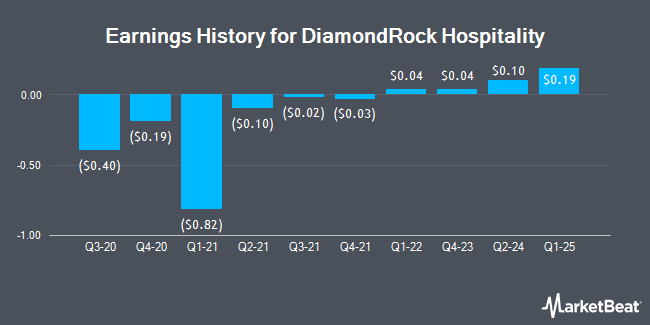

DiamondRock Hospitality (NYSE:DRH - Get Free Report) issued its quarterly earnings results on Thursday. The real estate investment trust reported $0.35 earnings per share for the quarter, topping analysts' consensus estimates of $0.33 by $0.02, Zacks reports. The company had revenue of $305.70 million during the quarter, compared to the consensus estimate of $303.70 million. DiamondRock Hospitality had a net margin of 6.04% and a return on equity of 4.23%. The firm's quarterly revenue was down 1.2% on a year-over-year basis. During the same quarter in the prior year, the firm posted $0.34 EPS. DiamondRock Hospitality updated its FY 2025 guidance to 0.960-1.060 EPS.

DiamondRock Hospitality Stock Up 2.6%

DiamondRock Hospitality stock traded up $0.20 during midday trading on Tuesday, hitting $7.81. 1,686,368 shares of the stock were exchanged, compared to its average volume of 2,661,408. The business's 50-day moving average price is $7.81 and its 200-day moving average price is $7.82. DiamondRock Hospitality has a 52-week low of $6.18 and a 52-week high of $10.00. The company has a quick ratio of 1.62, a current ratio of 1.30 and a debt-to-equity ratio of 0.64. The stock has a market capitalization of $1.61 billion, a price-to-earnings ratio of 30.02, a price-to-earnings-growth ratio of 4.36 and a beta of 1.41.

DiamondRock Hospitality Cuts Dividend

The firm also recently disclosed a dividend, which was paid on Friday, July 11th. Shareholders of record on Tuesday, July 1st were paid a $0.08 dividend. This represents a dividend yield of 420.0%. The ex-dividend date of this dividend was Monday, June 30th. DiamondRock Hospitality's dividend payout ratio (DPR) is 123.08%.

Wall Street Analyst Weigh In

DRH has been the subject of several recent analyst reports. Morgan Stanley decreased their price objective on shares of DiamondRock Hospitality from $9.00 to $7.00 and set an "equal weight" rating for the company in a research report on Tuesday, April 22nd. Bank of America upgraded shares of DiamondRock Hospitality from an "underperform" rating to a "buy" rating and set a $9.50 price objective for the company in a research report on Wednesday, April 30th. Truist Financial decreased their price objective on shares of DiamondRock Hospitality from $10.00 to $9.00 and set a "hold" rating for the company in a research report on Friday, May 30th. Evercore ISI decreased their price objective on shares of DiamondRock Hospitality from $10.00 to $9.00 and set an "in-line" rating for the company in a research report on Monday, April 28th. Finally, Stifel Nicolaus raised their price target on shares of DiamondRock Hospitality from $8.00 to $8.25 and gave the stock a "hold" rating in a report on Friday, May 2nd. Six research analysts have rated the stock with a hold rating and one has assigned a buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus price target of $8.50.

Get Our Latest Analysis on DRH

Hedge Funds Weigh In On DiamondRock Hospitality

A number of hedge funds and other institutional investors have recently bought and sold shares of the stock. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC boosted its position in shares of DiamondRock Hospitality by 3.8% in the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 1,327,841 shares of the real estate investment trust's stock worth $10,251,000 after purchasing an additional 48,558 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. boosted its position in shares of DiamondRock Hospitality by 5.1% during the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 123,672 shares of the real estate investment trust's stock worth $955,000 after acquiring an additional 5,971 shares during the last quarter. AQR Capital Management LLC raised its stake in DiamondRock Hospitality by 223.2% during the first quarter. AQR Capital Management LLC now owns 65,376 shares of the real estate investment trust's stock valued at $505,000 after purchasing an additional 45,146 shares in the last quarter. Creative Planning purchased a new stake in DiamondRock Hospitality during the second quarter valued at $99,000. Finally, United Services Automobile Association purchased a new stake in shares of DiamondRock Hospitality in the first quarter valued at $91,000.

About DiamondRock Hospitality

(

Get Free Report)

DiamondRock Hospitality Company is a self-advised real estate investment trust (REIT) that is an owner of a leading portfolio of geographically diversified hotels concentrated in leisure destinations and top gateway markets. The Company currently owns 36 premium quality hotels with over 9,700 rooms. The Company has strategically positioned its portfolio to be operated both under leading global brand families as well as independent boutique hotels in the lifestyle segment.

Further Reading

Before you consider DiamondRock Hospitality, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DiamondRock Hospitality wasn't on the list.

While DiamondRock Hospitality currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.