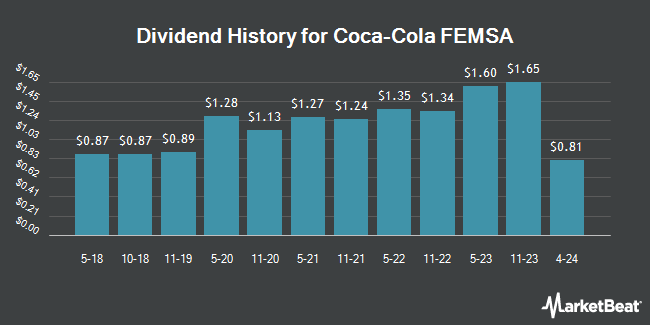

Coca Cola Femsa S.A.B. de C.V. (NYSE:KOF - Get Free Report) announced a quarterly dividend on Friday, October 3rd. Investors of record on Tuesday, October 14th will be given a dividend of 1.0006 per share on Monday, October 27th. This represents a c) dividend on an annualized basis and a yield of 4.9%. The ex-dividend date is Tuesday, October 14th. This is a 14.5% increase from Coca Cola Femsa's previous quarterly dividend of $0.87.

Coca Cola Femsa has a dividend payout ratio of 12.7% indicating that its dividend is sufficiently covered by earnings. Analysts expect Coca Cola Femsa to earn $6.87 per share next year, which means the company should continue to be able to cover its $0.94 annual dividend with an expected future payout ratio of 13.7%.

Coca Cola Femsa Trading Down 0.8%

Shares of Coca Cola Femsa stock opened at $82.41 on Friday. Coca Cola Femsa has a 1 year low of $72.68 and a 1 year high of $101.74. The firm has a market cap of $138.50 billion, a PE ratio of 14.43, a P/E/G ratio of 1.05 and a beta of 0.62. The stock has a fifty day moving average price of $84.28 and a 200-day moving average price of $90.20. The company has a debt-to-equity ratio of 0.54, a current ratio of 1.12 and a quick ratio of 0.90.

Coca Cola Femsa (NYSE:KOF - Get Free Report) last announced its earnings results on Wednesday, July 23rd. The company reported $1.30 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.52 by ($0.22). The business had revenue of $3.74 billion for the quarter, compared to analysts' expectations of $3.89 billion. Coca Cola Femsa had a net margin of 8.19% and a return on equity of 15.81%. Equities research analysts anticipate that Coca Cola Femsa will post 5.7 EPS for the current year.

About Coca Cola Femsa

(

Get Free Report)

Coca-Cola FEMSA, SAB. de C.V., a franchise bottler, produces, markets, sells, and distributes Coca-Cola trademark beverages in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Brazil, Argentina, and Uruguay. The company offers sparkling beverages, including colas and flavored sparkling beverages; waters; other non-carbonated beverages comprising juice drinks, coffee, teas, milk, value-added dairy products, sports and energy drinks, and plant-based drinks; and alcoholic beverages, such as hard seltzer under the Topo Chico brand name.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Coca Cola Femsa, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coca Cola Femsa wasn't on the list.

While Coca Cola Femsa currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.