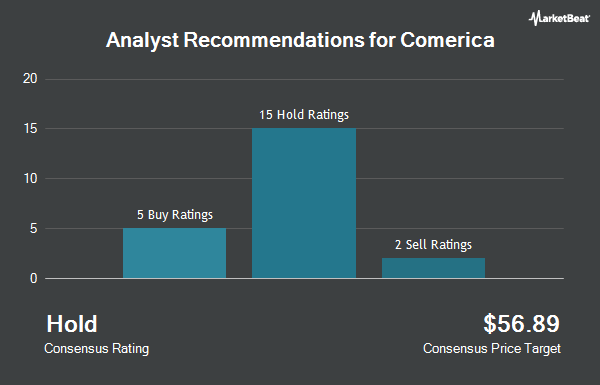

Shares of Comerica Incorporated (NYSE:CMA - Get Free Report) have earned a consensus recommendation of "Hold" from the twenty ratings firms that are presently covering the firm, Marketbeat Ratings reports. Six analysts have rated the stock with a sell recommendation, eight have given a hold recommendation and six have issued a buy recommendation on the company. The average 1-year target price among brokerages that have covered the stock in the last year is $62.37.

CMA has been the subject of a number of recent research reports. Royal Bank of Canada reduced their target price on shares of Comerica from $75.00 to $65.00 and set an "outperform" rating for the company in a research report on Tuesday, April 22nd. JPMorgan Chase & Co. downgraded shares of Comerica from a "neutral" rating to an "underweight" rating and cut their price objective for the company from $64.00 to $52.00 in a report on Tuesday, April 22nd. Robert W. Baird lowered their target price on shares of Comerica from $80.00 to $75.00 and set an "outperform" rating on the stock in a report on Tuesday, April 22nd. Truist Financial cut their price target on Comerica from $65.00 to $57.00 and set a "hold" rating for the company in a research note on Tuesday, April 22nd. Finally, Raymond James reduced their price target on Comerica from $72.00 to $67.00 and set an "outperform" rating on the stock in a research report on Wednesday, April 2nd.

Check Out Our Latest Report on Comerica

Comerica Stock Performance

Shares of NYSE:CMA traded down $0.39 during trading on Friday, reaching $57.58. 1,315,899 shares of the stock were exchanged, compared to its average volume of 2,188,519. Comerica has a 12 month low of $45.32 and a 12 month high of $73.45. The stock has a 50-day moving average price of $55.09 and a 200-day moving average price of $61.14. The company has a current ratio of 0.97, a quick ratio of 0.97 and a debt-to-equity ratio of 1.09. The firm has a market cap of $7.57 billion, a PE ratio of 11.47 and a beta of 0.92.

Comerica (NYSE:CMA - Get Free Report) last released its quarterly earnings results on Monday, April 21st. The financial services provider reported $1.25 earnings per share for the quarter, topping the consensus estimate of $1.14 by $0.11. Comerica had a return on equity of 12.04% and a net margin of 13.98%. The business had revenue of $829.00 million during the quarter, compared to analysts' expectations of $839.31 million. During the same period last year, the firm posted $1.29 EPS. Research analysts expect that Comerica will post 5.28 EPS for the current fiscal year.

Comerica Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, August 1st. Shareholders of record on Friday, June 13th will be given a $0.71 dividend. The ex-dividend date of this dividend is Friday, June 13th. This represents a $2.84 dividend on an annualized basis and a yield of 4.93%. Comerica's dividend payout ratio is currently 53.69%.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of the stock. Strs Ohio bought a new stake in Comerica during the 1st quarter worth $1,174,000. WBI Investments LLC bought a new position in Comerica in the first quarter valued at about $810,000. Geneos Wealth Management Inc. boosted its stake in shares of Comerica by 41.8% during the first quarter. Geneos Wealth Management Inc. now owns 597 shares of the financial services provider's stock valued at $35,000 after purchasing an additional 176 shares in the last quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC increased its stake in shares of Comerica by 2.4% in the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 483,992 shares of the financial services provider's stock valued at $28,585,000 after buying an additional 11,268 shares during the period. Finally, Empowered Funds LLC increased its stake in shares of Comerica by 12.6% in the first quarter. Empowered Funds LLC now owns 6,464 shares of the financial services provider's stock valued at $382,000 after buying an additional 724 shares during the period. 80.74% of the stock is currently owned by institutional investors and hedge funds.

About Comerica

(

Get Free ReportComerica Incorporated, through its subsidiaries, provides various financial products and services. The company operates through Commercial Bank, Retail Bank, Wealth Management, and Finance segments. The Commercial Bank segment offers various products and services, including commercial loans and lines of credit, deposits, cash management, payment solutions, card services, capital market products, international trade finance, letters of credit, foreign exchange management services, and loan syndication services for small and middle market businesses, multinational corporations, and governmental entities.

Recommended Stories

Before you consider Comerica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Comerica wasn't on the list.

While Comerica currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.