-to-equity ratio of 4.57, a quick ratio of 0.33 and a current ratio of 0.33.

Charter Communications (NASDAQ:CHTR - Get Free Report) last announced its earnings results on Friday, July 25th. The company reported $9.18 earnings per share (EPS) for the quarter, missing the consensus estimate of $10.06 by ($0.88). Charter Communications had a return on equity of 26.77% and a net margin of 9.53%.The company had revenue of $13.77 billion during the quarter, compared to analysts' expectations of $13.76 billion. During the same quarter last year, the firm posted $8.49 earnings per share. The firm's revenue was up .6% on a year-over-year basis. As a group, research analysts anticipate that Charter Communications will post 38.16 EPS for the current fiscal year.

Insider Activity

In related news, Director Balan Nair acquired 360 shares of the stock in a transaction on Thursday, July 31st. The stock was acquired at an average cost of $274.21 per share, for a total transaction of $98,715.60. Following the completion of the acquisition, the director directly owned 9,622 shares of the company's stock, valued at approximately $2,638,448.62. This represents a 3.89% increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO Christopher L. Winfrey acquired 3,670 shares of the stock in a transaction on Thursday, July 31st. The stock was bought at an average price of $273.10 per share, with a total value of $1,002,277.00. Following the completion of the acquisition, the chief executive officer directly owned 70,243 shares of the company's stock, valued at $19,183,363.30. This trade represents a 5.51% increase in their ownership of the stock. The disclosure for this purchase can be found here. Company insiders own 0.83% of the company's stock.

Institutional Trading of Charter Communications

Several institutional investors and hedge funds have recently bought and sold shares of the stock. Vanguard Group Inc. lifted its holdings in Charter Communications by 0.5% in the second quarter. Vanguard Group Inc. now owns 8,231,704 shares of the company's stock worth $3,365,203,000 after buying an additional 39,944 shares during the period. State Street Corp lifted its holdings in Charter Communications by 3.2% in the second quarter. State Street Corp now owns 6,486,312 shares of the company's stock worth $2,651,669,000 after buying an additional 198,979 shares during the period. Norges Bank bought a new position in shares of Charter Communications during the second quarter valued at approximately $1,145,387,000. Geode Capital Management LLC increased its stake in shares of Charter Communications by 1.6% during the second quarter. Geode Capital Management LLC now owns 2,595,167 shares of the company's stock valued at $1,056,800,000 after purchasing an additional 41,206 shares in the last quarter. Finally, JPMorgan Chase & Co. increased its stake in shares of Charter Communications by 53.6% during the first quarter. JPMorgan Chase & Co. now owns 2,310,073 shares of the company's stock valued at $851,331,000 after purchasing an additional 806,145 shares in the last quarter. 81.76% of the stock is currently owned by hedge funds and other institutional investors.

Charter Communications Company Profile

(

Get Free Report)

Charter Communications, Inc operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States. The company offers subscription-based internet, video, and mobile and voice services; a suite of broadband connectivity services, including fixed internet, WiFi, and mobile; Advanced WiFi services; Spectrum Security Shield; in-home WiFi, which provides customers with high performance wireless routers and managed WiFi services to enhance their fixed wireless internet experience; out-of-home WiFi; and Spectrum WiFi services.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Charter Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Charter Communications wasn't on the list.

While Charter Communications currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.