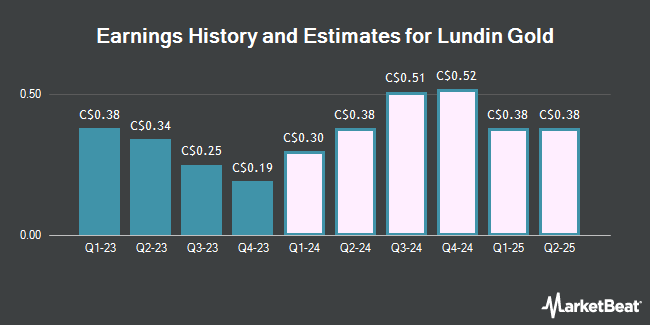

Lundin Gold Inc. (TSE:LUG - Free Report) - Investment analysts at Cormark lifted their FY2025 earnings per share estimates for Lundin Gold in a research report issued on Friday, October 10th. Cormark analyst N. Dion now expects that the company will post earnings per share of $3.84 for the year, up from their prior estimate of $3.60. The consensus estimate for Lundin Gold's current full-year earnings is $2.56 per share.

LUG has been the topic of several other research reports. BMO Capital Markets raised their target price on shares of Lundin Gold from C$93.00 to C$104.00 in a research note on Thursday. Raymond James Financial raised their price objective on shares of Lundin Gold from C$65.00 to C$80.00 in a research note on Friday. National Bankshares cut Lundin Gold from an "outperform" rating to a "sector perform" rating and lifted their price target for the company from C$67.75 to C$89.00 in a research report on Tuesday, June 24th. National Bank Financial cut Lundin Gold from a "strong-buy" rating to a "hold" rating in a research report on Monday, June 23rd. Finally, CIBC lifted their price target on Lundin Gold from C$85.00 to C$116.00 in a research report on Friday. Eleven equities research analysts have rated the stock with a Hold rating and one has given a Sell rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Reduce" and a consensus price target of C$68.54.

Get Our Latest Stock Analysis on Lundin Gold

Lundin Gold Stock Performance

Shares of LUG opened at C$93.06 on Monday. The firm has a market capitalization of C$22.46 billion, a price-to-earnings ratio of 36.64 and a beta of 1.26. The stock's fifty day moving average is C$85.39 and its 200-day moving average is C$70.11. Lundin Gold has a one year low of C$29.42 and a one year high of C$99.18.

Lundin Gold Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, September 25th. Shareholders of record on Thursday, September 25th were given a $0.675 dividend. This represents a $2.70 annualized dividend and a yield of 2.9%. This is a positive change from Lundin Gold's previous quarterly dividend of $0.21. The ex-dividend date was Wednesday, September 10th. Lundin Gold's dividend payout ratio (DPR) is presently 45.28%.

Insiders Place Their Bets

In related news, insider Chester See sold 20,000 shares of Lundin Gold stock in a transaction on Tuesday, August 26th. The stock was sold at an average price of C$83.30, for a total value of C$1,666,000.00. Following the transaction, the insider directly owned 132,571 shares in the company, valued at C$11,043,164.30. The trade was a 13.11% decrease in their position. Also, insider Sheila Margaret Colman sold 14,600 shares of Lundin Gold stock in a transaction dated Tuesday, August 26th. The stock was sold at an average price of C$81.49, for a total value of C$1,189,754.00. Following the completion of the transaction, the insider directly owned 37,068 shares in the company, valued at C$3,020,671.32. This represents a 28.26% decrease in their position. Insiders own 58.72% of the company's stock.

Lundin Gold Company Profile

(

Get Free Report)

Lundin Gold Inc is a Canada based company focused on its Fruta del Norte gold operation and developing its portfolio of mineral concessions in Ecuador. The Fruta del Norte deposit is located within a 150 km long copper-gold metallogenic sub-province located in the Cordillera del Condor region in southeastern Ecuador.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lundin Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lundin Gold wasn't on the list.

While Lundin Gold currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.