Five9 (NASDAQ:FIVN - Get Free Report)'s stock had its "neutral" rating reaffirmed by research analysts at DA Davidson in a research note issued to investors on Friday,Benzinga reports. They presently have a $28.00 price target on the software maker's stock, up from their previous price target of $25.00. DA Davidson's price objective points to a potential upside of 15.32% from the stock's current price. DA Davidson also issued estimates for Five9's Q3 2025 earnings at $0.22 EPS, FY2025 earnings at $0.82 EPS and FY2026 earnings at $0.98 EPS.

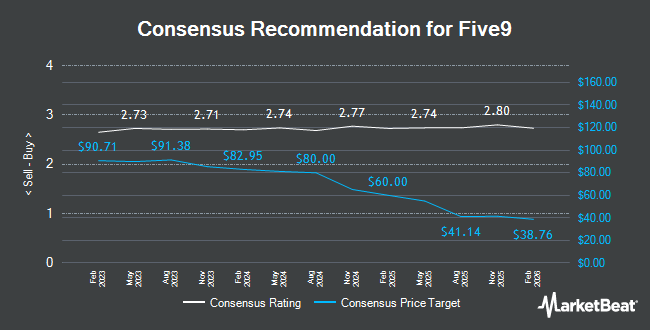

A number of other research analysts also recently issued reports on FIVN. UBS Group reduced their price target on shares of Five9 from $55.00 to $35.00 and set a "buy" rating on the stock in a research report on Friday, May 2nd. Barclays lowered their price objective on shares of Five9 from $60.00 to $33.00 and set an "overweight" rating on the stock in a research note on Monday, May 5th. Canaccord Genuity Group reiterated a "buy" rating and issued a $40.00 target price on shares of Five9 in a report on Friday. Wells Fargo & Company reduced their target price on shares of Five9 from $45.00 to $23.00 and set an "equal weight" rating for the company in a research note on Tuesday, April 22nd. Finally, Morgan Stanley dropped their price target on shares of Five9 from $48.00 to $28.00 and set an "equal weight" rating on the stock in a research report on Wednesday, April 16th. Six equities research analysts have rated the stock with a hold rating, seventeen have issued a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $41.14.

Get Our Latest Report on Five9

Five9 Trading Down 6.0%

Shares of Five9 stock traded down $1.55 during trading hours on Friday, hitting $24.28. The company's stock had a trading volume of 6,300,693 shares, compared to its average volume of 1,734,645. Five9 has a 1-year low of $21.04 and a 1-year high of $49.90. The business has a fifty day moving average of $27.42 and a 200 day moving average of $30.00. The company has a market capitalization of $1.85 billion, a PE ratio of 269.81, a P/E/G ratio of 2.31 and a beta of 1.17. The company has a quick ratio of 2.02, a current ratio of 2.02 and a debt-to-equity ratio of 1.12.

Five9 (NASDAQ:FIVN - Get Free Report) last released its quarterly earnings results on Thursday, July 31st. The software maker reported $0.76 earnings per share for the quarter, beating analysts' consensus estimates of $0.65 by $0.11. Five9 had a net margin of 0.80% and a return on equity of 9.27%. The business had revenue of $283.27 million during the quarter, compared to analyst estimates of $275.18 million. During the same period last year, the business earned $0.52 EPS. The business's revenue was up 12.4% on a year-over-year basis. As a group, equities analysts forecast that Five9 will post 0.28 EPS for the current year.

Insider Buying and Selling at Five9

In other Five9 news, EVP Panos Kozanian sold 3,816 shares of the business's stock in a transaction dated Wednesday, June 4th. The stock was sold at an average price of $28.28, for a total transaction of $107,916.48. Following the completion of the sale, the executive vice president directly owned 123,218 shares of the company's stock, valued at approximately $3,484,605.04. The trade was a 3.00% decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, CAO Leena Mansharamani sold 2,938 shares of the company's stock in a transaction dated Wednesday, June 4th. The shares were sold at an average price of $27.83, for a total value of $81,764.54. Following the completion of the sale, the chief accounting officer directly owned 44,901 shares of the company's stock, valued at approximately $1,249,594.83. This trade represents a 6.14% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 32,866 shares of company stock worth $913,042 over the last quarter. Corporate insiders own 1.60% of the company's stock.

Hedge Funds Weigh In On Five9

A number of large investors have recently bought and sold shares of FIVN. Banque Transatlantique SA acquired a new stake in shares of Five9 in the 4th quarter valued at approximately $36,000. Johnson Financial Group Inc. acquired a new stake in shares of Five9 during the fourth quarter worth $47,000. Nisa Investment Advisors LLC bought a new position in shares of Five9 in the second quarter worth $32,000. Kayne Anderson Rudnick Investment Management LLC increased its position in shares of Five9 by 419.2% in the first quarter. Kayne Anderson Rudnick Investment Management LLC now owns 2,243 shares of the software maker's stock worth $61,000 after purchasing an additional 1,811 shares during the period. Finally, Quarry LP acquired a new position in Five9 during the first quarter worth about $74,000. Institutional investors and hedge funds own 96.64% of the company's stock.

About Five9

(

Get Free Report)

Five9, Inc, together with its subsidiaries, provides intelligent cloud software for contact centers in the United States, India, and internationally. It offers a virtual contact center cloud platform that delivers a suite of applications, which enables the breadth of contact center-related customer service, sales, and marketing functions.

Further Reading

Before you consider Five9, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Five9 wasn't on the list.

While Five9 currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.