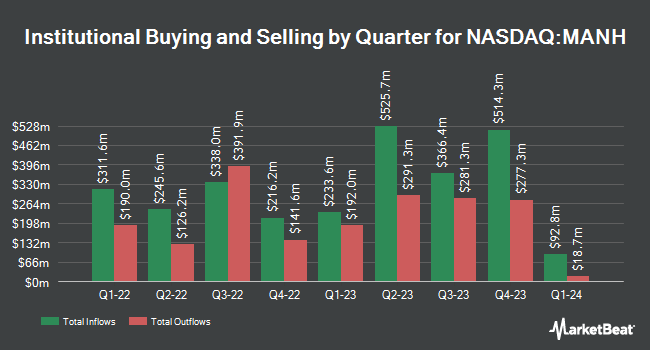

Cresset Asset Management LLC reduced its position in Manhattan Associates, Inc. (NASDAQ:MANH - Free Report) by 45.5% during the fourth quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 3,834 shares of the software maker's stock after selling 3,200 shares during the period. Cresset Asset Management LLC's holdings in Manhattan Associates were worth $1,036,000 at the end of the most recent quarter.

A number of other institutional investors have also modified their holdings of MANH. Twin Tree Management LP bought a new stake in shares of Manhattan Associates in the 4th quarter valued at about $25,000. Whipplewood Advisors LLC purchased a new position in shares of Manhattan Associates in the 4th quarter valued at approximately $34,000. Synergy Asset Management LLC purchased a new position in shares of Manhattan Associates in the 4th quarter valued at approximately $35,000. Transce3nd LLC purchased a new position in shares of Manhattan Associates in the 4th quarter valued at approximately $41,000. Finally, Bank of Jackson Hole Trust purchased a new position in shares of Manhattan Associates in the 4th quarter valued at approximately $72,000. 98.45% of the stock is currently owned by institutional investors.

Insider Activity at Manhattan Associates

In related news, CFO Dennis B. Story sold 2,788 shares of Manhattan Associates stock in a transaction on Thursday, March 6th. The shares were sold at an average price of $170.83, for a total value of $476,274.04. Following the sale, the chief financial officer now owns 101,263 shares of the company's stock, valued at approximately $17,298,758.29. This trade represents a 2.68% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. 0.88% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

MANH has been the subject of several research analyst reports. Truist Financial increased their price objective on shares of Manhattan Associates from $180.00 to $190.00 and gave the company a "buy" rating in a research report on Wednesday, April 23rd. Citigroup reduced their price target on shares of Manhattan Associates from $244.00 to $184.00 and set a "neutral" rating for the company in a research report on Friday, March 14th. StockNews.com lowered shares of Manhattan Associates from a "buy" rating to a "hold" rating in a research report on Monday, January 13th. William Blair raised shares of Manhattan Associates from a "market perform" rating to an "outperform" rating in a research report on Thursday, February 13th. Finally, Robert W. Baird cut their target price on shares of Manhattan Associates from $282.00 to $225.00 and set an "outperform" rating for the company in a report on Tuesday, March 18th. Three equities research analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. According to data from MarketBeat, Manhattan Associates has a consensus rating of "Moderate Buy" and a consensus price target of $212.38.

View Our Latest Stock Report on Manhattan Associates

Manhattan Associates Stock Performance

Manhattan Associates stock opened at $184.67 on Monday. The company's fifty day moving average price is $169.82 and its 200 day moving average price is $226.01. Manhattan Associates, Inc. has a 1 year low of $140.81 and a 1 year high of $312.60. The stock has a market capitalization of $11.21 billion, a P/E ratio of 52.61 and a beta of 1.13.

About Manhattan Associates

(

Free Report)

Manhattan Associates, Inc develops, sells, deploys, services, and maintains software solutions to manage supply chains, inventory, and omni-channel operations. It offers Warehouse Management Solution for managing goods and information across the distribution centers; Manhattan Active Warehouse Management, a cloud native and version less application for the associate; and Transportation Management Solution for helping shippers navigate their way through the demands and meet customer service expectations at the lowest possible freight costs; Manhattan SCALE, a portfolio of logistics execution solution; and Manhattan Active Omni, which offers order management, store inventory and fulfillment, POS, and customer engagement tools for enterprises and stores.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Manhattan Associates, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Manhattan Associates wasn't on the list.

While Manhattan Associates currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.