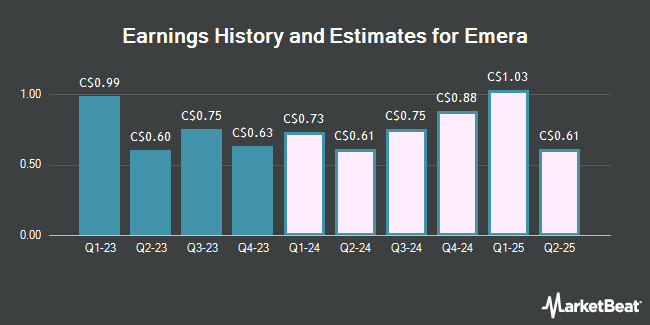

Emera Incorporated (TSE:EMA - Free Report) - Equities research analysts at Desjardins decreased their Q3 2025 earnings per share estimates for Emera in a note issued to investors on Tuesday, October 21st. Desjardins analyst B. Stadler now forecasts that the company will earn $0.85 per share for the quarter, down from their previous estimate of $0.95. Desjardins has a "Hold" rating and a $68.00 price target on the stock. The consensus estimate for Emera's current full-year earnings is $3.20 per share. Desjardins also issued estimates for Emera's Q4 2025 earnings at $0.70 EPS, FY2025 earnings at $3.62 EPS, FY2026 earnings at $3.51 EPS and FY2027 earnings at $3.59 EPS.

A number of other analysts have also recently issued reports on EMA. Scotiabank raised their price objective on Emera from C$70.00 to C$72.00 and gave the company an "outperform" rating in a research report on Monday, October 6th. CIBC raised their price objective on Emera from C$68.00 to C$71.00 in a research report on Tuesday. TD Securities raised their price objective on Emera from C$69.00 to C$74.00 and gave the company a "buy" rating in a research report on Monday, August 11th. National Bankshares raised their price objective on Emera from C$60.00 to C$62.00 and gave the company a "sector perform" rating in a research report on Monday, August 11th. Finally, Raymond James Financial raised their price objective on Emera from C$66.00 to C$70.00 and gave the company an "outperform" rating in a research report on Monday, August 11th. Six analysts have rated the stock with a Buy rating and five have assigned a Hold rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of C$65.25.

Check Out Our Latest Analysis on EMA

Emera Stock Performance

Shares of TSE EMA opened at C$69.06 on Friday. The stock has a 50 day moving average price of C$66.13 and a 200 day moving average price of C$63.34. Emera has a 52 week low of C$49.46 and a 52 week high of C$69.62. The company has a debt-to-equity ratio of 150.23, a quick ratio of 0.23 and a current ratio of 0.72. The stock has a market capitalization of C$20.67 billion, a PE ratio of 23.41, a price-to-earnings-growth ratio of 6.20 and a beta of 0.46.

Emera Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, August 15th. Stockholders of record on Friday, August 15th were paid a dividend of $0.725 per share. The ex-dividend date was Friday, August 1st. This represents a $2.90 dividend on an annualized basis and a dividend yield of 4.2%. Emera's dividend payout ratio (DPR) is 98.05%.

Insider Buying and Selling

In other news, Director Archibald Collins sold 30,600 shares of the stock in a transaction that occurred on Tuesday, September 9th. The stock was sold at an average price of C$64.95, for a total transaction of C$1,987,470.00. Following the transaction, the director owned 13,045 shares in the company, valued at approximately C$847,272.75. This trade represents a 70.11% decrease in their ownership of the stock. Also, Director Judy Ann Steele sold 18,100 shares of the stock in a transaction that occurred on Tuesday, September 9th. The stock was sold at an average price of C$64.90, for a total value of C$1,174,690.00. Following the transaction, the director owned 352 shares in the company, valued at approximately C$22,844.80. This trade represents a 98.09% decrease in their position. In the last quarter, insiders have sold 49,494 shares of company stock worth $3,213,691. 0.09% of the stock is owned by corporate insiders.

Emera Company Profile

(

Get Free Report)

Emera is a geographically diverse energy and services company investing in electricity generation, transmission, and distribution as well as gas transmission and utility energy services. Emera has operations throughout North America and the Caribbean countries.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Emera, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Emera wasn't on the list.

While Emera currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.