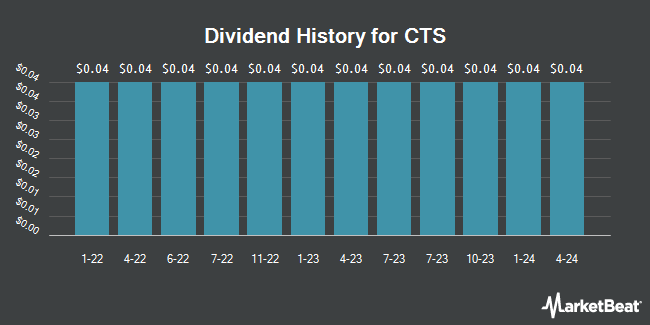

CTS Corporation (NYSE:CTS - Get Free Report) declared a quarterly dividend on Thursday, August 14th, RTT News reports. Investors of record on Friday, September 26th will be given a dividend of 0.04 per share by the electronics maker on Friday, October 24th. This represents a c) dividend on an annualized basis and a yield of 0.4%. The ex-dividend date of this dividend is Friday, September 26th.

CTS has a dividend payout ratio of 6.6% indicating that its dividend is sufficiently covered by earnings.

CTS Trading Up 1.0%

NYSE:CTS traded up $0.41 on Tuesday, hitting $41.72. The stock had a trading volume of 4,655 shares, compared to its average volume of 183,067. The company has a quick ratio of 2.04, a current ratio of 2.61 and a debt-to-equity ratio of 0.16. The stock has a market cap of $1.23 billion, a price-to-earnings ratio of 19.59, a PEG ratio of 1.14 and a beta of 0.82. The company has a fifty day moving average price of $41.61 and a two-hundred day moving average price of $41.71. CTS has a 1-year low of $34.02 and a 1-year high of $59.68.

CTS (NYSE:CTS - Get Free Report) last posted its earnings results on Thursday, July 24th. The electronics maker reported $0.57 earnings per share for the quarter, beating the consensus estimate of $0.55 by $0.02. The company had revenue of $135.30 million for the quarter, compared to analyst estimates of $132.65 million. CTS had a net margin of 12.32% and a return on equity of 12.31%. During the same period in the previous year, the business posted $0.54 EPS. Equities research analysts expect that CTS will post 2.28 earnings per share for the current fiscal year.

Hedge Funds Weigh In On CTS

Several large investors have recently made changes to their positions in CTS. Quarry LP lifted its holdings in CTS by 572.4% during the 4th quarter. Quarry LP now owns 659 shares of the electronics maker's stock worth $35,000 after buying an additional 561 shares in the last quarter. Meeder Asset Management Inc. purchased a new stake in shares of CTS in the 1st quarter valued at approximately $37,000. GAMMA Investing LLC increased its position in shares of CTS by 81.3% in the 1st quarter. GAMMA Investing LLC now owns 1,273 shares of the electronics maker's stock valued at $53,000 after purchasing an additional 571 shares during the last quarter. Versant Capital Management Inc increased its position in shares of CTS by 581.7% in the 1st quarter. Versant Capital Management Inc now owns 1,793 shares of the electronics maker's stock valued at $74,000 after purchasing an additional 1,530 shares during the last quarter. Finally, Larson Financial Group LLC purchased a new stake in shares of CTS in the 1st quarter valued at approximately $75,000. 96.87% of the stock is currently owned by institutional investors and hedge funds.

CTS Company Profile

(

Get Free Report)

CTS Corporation manufactures and sells sensors, actuators, and connectivity components in North America, Europe, and Asia. The company provides encoders, rotary position sensors, slide potentiometers, industrial and commercial rotary potentiometers. It also provides non-contacting, and contacting pedals; and eBrake pedals.

Further Reading

Before you consider CTS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CTS wasn't on the list.

While CTS currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.