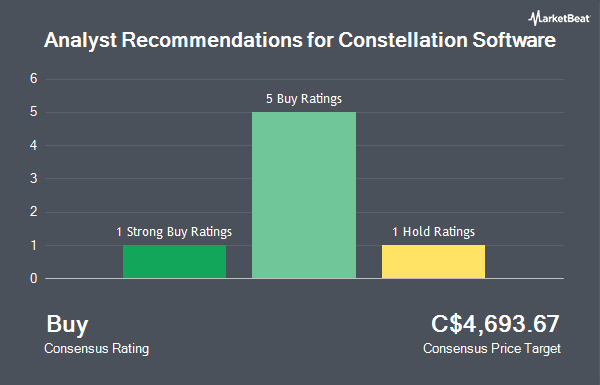

Constellation Software Inc. (TSE:CSU - Get Free Report) has been given an average recommendation of "Buy" by the seven analysts that are covering the firm, Marketbeat Ratings reports. One analyst has rated the stock with a hold rating, five have given a buy rating and one has given a strong buy rating to the company. The average 1 year price objective among brokers that have covered the stock in the last year is C$4,693.67.

Several research analysts have issued reports on the stock. CIBC lifted their target price on shares of Constellation Software from C$5,300.00 to C$5,450.00 in a report on Monday, March 10th. Royal Bank of Canada set a C$5.70 target price on shares of Constellation Software and gave the stock an "outperform" rating in a report on Friday, March 21st. TD Securities boosted their price objective on shares of Constellation Software from C$5,500.00 to C$5,600.00 and gave the company a "buy" rating in a report on Thursday. Jefferies Financial Group boosted their price objective on shares of Constellation Software from C$5,350.00 to C$5,850.00 and gave the company a "buy" rating in a report on Thursday. Finally, Raymond James boosted their price objective on shares of Constellation Software from C$4,550.00 to C$5,250.00 in a report on Monday, March 10th.

Read Our Latest Analysis on Constellation Software

Constellation Software Stock Down 1.2%

Constellation Software stock traded down C$58.93 during trading hours on Friday, hitting C$4,841.07. The stock had a trading volume of 30,417 shares, compared to its average volume of 36,704. The company has a quick ratio of 0.55, a current ratio of 0.93 and a debt-to-equity ratio of 169.83. The stock has a market capitalization of C$73.16 billion, a P/E ratio of 115.03, a price-to-earnings-growth ratio of 2.95 and a beta of 0.81. Constellation Software has a 12-month low of C$3,712.62 and a 12-month high of C$5,300.00. The stock's 50-day moving average price is C$4,768.44 and its 200-day moving average price is C$4,682.63.

Constellation Software Cuts Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, April 15th. Shareholders of record on Tuesday, April 15th were given a $1.00 dividend. The ex-dividend date was Friday, March 28th. This represents a $4.00 dividend on an annualized basis and a dividend yield of 0.08%. Constellation Software's payout ratio is currently 13.02%.

About Constellation Software

(

Get Free ReportConstellation Software Inc is a Canada-based company that develops and customizes software for public- and private-sector markets. The firm acquires, manages, and builds vertical-specific businesses. Its operations are organized in two segments: Public Sector and Private Sector. The portfolio companies serve various markets including communications, credit unions, beverage distribution, tour operators, auto clubs, textiles and apparel, hospitality, and community care.

Read More

Before you consider Constellation Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Constellation Software wasn't on the list.

While Constellation Software currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.