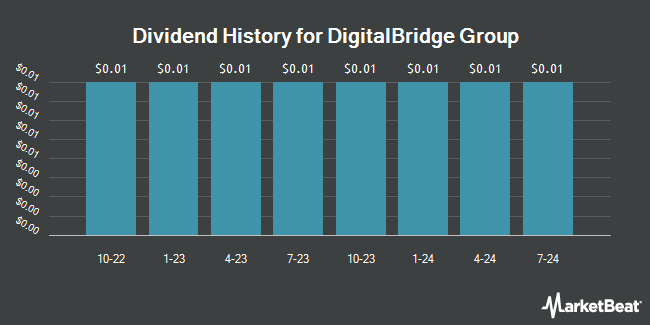

DigitalBridge Group, Inc. (NYSE:DBRG - Get Free Report) announced a quarterly dividend on Thursday, August 7th, RTT News reports. Stockholders of record on Tuesday, September 30th will be given a dividend of 0.01 per share on Wednesday, October 15th. This represents a c) annualized dividend and a dividend yield of 0.4%. The ex-dividend date of this dividend is Tuesday, September 30th.

DigitalBridge Group has a dividend payout ratio of 12.5% meaning its dividend is sufficiently covered by earnings. Equities analysts expect DigitalBridge Group to earn $0.32 per share next year, which means the company should continue to be able to cover its $0.04 annual dividend with an expected future payout ratio of 12.5%.

DigitalBridge Group Price Performance

Shares of NYSE DBRG traded up $0.22 during trading hours on Friday, hitting $10.49. 2,037,193 shares of the company's stock were exchanged, compared to its average volume of 1,781,086. DigitalBridge Group has a 1-year low of $6.41 and a 1-year high of $17.33. The stock has a market capitalization of $1.85 billion, a price-to-earnings ratio of -262.25, a PEG ratio of 1.18 and a beta of 1.77. The company's 50-day moving average price is $10.61 and its 200-day moving average price is $10.03.

Hedge Funds Weigh In On DigitalBridge Group

Large investors have recently added to or reduced their stakes in the company. Sunbelt Securities Inc. raised its holdings in DigitalBridge Group by 109.9% in the 4th quarter. Sunbelt Securities Inc. now owns 2,796 shares of the company's stock valued at $31,000 after acquiring an additional 1,464 shares in the last quarter. Point72 Hong Kong Ltd acquired a new position in DigitalBridge Group in the 4th quarter valued at approximately $39,000. GAMMA Investing LLC raised its holdings in DigitalBridge Group by 978.9% in the 1st quarter. GAMMA Investing LLC now owns 4,445 shares of the company's stock valued at $39,000 after acquiring an additional 4,033 shares in the last quarter. Spire Wealth Management raised its holdings in DigitalBridge Group by 91.1% in the 1st quarter. Spire Wealth Management now owns 6,208 shares of the company's stock valued at $55,000 after acquiring an additional 2,960 shares in the last quarter. Finally, US Bancorp DE raised its holdings in DigitalBridge Group by 187.3% in the 1st quarter. US Bancorp DE now owns 6,265 shares of the company's stock valued at $55,000 after acquiring an additional 4,084 shares in the last quarter. Institutional investors and hedge funds own 92.69% of the company's stock.

DigitalBridge Group Company Profile

(

Get Free Report)

DigitalBridge is an infrastructure investment firm specializing in digital infrastructure assets. They provide services to institutional investors. They primarily invest in data centers, cell towers, fiber networks, small cells, and edge infrastructure. DigitalBridge Group, Inc was founded in 1991 and is headquartered in Boca Raton, Florida with additional offices in Los Angles, California, and New York New York.

Read More

Before you consider DigitalBridge Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DigitalBridge Group wasn't on the list.

While DigitalBridge Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.