Coursera (NYSE:COUR - Free Report) had its price objective hoisted by Scotiabank from $9.00 to $11.00 in a research report released on Friday,Benzinga reports. Scotiabank currently has a sector perform rating on the stock.

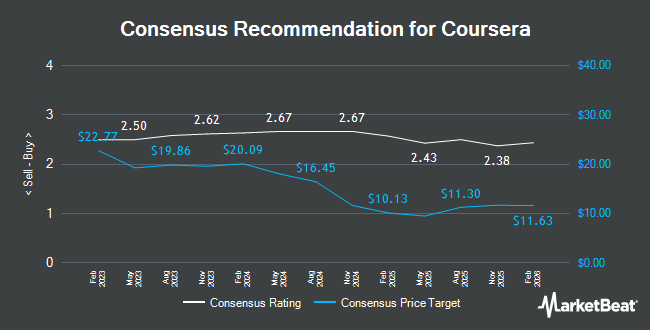

Other equities analysts have also recently issued research reports about the stock. Cantor Fitzgerald boosted their price objective on shares of Coursera from $10.00 to $13.00 and gave the company an "overweight" rating in a research note on Friday. Bank of America raised shares of Coursera from an "underperform" rating to a "neutral" rating and boosted their price objective for the company from $7.00 to $12.00 in a research note on Friday. Telsey Advisory Group reaffirmed an "outperform" rating and set a $12.00 price objective on shares of Coursera in a research note on Monday, July 21st. Morgan Stanley boosted their price target on shares of Coursera from $11.00 to $12.00 and gave the stock an "equal weight" rating in a research note on Friday. Finally, JPMorgan Chase & Co. boosted their price target on shares of Coursera from $8.00 to $9.00 and gave the stock a "neutral" rating in a research note on Wednesday, July 16th. One research analyst has rated the stock with a sell rating, five have given a hold rating and eight have issued a buy rating to the stock. Based on data from MarketBeat.com, Coursera has an average rating of "Moderate Buy" and a consensus price target of $11.25.

Read Our Latest Stock Report on Coursera

Coursera Stock Down 3.8%

NYSE COUR traded down $0.47 during trading hours on Friday, reaching $12.04. 5,144,405 shares of the company were exchanged, compared to its average volume of 3,928,573. Coursera has a 1 year low of $5.76 and a 1 year high of $13.56. The business's 50 day simple moving average is $8.86 and its 200-day simple moving average is $8.19. The stock has a market capitalization of $1.94 billion, a P/E ratio of -36.47 and a beta of 1.36.

Coursera (NYSE:COUR - Get Free Report) last released its quarterly earnings data on Thursday, July 24th. The company reported $0.12 EPS for the quarter, topping the consensus estimate of $0.09 by $0.03. The company had revenue of $187.10 million during the quarter, compared to the consensus estimate of $180.52 million. Coursera had a negative net margin of 7.05% and a negative return on equity of 5.22%. Coursera's revenue for the quarter was up 9.9% on a year-over-year basis. During the same period last year, the firm earned $0.09 EPS. As a group, sell-side analysts anticipate that Coursera will post -0.28 earnings per share for the current year.

Insider Activity

In related news, CAO Michele M. Meyers sold 12,500 shares of the stock in a transaction dated Friday, July 25th. The shares were sold at an average price of $11.60, for a total transaction of $145,000.00. Following the sale, the chief accounting officer directly owned 253,351 shares of the company's stock, valued at approximately $2,938,871.60. This represents a 4.70% decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director Sabrina Simmons sold 9,335 shares of the company's stock in a transaction dated Thursday, May 22nd. The shares were sold at an average price of $8.48, for a total transaction of $79,160.80. Following the transaction, the director owned 50,215 shares in the company, valued at $425,823.20. This represents a 15.68% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 37,270 shares of company stock valued at $356,087. Company insiders own 16.80% of the company's stock.

Hedge Funds Weigh In On Coursera

Several institutional investors have recently made changes to their positions in the business. Total Clarity Wealth Management Inc. bought a new position in shares of Coursera in the 2nd quarter worth approximately $183,000. CWM LLC raised its stake in Coursera by 165.5% during the 2nd quarter. CWM LLC now owns 63,179 shares of the company's stock worth $553,000 after acquiring an additional 39,385 shares during the period. KLP Kapitalforvaltning AS raised its stake in Coursera by 22.9% during the 2nd quarter. KLP Kapitalforvaltning AS now owns 30,100 shares of the company's stock worth $264,000 after acquiring an additional 5,600 shares during the period. 111 Capital raised its stake in Coursera by 152.8% during the 2nd quarter. 111 Capital now owns 29,643 shares of the company's stock worth $260,000 after acquiring an additional 17,915 shares during the period. Finally, Robeco Institutional Asset Management B.V. bought a new stake in Coursera during the 2nd quarter worth approximately $239,000. Institutional investors own 89.55% of the company's stock.

About Coursera

(

Get Free Report)

Coursera, Inc operates an online educational content platform in the United States, Europe, Africa, the Asia Pacific, the Middle East, and internationally. It operates in three segments: Consumer, Enterprise, and Degrees. The company offers guided projects, courses, and specializations, as well as online degrees; and certificates for entry-level professional, non-entry level professional, university, and MasterTrack.

Further Reading

Before you consider Coursera, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coursera wasn't on the list.

While Coursera currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.