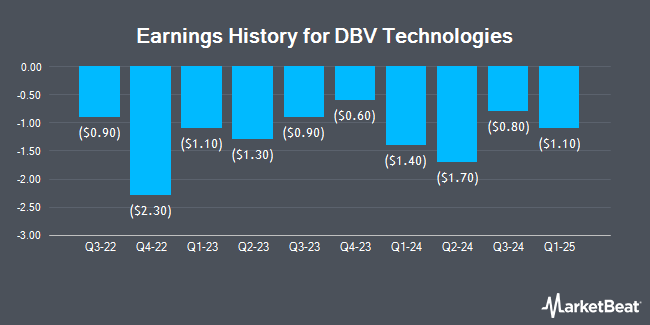

DBV Technologies (NASDAQ:DBVT - Get Free Report) issued its quarterly earnings results on Tuesday. The company reported ($1.55) EPS for the quarter, missing the consensus estimate of ($0.21) by ($1.34), Zacks reports. DBV Technologies had a negative return on equity of 287.15% and a negative net margin of 3,220.49%. The company had revenue of $1.74 million for the quarter, compared to the consensus estimate of $0.64 million.

DBV Technologies Stock Performance

Shares of NASDAQ:DBVT traded up $0.49 during trading hours on Friday, hitting $9.00. The stock had a trading volume of 24,525 shares, compared to its average volume of 26,058. DBV Technologies has a 1-year low of $2.20 and a 1-year high of $12.78. The firm has a market capitalization of $246.51 million, a price-to-earnings ratio of -1.89 and a beta of -0.58. The stock's fifty day simple moving average is $9.50 and its 200 day simple moving average is $7.41.

Wall Street Analyst Weigh In

DBVT has been the topic of a number of recent research reports. Lifesci Capital raised shares of DBV Technologies to a "strong-buy" rating in a report on Thursday, June 26th. HC Wainwright raised their target price on shares of DBV Technologies from $7.00 to $16.00 and gave the stock a "buy" rating in a report on Monday, May 5th. JMP Securities reissued a "market outperform" rating and issued a $21.00 target price on shares of DBV Technologies in a report on Thursday, June 26th. Citigroup restated an "outperform" rating on shares of DBV Technologies in a research note on Tuesday, May 27th. Finally, The Goldman Sachs Group upgraded shares of DBV Technologies to a "sell" rating and set a $7.25 price target on the stock in a research note on Thursday, May 29th. Two investment analysts have rated the stock with a sell rating, three have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus target price of $14.75.

View Our Latest Analysis on DBVT

DBV Technologies Company Profile

(

Get Free Report)

DBV Technologies SA, a clinical-stage biopharmaceutical company, engages in the research and development of epicutaneous immunotherapy products. Its product pipeline comprising Viaskin Peanut, an immunotherapy product, which has completed Phase 3 clinical trial for the treatment of peanut allergies; and Viaskin Milk which is in Phase 1/2 clinical trial for the treatment of immunoglobulin E (IgE) mediated or cow's milk protein allergy and eosinophilic esophagitis.

Featured Articles

Before you consider DBV Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DBV Technologies wasn't on the list.

While DBV Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.