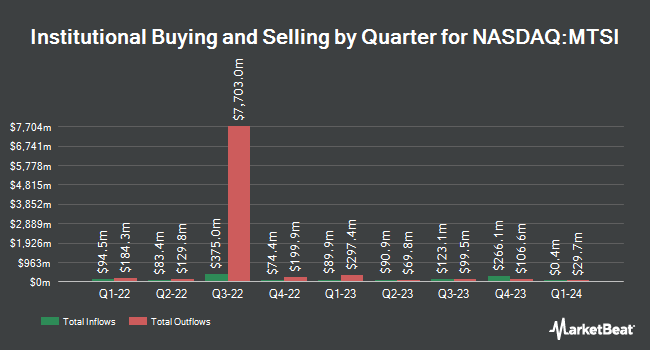

Concentric Capital Strategies LP cut its holdings in MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI - Free Report) by 5.9% during the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 96,184 shares of the semiconductor company's stock after selling 6,032 shares during the quarter. Concentric Capital Strategies LP owned about 0.13% of MACOM Technology Solutions worth $12,495,000 as of its most recent filing with the SEC.

Several other hedge funds and other institutional investors have also made changes to their positions in the company. UMB Bank n.a. increased its stake in shares of MACOM Technology Solutions by 74.3% during the fourth quarter. UMB Bank n.a. now owns 237 shares of the semiconductor company's stock worth $31,000 after acquiring an additional 101 shares during the period. Empowered Funds LLC acquired a new position in shares of MACOM Technology Solutions during the fourth quarter worth about $33,000. SBI Securities Co. Ltd. acquired a new position in shares of MACOM Technology Solutions during the fourth quarter worth about $35,000. ORG Wealth Partners LLC acquired a new position in shares of MACOM Technology Solutions during the fourth quarter worth about $36,000. Finally, Smartleaf Asset Management LLC increased its stake in shares of MACOM Technology Solutions by 97.2% during the fourth quarter. Smartleaf Asset Management LLC now owns 280 shares of the semiconductor company's stock worth $36,000 after acquiring an additional 138 shares during the period. Hedge funds and other institutional investors own 76.14% of the company's stock.

MACOM Technology Solutions Trading Up 6.1%

Shares of MTSI traded up $7.15 on Monday, hitting $125.23. 672,414 shares of the stock traded hands, compared to its average volume of 671,630. MACOM Technology Solutions Holdings, Inc. has a 1 year low of $84.00 and a 1 year high of $152.50. The stock's 50 day moving average is $103.46 and its two-hundred day moving average is $120.88. The firm has a market capitalization of $9.31 billion, a P/E ratio of -86.83, a P/E/G ratio of 2.42 and a beta of 1.36. The company has a quick ratio of 2.88, a current ratio of 3.61 and a debt-to-equity ratio of 0.33.

MACOM Technology Solutions (NASDAQ:MTSI - Get Free Report) last issued its quarterly earnings results on Thursday, May 8th. The semiconductor company reported $0.85 earnings per share for the quarter, topping analysts' consensus estimates of $0.84 by $0.01. MACOM Technology Solutions had a positive return on equity of 12.42% and a negative net margin of 13.05%. The company had revenue of $235.89 million for the quarter, compared to analyst estimates of $230.04 million. During the same quarter in the prior year, the company posted $0.59 EPS. The business's revenue for the quarter was up 30.2% compared to the same quarter last year. As a group, sell-side analysts predict that MACOM Technology Solutions Holdings, Inc. will post 2.43 earnings per share for the current year.

Analysts Set New Price Targets

A number of research analysts have recently issued reports on the stock. Northland Capmk upgraded shares of MACOM Technology Solutions from a "hold" rating to a "strong-buy" rating in a research note on Monday, February 10th. Stifel Nicolaus lowered their target price on shares of MACOM Technology Solutions from $150.00 to $120.00 and set a "buy" rating on the stock in a research report on Thursday, April 17th. Northland Securities upgraded shares of MACOM Technology Solutions from a "market perform" rating to an "outperform" rating and upped their target price for the stock from $105.00 to $140.00 in a research report on Monday, February 10th. BNP Paribas upgraded shares of MACOM Technology Solutions from a "neutral" rating to an "outperform" rating and set a $135.00 target price on the stock in a research report on Wednesday, April 9th. Finally, Bank of America lowered their target price on shares of MACOM Technology Solutions from $160.00 to $130.00 and set a "buy" rating on the stock in a research report on Wednesday, April 16th. Two analysts have rated the stock with a hold rating, nine have issued a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $130.91.

Check Out Our Latest Report on MTSI

Insiders Place Their Bets

In other MACOM Technology Solutions news, Director Geoffrey G. Ribar sold 6,656 shares of the stock in a transaction on Wednesday, February 12th. The stock was sold at an average price of $121.61, for a total transaction of $809,436.16. Following the transaction, the director now owns 14,031 shares of the company's stock, valued at $1,706,309.91. This represents a 32.17% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this link. Also, Director Susan Ocampo sold 300,000 shares of the stock in a transaction on Tuesday, February 18th. The stock was sold at an average price of $124.13, for a total value of $37,239,000.00. Following the transaction, the director now directly owns 4,823,636 shares in the company, valued at approximately $598,757,936.68. This represents a 5.86% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 697,291 shares of company stock valued at $86,141,880 in the last quarter. 16.30% of the stock is currently owned by company insiders.

About MACOM Technology Solutions

(

Free Report)

MACOM Technology Solutions Holdings, Inc, together with its subsidiaries, designs and manufactures analog semiconductor solutions for use in wireless and wireline applications across the radio frequency (RF), microwave, millimeter wave, and lightwave spectrum in the United States, China, Australia, Japan, Malaysia, Singapore, South Korea, Taiwan, Thailand, and internationally.

See Also

Before you consider MACOM Technology Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MACOM Technology Solutions wasn't on the list.

While MACOM Technology Solutions currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.