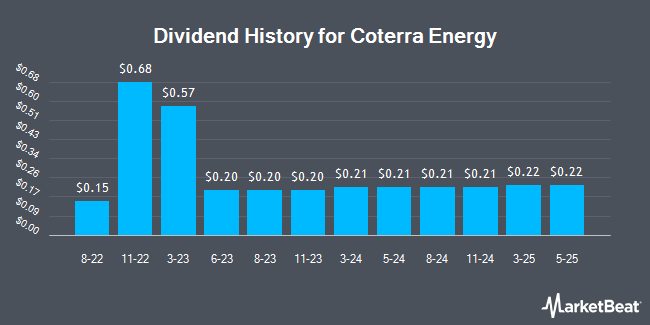

Coterra Energy Inc. (NYSE:CTRA - Get Free Report) declared a quarterly dividend on Monday, August 4th, RTT News reports. Stockholders of record on Thursday, August 14th will be paid a dividend of 0.22 per share on Thursday, August 28th. This represents a c) dividend on an annualized basis and a dividend yield of 3.7%. The ex-dividend date of this dividend is Thursday, August 14th.

Coterra Energy has a dividend payout ratio of 28.0% indicating that its dividend is sufficiently covered by earnings. Analysts expect Coterra Energy to earn $3.13 per share next year, which means the company should continue to be able to cover its $0.88 annual dividend with an expected future payout ratio of 28.1%.

Coterra Energy Trading Up 0.4%

Shares of NYSE:CTRA traded up $0.11 during mid-day trading on Friday, reaching $23.88. 1,744,448 shares of the company's stock were exchanged, compared to its average volume of 7,130,612. The firm has a market capitalization of $18.22 billion, a price-to-earnings ratio of 11.42, a PEG ratio of 0.33 and a beta of 0.33. The business's fifty day moving average price is $25.08 and its 200-day moving average price is $26.06. The company has a debt-to-equity ratio of 0.29, a quick ratio of 0.86 and a current ratio of 1.13. Coterra Energy has a twelve month low of $22.30 and a twelve month high of $29.95.

Coterra Energy (NYSE:CTRA - Get Free Report) last released its earnings results on Monday, August 4th. The company reported $0.48 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.50 by ($0.02). Coterra Energy had a net margin of 23.80% and a return on equity of 10.99%. The firm had revenue of $1.97 billion during the quarter, compared to analyst estimates of $1.78 billion. During the same quarter in the previous year, the firm earned $0.37 EPS. Coterra Energy's quarterly revenue was up 54.6% on a year-over-year basis. On average, research analysts predict that Coterra Energy will post 1.54 EPS for the current fiscal year.

Institutional Trading of Coterra Energy

Hedge funds have recently made changes to their positions in the stock. Cornerstone Planning Group LLC lifted its holdings in shares of Coterra Energy by 175.6% during the 1st quarter. Cornerstone Planning Group LLC now owns 871 shares of the company's stock valued at $25,000 after buying an additional 555 shares during the period. Raleigh Capital Management Inc. increased its stake in shares of Coterra Energy by 463.5% in the 1st quarter. Raleigh Capital Management Inc. now owns 896 shares of the company's stock worth $26,000 after purchasing an additional 737 shares in the last quarter. Bogart Wealth LLC purchased a new stake in Coterra Energy in the 2nd quarter worth $26,000. REAP Financial Group LLC increased its stake in Coterra Energy by 190.1% in the 2nd quarter. REAP Financial Group LLC now owns 1,108 shares of the company's stock worth $28,000 after buying an additional 726 shares in the last quarter. Finally, Banque Cantonale Vaudoise purchased a new stake in Coterra Energy in the 1st quarter worth $29,000. 87.92% of the stock is owned by institutional investors.

About Coterra Energy

(

Get Free Report)

Coterra Energy Inc, an independent oil and gas company, engages in the development, exploration, and production of oil, natural gas, and natural gas liquids in the United States. The company's properties include the Marcellus Shale with approximately 186,000 net acres in the dry gas window of the play located in Susquehanna County, Pennsylvania; Permian Basin properties with approximately 296,000 net acres located in west Texas and southeast New Mexico; and Anadarko Basin properties with approximately 182,000 net acres located in Oklahoma.

Further Reading

Before you consider Coterra Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coterra Energy wasn't on the list.

While Coterra Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.