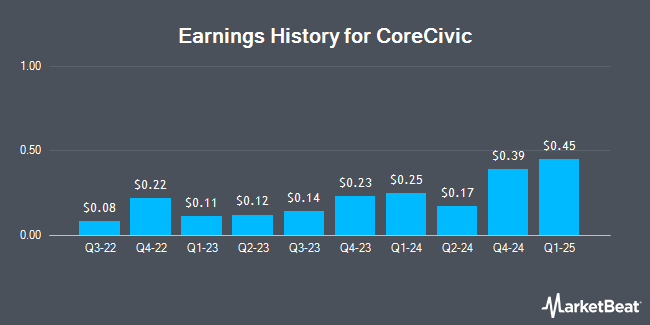

CoreCivic (NYSE:CXW - Get Free Report) is anticipated to post its Q1 2025 quarterly earnings results after the market closes on Wednesday, May 7th. Analysts expect CoreCivic to post earnings of $0.35 per share and revenue of $478.49 million for the quarter. CoreCivic has set its FY 2025 guidance at 1.370-1.500 EPS.

CoreCivic (NYSE:CXW - Get Free Report) last announced its quarterly earnings results on Monday, February 10th. The real estate investment trust reported $0.39 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.33 by $0.06. CoreCivic had a net margin of 3.51% and a return on equity of 5.97%. On average, analysts expect CoreCivic to post $2 EPS for the current fiscal year and $1 EPS for the next fiscal year.

CoreCivic Price Performance

Shares of NYSE:CXW opened at $22.78 on Wednesday. The company has a debt-to-equity ratio of 0.65, a quick ratio of 1.51 and a current ratio of 1.57. CoreCivic has a 52 week low of $10.74 and a 52 week high of $24.99. The firm has a market cap of $2.49 billion, a PE ratio of 37.34 and a beta of 0.86. The firm's fifty day moving average is $20.20 and its 200-day moving average is $20.00.

Analyst Ratings Changes

Several brokerages have commented on CXW. StockNews.com downgraded CoreCivic from a "buy" rating to a "hold" rating in a report on Tuesday. Noble Financial upgraded CoreCivic from a "market perform" rating to an "outperform" rating in a report on Wednesday, February 12th. Finally, Wedbush reiterated an "outperform" rating and set a $30.00 price objective on shares of CoreCivic in a report on Tuesday, February 11th.

Get Our Latest Stock Analysis on CXW

About CoreCivic

(

Get Free Report)

CoreCivic, Inc owns and operates partnership correctional, detention, and residential reentry facilities in the United States. It operates through three segments: CoreCivic Safety, CoreCivic Community, and CoreCivic Properties. The company provides a range of solutions to government partners that serve the public good through corrections and detention management, a network of residential reentry centers to help address America's recidivism crisis, and government real estate solutions.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CoreCivic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CoreCivic wasn't on the list.

While CoreCivic currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.