Corcept Therapeutics (NASDAQ:CORT - Get Free Report) is projected to release its Q2 2025 earnings data before the market opens on Thursday, July 31st. Analysts expect Corcept Therapeutics to post earnings of $0.23 per share and revenue of $199.40 million for the quarter. Corcept Therapeutics has set its FY 2025 guidance at EPS.

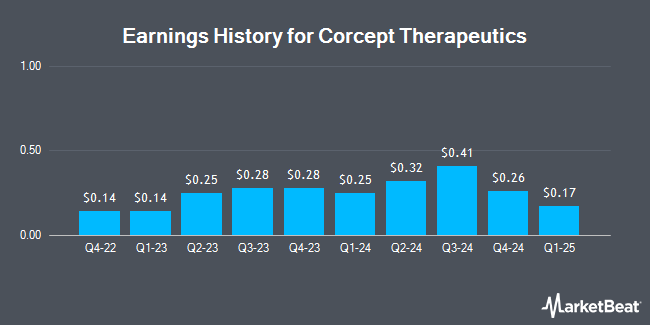

Corcept Therapeutics (NASDAQ:CORT - Get Free Report) last announced its quarterly earnings data on Monday, May 5th. The biotechnology company reported $0.17 earnings per share for the quarter, hitting the consensus estimate of $0.17. The firm had revenue of $157.21 million during the quarter, compared to analysts' expectations of $177.93 million. Corcept Therapeutics had a return on equity of 20.40% and a net margin of 19.33%. The company's quarterly revenue was up 7.1% compared to the same quarter last year. During the same period in the previous year, the business posted $0.25 EPS. On average, analysts expect Corcept Therapeutics to post $1 EPS for the current fiscal year and $2 EPS for the next fiscal year.

Corcept Therapeutics Trading Up 1.0%

Shares of NASDAQ:CORT traded up $0.70 during trading on Friday, hitting $68.29. 395,581 shares of the company's stock traded hands, compared to its average volume of 1,418,507. Corcept Therapeutics has a 52 week low of $32.33 and a 52 week high of $117.33. The company has a market cap of $7.24 billion, a price-to-earnings ratio of 58.87 and a beta of 0.15. The company has a 50-day moving average price of $72.38 and a 200-day moving average price of $67.73.

Analyst Upgrades and Downgrades

Several research firms have commented on CORT. Truist Financial set a $135.00 target price on Corcept Therapeutics in a research note on Tuesday, May 6th. Piper Sandler increased their target price on Corcept Therapeutics from $128.00 to $131.00 and gave the stock an "overweight" rating in a report on Thursday, April 3rd. HC Wainwright cut their price target on Corcept Therapeutics from $150.00 to $145.00 and set a "buy" rating on the stock in a research note on Tuesday, May 6th. Wall Street Zen lowered Corcept Therapeutics from a "buy" rating to a "hold" rating in a research note on Wednesday, May 14th. Finally, Canaccord Genuity Group raised their price objective on Corcept Therapeutics from $130.00 to $142.00 and gave the stock a "buy" rating in a research report on Tuesday, April 1st. One analyst has rated the stock with a hold rating and five have given a buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $138.25.

View Our Latest Research Report on CORT

Insider Activity

In related news, insider Joseph Douglas Lyon sold 3,877 shares of Corcept Therapeutics stock in a transaction that occurred on Thursday, July 17th. The stock was sold at an average price of $73.48, for a total transaction of $284,881.96. Following the transaction, the insider owned 10,066 shares of the company's stock, valued at $739,649.68. The trade was a 27.81% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, Director Daniel N. Swisher, Jr. sold 2,200 shares of Corcept Therapeutics stock in a transaction that occurred on Thursday, July 10th. The shares were sold at an average price of $71.08, for a total value of $156,376.00. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 239,592 shares of company stock valued at $18,071,616. Corporate insiders own 20.80% of the company's stock.

Institutional Inflows and Outflows

A number of institutional investors have recently made changes to their positions in the company. Royal Bank of Canada increased its stake in Corcept Therapeutics by 18.9% in the 1st quarter. Royal Bank of Canada now owns 15,385 shares of the biotechnology company's stock worth $1,757,000 after acquiring an additional 2,444 shares during the last quarter. Amundi bought a new stake in shares of Corcept Therapeutics in the 1st quarter worth $450,000. Finally, NewEdge Advisors LLC bought a new stake in shares of Corcept Therapeutics in the 1st quarter worth $518,000. Hedge funds and other institutional investors own 93.61% of the company's stock.

Corcept Therapeutics Company Profile

(

Get Free Report)

Corcept Therapeutics Incorporated engages in discovery and development of drugs for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States. It offers Korlym tablets medication for the treatment of hyperglycemia secondary to hypercortisolism in adult patients with endogenous cushing's syndrome; and who have type 2 diabetes mellitus or glucose intolerance and have failed surgery or are not candidates for surgery.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Corcept Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corcept Therapeutics wasn't on the list.

While Corcept Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.