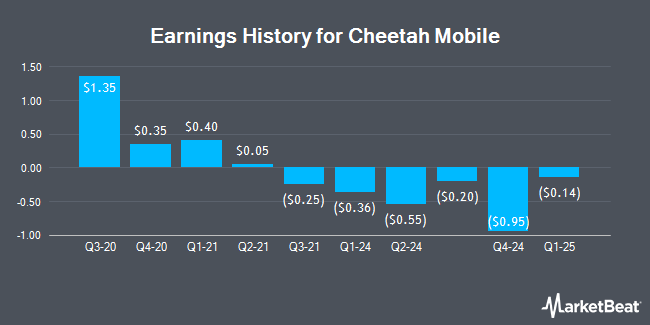

Cheetah Mobile (NYSE:CMCM - Get Free Report) posted its quarterly earnings data on Thursday. The software maker reported ($0.08) earnings per share for the quarter, Zacks reports. The firm had revenue of $41.21 million during the quarter. Cheetah Mobile had a negative net margin of 47.30% and a negative return on equity of 13.85%.

Cheetah Mobile Price Performance

Shares of NYSE CMCM traded up $0.67 during mid-day trading on Tuesday, hitting $8.54. The company had a trading volume of 92,261 shares, compared to its average volume of 42,162. The business's 50-day simple moving average is $5.72 and its 200-day simple moving average is $4.76. Cheetah Mobile has a 12 month low of $3.28 and a 12 month high of $9.39. The firm has a market cap of $258.78 million, a P/E ratio of -3.90 and a beta of 1.75.

Wall Street Analyst Weigh In

Separately, Wall Street Zen raised shares of Cheetah Mobile to a "hold" rating in a research note on Saturday.

Get Our Latest Research Report on CMCM

Cheetah Mobile Company Profile

(

Get Free Report)

Cheetah Mobile Inc along with its subsidiaries, engages in provision of internet services, artificial intelligence, and other services in the People's Republic of China, Hong Kong, Japan, and internationally. The company's internet products include Duba Anti-virus, an internet security application to protect users against known and unknown security threats and malicious applications; and Clean Master, a junk file cleaning, memory boosting, and privacy protection tool for mobile devices.

Read More

Before you consider Cheetah Mobile, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cheetah Mobile wasn't on the list.

While Cheetah Mobile currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.