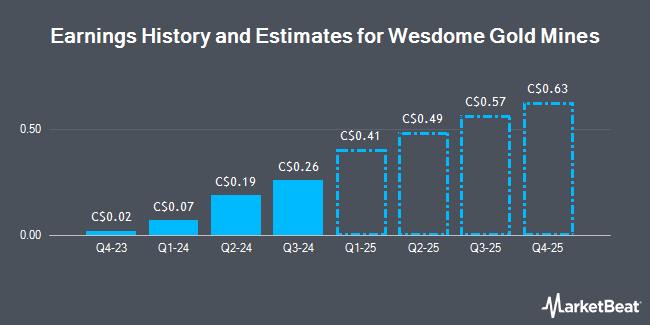

Wesdome Gold Mines Ltd. (TSE:WDO - Free Report) - Desjardins upped their FY2025 EPS estimates for Wesdome Gold Mines in a research note issued on Wednesday, August 13th. Desjardins analyst A. Carson now forecasts that the company will post earnings per share of $1.94 for the year, up from their previous estimate of $1.87. The consensus estimate for Wesdome Gold Mines' current full-year earnings is $1.29 per share. Desjardins also issued estimates for Wesdome Gold Mines' FY2026 earnings at $2.52 EPS.

A number of other research firms also recently weighed in on WDO. National Bankshares lifted their price objective on Wesdome Gold Mines from C$26.75 to C$28.00 and gave the company an "outperform" rating in a report on Thursday, May 22nd. Stifel Canada downgraded Wesdome Gold Mines from a "strong-buy" rating to a "hold" rating in a report on Thursday, August 14th. Canaccord Genuity Group raised Wesdome Gold Mines from a "hold" rating to a "strong-buy" rating in a report on Wednesday, July 23rd. Royal Bank Of Canada raised their price objective on shares of Wesdome Gold Mines from C$19.00 to C$22.00 in a report on Wednesday, June 4th. Finally, Stifel Nicolaus lowered shares of Wesdome Gold Mines from a "buy" rating to a "hold" rating and dropped their price objective for the stock from C$24.00 to C$20.50 in a report on Friday, August 15th. One research analyst has rated the stock with a Strong Buy rating, two have issued a Buy rating and three have issued a Hold rating to the stock. According to data from MarketBeat, Wesdome Gold Mines presently has an average rating of "Moderate Buy" and an average target price of C$20.70.

Read Our Latest Stock Analysis on WDO

Wesdome Gold Mines Price Performance

TSE WDO traded up C$0.30 during trading on Friday, reaching C$16.30. 575,489 shares of the company traded hands, compared to its average volume of 561,014. The company has a debt-to-equity ratio of 0.30, a quick ratio of 0.37 and a current ratio of 2.14. The stock's 50 day moving average price is C$17.96 and its two-hundred day moving average price is C$16.98. The company has a market cap of C$2.47 billion, a price-to-earnings ratio of 30.42 and a beta of 0.85. Wesdome Gold Mines has a 1-year low of C$10.89 and a 1-year high of C$20.24.

Insider Buying and Selling

In related news, Senior Officer Robert Kristian Fitzgerald Kallio sold 3,348 shares of the firm's stock in a transaction that occurred on Thursday, June 5th. The shares were sold at an average price of C$19.27, for a total value of C$64,515.96. Also, Senior Officer Rajbir Gill sold 10,822 shares of the firm's stock in a transaction that occurred on Monday, June 30th. The shares were sold at an average price of C$18.56, for a total transaction of C$200,856.32. In the last three months, insiders sold 28,343 shares of company stock valued at $529,274. 0.17% of the stock is currently owned by company insiders.

About Wesdome Gold Mines

(

Get Free Report)

Wesdome Gold Mines Ltd is a gold producer engaged in mining-related activities including exploration, processing, and reclamation. The company produces gold at the Eagle River Complex located near Wawa, Ontario from the Eagle River Underground and Mishi Open Pit gold mines. Activities of the group primarily function through Canada and it derives revenue from the sale of gold and silver bullion.

Featured Articles

Before you consider Wesdome Gold Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wesdome Gold Mines wasn't on the list.

While Wesdome Gold Mines currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.