CommScope (NASDAQ:COMM - Get Free Report) is projected to release its Q2 2025 earnings data before the market opens on Thursday, August 7th. Analysts expect CommScope to post earnings of $0.24 per share and revenue of $1.27 billion for the quarter.

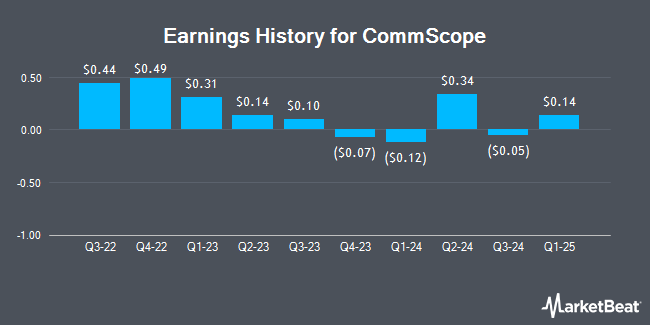

CommScope (NASDAQ:COMM - Get Free Report) last released its quarterly earnings data on Thursday, May 1st. The communications equipment provider reported $0.14 EPS for the quarter, topping analysts' consensus estimates of $0.07 by $0.07. The business had revenue of $1.11 billion during the quarter, compared to the consensus estimate of $1.11 billion. CommScope had a negative return on equity of 4.51% and a net margin of 16.89%. The business's revenue for the quarter was up 23.5% on a year-over-year basis. During the same period in the prior year, the firm posted ($0.08) EPS. On average, analysts expect CommScope to post $0 EPS for the current fiscal year and $1 EPS for the next fiscal year.

CommScope Stock Down 5.0%

Shares of COMM stock traded down $0.41 on Friday, reaching $7.79. 7,326,306 shares of the stock were exchanged, compared to its average volume of 4,105,454. The stock has a market cap of $1.69 billion, a P/E ratio of 2.85, a price-to-earnings-growth ratio of 0.23 and a beta of 2.38. The firm has a 50 day moving average of $7.16 and a two-hundred day moving average of $5.70. CommScope has a 1-year low of $1.93 and a 1-year high of $8.68.

Wall Street Analyst Weigh In

COMM has been the subject of several recent research reports. Wolfe Research initiated coverage on CommScope in a report on Monday, July 7th. They issued a "peer perform" rating for the company. Deutsche Bank Aktiengesellschaft increased their price target on CommScope from $6.00 to $7.50 and gave the company a "hold" rating in a report on Tuesday, June 24th. Finally, Wall Street Zen downgraded CommScope from a "strong-buy" rating to a "buy" rating in a report on Tuesday, May 13th. Two analysts have rated the stock with a sell rating, four have given a hold rating and one has given a buy rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $4.88.

Read Our Latest Analysis on COMM

Institutional Trading of CommScope

Large investors have recently modified their holdings of the business. Goldman Sachs Group Inc. grew its stake in shares of CommScope by 244.8% during the first quarter. Goldman Sachs Group Inc. now owns 9,498,510 shares of the communications equipment provider's stock valued at $50,437,000 after acquiring an additional 6,743,929 shares in the last quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC grew its stake in shares of CommScope by 8.1% during the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 520,677 shares of the communications equipment provider's stock valued at $2,765,000 after acquiring an additional 39,064 shares in the last quarter. AQR Capital Management LLC grew its stake in shares of CommScope by 1,029.9% during the first quarter. AQR Capital Management LLC now owns 360,577 shares of the communications equipment provider's stock valued at $1,877,000 after acquiring an additional 328,664 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its stake in shares of CommScope by 5.9% during the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 128,503 shares of the communications equipment provider's stock valued at $682,000 after acquiring an additional 7,149 shares in the last quarter. Finally, NewEdge Advisors LLC grew its stake in shares of CommScope by 7.9% during the first quarter. NewEdge Advisors LLC now owns 63,433 shares of the communications equipment provider's stock valued at $337,000 after acquiring an additional 4,669 shares in the last quarter. 88.04% of the stock is currently owned by institutional investors and hedge funds.

CommScope Company Profile

(

Get Free Report)

CommScope Holding Company, Inc provides infrastructure solutions for communications, data center, and entertainment networks worldwide. The company operates through Connectivity and Cable Solutions (CCS); Outdoor Wireless Networks (OWN); Networking, Intelligent Cellular and Security Solutions (NICS), and Access Network Solutions (ANS) segments.

Featured Stories

Before you consider CommScope, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CommScope wasn't on the list.

While CommScope currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.