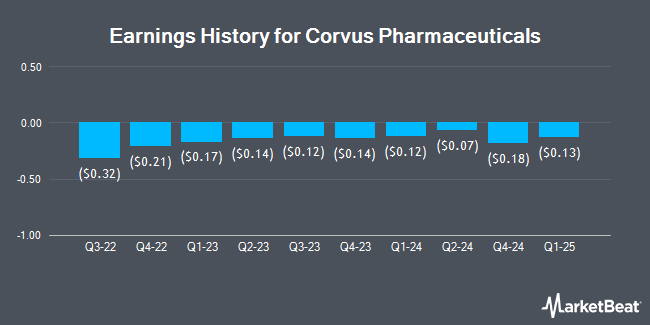

Corvus Pharmaceuticals (NASDAQ:CRVS - Get Free Report) is expected to be announcing its Q2 2025 earnings results before the market opens on Thursday, August 7th. Analysts expect the company to announce earnings of ($0.13) per share for the quarter.

Corvus Pharmaceuticals (NASDAQ:CRVS - Get Free Report) last posted its quarterly earnings results on Thursday, May 8th. The company reported ($0.13) EPS for the quarter, hitting analysts' consensus estimates of ($0.13). On average, analysts expect Corvus Pharmaceuticals to post $-1 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Corvus Pharmaceuticals Price Performance

NASDAQ:CRVS traded down $0.07 during mid-day trading on Friday, reaching $4.10. The stock had a trading volume of 604,705 shares, compared to its average volume of 436,656. The stock's 50 day simple moving average is $4.11 and its two-hundred day simple moving average is $4.09. Corvus Pharmaceuticals has a 1-year low of $2.54 and a 1-year high of $10.00. The company has a market capitalization of $279.50 million, a price-to-earnings ratio of -4.18 and a beta of 0.42.

Analyst Ratings Changes

A number of equities research analysts have recently weighed in on CRVS shares. Oppenheimer reaffirmed an "outperform" rating and set a $17.00 price target (up previously from $15.00) on shares of Corvus Pharmaceuticals in a report on Friday, May 9th. Mizuho set a $11.00 price target on Corvus Pharmaceuticals and gave the company an "outperform" rating in a report on Tuesday, May 20th. Finally, Wall Street Zen cut Corvus Pharmaceuticals from a "hold" rating to a "sell" rating in a report on Tuesday, May 20th. One research analyst has rated the stock with a sell rating and four have given a buy rating to the company. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $15.00.

View Our Latest Report on CRVS

Insider Activity

In related news, Director Peter A. Thompson sold 1,176,332 shares of Corvus Pharmaceuticals stock in a transaction on Friday, June 27th. The shares were sold at an average price of $4.16, for a total value of $4,893,541.12. Following the completion of the sale, the director owned 7,165,006 shares of the company's stock, valued at approximately $29,806,424.96. The trade was a 14.10% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Insiders own 28.50% of the company's stock.

Corvus Pharmaceuticals Company Profile

(

Get Free Report)

Corvus Pharmaceuticals, Inc, a clinical stage biopharmaceutical company, focuses on the development and commercialization of immune modulator product candidates to treat solid cancers, T cell lymphomas, autoimmune, allergic, and infectious diseases. Its lead product candidate is soquelitinib (CPI-818), a selective covalent inhibitor of interleukin 2 inducible T cell kinase (ITK), which is in a multi-center Phase 1/1b clinical trial for the treatment of peripheral T cell lymphoma, solid tumors, and atopic dermatitis.

Recommended Stories

Before you consider Corvus Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corvus Pharmaceuticals wasn't on the list.

While Corvus Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.