Doman Building Materials Group (TSE:DBM - Get Free Report) had its price objective cut by Stifel Nicolaus from C$12.00 to C$10.50 in a research note issued on Tuesday,BayStreet.CA reports. The firm currently has a "buy" rating on the stock. Stifel Nicolaus' target price points to a potential upside of 21.67% from the company's previous close.

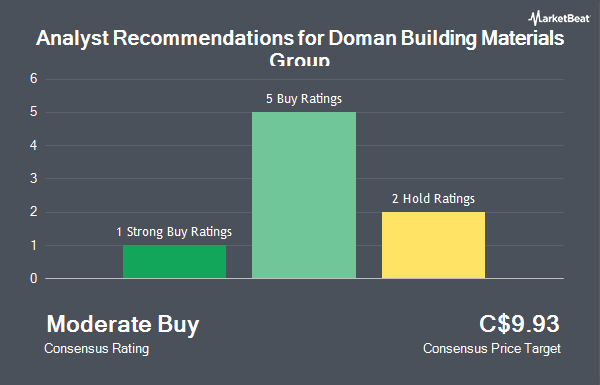

Several other research firms have also recently weighed in on DBM. TD Securities boosted their price objective on shares of Doman Building Materials Group from C$10.00 to C$11.00 and gave the company a "buy" rating in a report on Friday, August 8th. Raymond James Financial increased their price objective on shares of Doman Building Materials Group from C$10.00 to C$11.00 and gave the company a "strong-buy" rating in a research report on Thursday, August 7th. One analyst has rated the stock with a Strong Buy rating, three have issued a Buy rating and two have issued a Hold rating to the company's stock. According to MarketBeat, Doman Building Materials Group has a consensus rating of "Moderate Buy" and an average target price of C$10.00.

View Our Latest Research Report on Doman Building Materials Group

Doman Building Materials Group Stock Performance

Shares of DBM traded down C$0.42 during mid-day trading on Tuesday, hitting C$8.63. 221,336 shares of the company traded hands, compared to its average volume of 175,481. The company has a debt-to-equity ratio of 112.91, a quick ratio of 1.11 and a current ratio of 2.94. The stock has a 50-day moving average price of C$9.46 and a two-hundred day moving average price of C$8.46. Doman Building Materials Group has a 1 year low of C$6.30 and a 1 year high of C$10.04. The stock has a market cap of C$756.26 million, a price-to-earnings ratio of 10.15 and a beta of 1.32.

About Doman Building Materials Group

(

Get Free Report)

Doman Building Materials Group Ltd is a wholesale distributor of building materials and home renovation products. The company services the new home construction, home renovation and industrial markets by supplying the retail and wholesale lumber and building materials industry, hardware stores, industrial and furniture manufacturers and similar concerns.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Doman Building Materials Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Doman Building Materials Group wasn't on the list.

While Doman Building Materials Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.