Dimensional Fund Advisors LP increased its position in shares of Wynn Resorts, Limited (NASDAQ:WYNN - Free Report) by 2.2% in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 613,343 shares of the casino operator's stock after purchasing an additional 13,100 shares during the period. Dimensional Fund Advisors LP owned approximately 0.56% of Wynn Resorts worth $52,845,000 as of its most recent filing with the Securities and Exchange Commission.

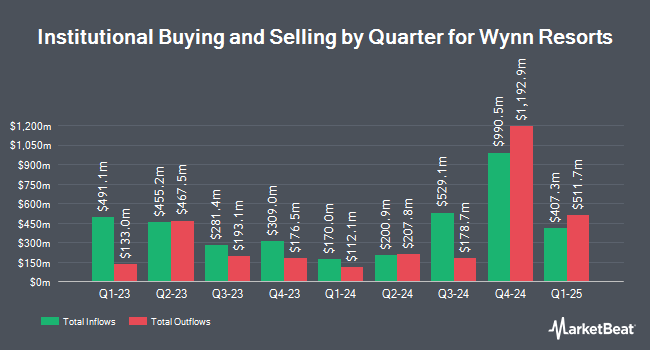

Several other institutional investors have also added to or reduced their stakes in the company. Barrow Hanley Mewhinney & Strauss LLC boosted its position in shares of Wynn Resorts by 18.4% in the fourth quarter. Barrow Hanley Mewhinney & Strauss LLC now owns 3,125,668 shares of the casino operator's stock valued at $269,308,000 after acquiring an additional 485,204 shares during the period. Geode Capital Management LLC boosted its holdings in Wynn Resorts by 1.1% in the 4th quarter. Geode Capital Management LLC now owns 2,433,052 shares of the casino operator's stock valued at $209,120,000 after purchasing an additional 26,792 shares during the period. Renaissance Technologies LLC grew its position in shares of Wynn Resorts by 16.4% during the 4th quarter. Renaissance Technologies LLC now owns 1,616,756 shares of the casino operator's stock worth $139,300,000 after purchasing an additional 228,000 shares in the last quarter. Norges Bank bought a new position in shares of Wynn Resorts during the fourth quarter worth approximately $117,352,000. Finally, Charles Schwab Investment Management Inc. raised its position in shares of Wynn Resorts by 0.5% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 952,442 shares of the casino operator's stock valued at $82,062,000 after buying an additional 5,032 shares in the last quarter. 88.64% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

A number of equities analysts have commented on WYNN shares. StockNews.com lowered Wynn Resorts from a "buy" rating to a "hold" rating in a research note on Wednesday, March 12th. Barclays decreased their price target on Wynn Resorts from $116.00 to $99.00 and set an "overweight" rating on the stock in a research report on Tuesday, April 22nd. Morgan Stanley cut their price objective on shares of Wynn Resorts from $105.00 to $103.00 and set an "overweight" rating for the company in a research report on Monday, February 24th. Jefferies Financial Group raised shares of Wynn Resorts from a "hold" rating to a "buy" rating and raised their target price for the company from $105.00 to $118.00 in a report on Tuesday, February 18th. Finally, Macquarie reaffirmed an "outperform" rating and set a $115.00 price target on shares of Wynn Resorts in a report on Friday, February 14th. Three equities research analysts have rated the stock with a hold rating, eleven have assigned a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $118.17.

Check Out Our Latest Stock Analysis on WYNN

Wynn Resorts Stock Performance

Shares of NASDAQ:WYNN opened at $82.49 on Friday. The firm has a market cap of $8.76 billion, a PE ratio of 19.59, a price-to-earnings-growth ratio of 2.35 and a beta of 1.53. Wynn Resorts, Limited has a 52 week low of $65.25 and a 52 week high of $107.81. The firm's fifty day moving average is $81.04 and its 200-day moving average is $86.37.

Wynn Resorts (NASDAQ:WYNN - Get Free Report) last released its quarterly earnings results on Thursday, February 13th. The casino operator reported $2.42 EPS for the quarter, beating analysts' consensus estimates of $1.27 by $1.15. Wynn Resorts had a negative return on equity of 71.17% and a net margin of 7.03%. The firm had revenue of $1.84 billion for the quarter, compared to analyst estimates of $1.78 billion. Sell-side analysts forecast that Wynn Resorts, Limited will post 5.17 EPS for the current year.

Wynn Resorts Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Wednesday, March 5th. Stockholders of record on Monday, February 24th were given a $0.25 dividend. The ex-dividend date was Monday, February 24th. This represents a $1.00 dividend on an annualized basis and a dividend yield of 1.21%. Wynn Resorts's dividend payout ratio (DPR) is currently 23.75%.

Insider Activity

In other news, major shareholder Tilman J. Fertitta purchased 300,000 shares of the business's stock in a transaction on Friday, April 4th. The shares were acquired at an average price of $70.37 per share, with a total value of $21,111,000.00. Following the completion of the transaction, the insider now owns 12,900,000 shares of the company's stock, valued at $907,773,000. The trade was a 2.38 % increase in their position. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, Director Philip G. Satre acquired 22,200 shares of the stock in a transaction dated Tuesday, February 18th. The stock was acquired at an average cost of $92.18 per share, with a total value of $2,046,396.00. Following the completion of the transaction, the director now owns 34,195 shares in the company, valued at approximately $3,152,095.10. This represents a 185.08 % increase in their position. The disclosure for this purchase can be found here. In the last three months, insiders have bought 438,700 shares of company stock valued at $31,300,943. 0.52% of the stock is currently owned by insiders.

About Wynn Resorts

(

Free Report)

Wynn Resorts, Limited designs, develops, and operates integrated resorts. The company operates through four segments: Wynn Palace, Wynn Macau, Las Vegas Operations, and Encore Boston Harbor. The Wynn Palace segment operates private gaming salons and sky casinos; a luxury hotel tower with suites, and villas, including a health club, spa, salon, and pool; food and beverage outlets; retail space; meeting and convention space; and performance lake and floral art displays.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Wynn Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wynn Resorts wasn't on the list.

While Wynn Resorts currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report