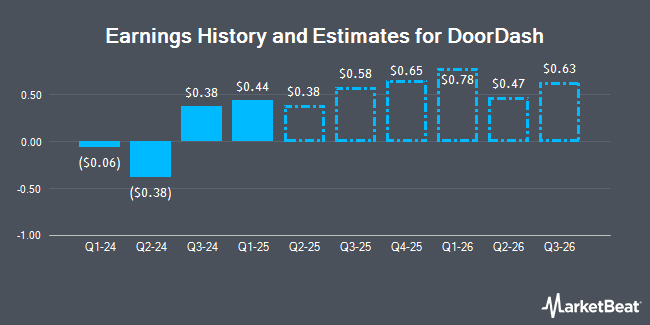

DoorDash, Inc. (NASDAQ:DASH - Free Report) - Investment analysts at Cantor Fitzgerald raised their FY2025 EPS estimates for DoorDash in a report issued on Wednesday, June 25th. Cantor Fitzgerald analyst D. Mathivanan now forecasts that the company will post earnings per share of $1.71 for the year, up from their prior estimate of $1.69. Cantor Fitzgerald currently has a "Overweight" rating and a $260.00 target price on the stock. The consensus estimate for DoorDash's current full-year earnings is $2.22 per share. Cantor Fitzgerald also issued estimates for DoorDash's FY2026 earnings at $2.78 EPS.

DoorDash (NASDAQ:DASH - Get Free Report) last issued its earnings results on Tuesday, May 6th. The company reported $0.44 earnings per share for the quarter, beating analysts' consensus estimates of $0.39 by $0.05. The business had revenue of $3.03 billion during the quarter, compared to analyst estimates of $3.10 billion. DoorDash had a return on equity of 4.39% and a net margin of 3.02%. DoorDash's revenue was up 20.7% on a year-over-year basis. During the same period in the previous year, the company posted ($0.06) EPS.

Several other equities research analysts have also commented on DASH. Wall Street Zen upgraded shares of DoorDash from a "hold" rating to a "buy" rating in a report on Saturday, June 7th. DA Davidson lifted their price objective on shares of DoorDash from $150.00 to $190.00 and gave the company a "neutral" rating in a report on Tuesday, May 6th. FBN Securities started coverage on DoorDash in a report on Friday, March 28th. They set an "outperform" rating and a $230.00 target price for the company. Morgan Stanley dropped their target price on DoorDash from $245.00 to $210.00 and set an "overweight" rating on the stock in a research report on Thursday, April 17th. Finally, Royal Bank Of Canada reissued an "outperform" rating and issued a $230.00 price target on shares of DoorDash in a research report on Wednesday, May 7th. Eleven investment analysts have rated the stock with a hold rating, twenty-four have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $214.76.

Check Out Our Latest Stock Report on DoorDash

DoorDash Price Performance

NASDAQ:DASH opened at $232.68 on Thursday. DoorDash has a 1-year low of $99.32 and a 1-year high of $238.47. The company has a 50-day moving average of $203.65 and a 200 day moving average of $190.41. The firm has a market cap of $98.60 billion, a PE ratio of 302.19 and a beta of 1.67.

Insider Buying and Selling at DoorDash

In related news, Director Stanley Tang sold 45,410 shares of the firm's stock in a transaction dated Tuesday, April 1st. The stock was sold at an average price of $181.21, for a total transaction of $8,228,746.10. Following the sale, the director now directly owns 18,285 shares of the company's stock, valued at $3,313,424.85. This trade represents a 71.29% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director Shona L. Brown sold 825 shares of the business's stock in a transaction that occurred on Monday, June 23rd. The shares were sold at an average price of $230.00, for a total value of $189,750.00. Following the completion of the transaction, the director now directly owns 46,461 shares of the company's stock, valued at $10,686,030. The trade was a 1.74% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 332,127 shares of company stock worth $67,346,994. Company insiders own 5.83% of the company's stock.

Hedge Funds Weigh In On DoorDash

Several large investors have recently made changes to their positions in DASH. Vanguard Group Inc. lifted its position in shares of DoorDash by 25.8% during the 1st quarter. Vanguard Group Inc. now owns 39,397,286 shares of the company's stock valued at $7,200,642,000 after buying an additional 8,073,882 shares in the last quarter. Capital World Investors raised its position in DoorDash by 26.4% during the fourth quarter. Capital World Investors now owns 12,153,265 shares of the company's stock worth $2,038,712,000 after acquiring an additional 2,538,160 shares during the period. Price T Rowe Associates Inc. MD lifted its holdings in DoorDash by 15.0% during the first quarter. Price T Rowe Associates Inc. MD now owns 4,907,970 shares of the company's stock valued at $897,031,000 after purchasing an additional 641,601 shares in the last quarter. Invesco Ltd. grew its position in shares of DoorDash by 41.9% in the first quarter. Invesco Ltd. now owns 4,799,851 shares of the company's stock valued at $877,269,000 after purchasing an additional 1,416,194 shares during the period. Finally, Franklin Resources Inc. grew its position in shares of DoorDash by 25.0% in the fourth quarter. Franklin Resources Inc. now owns 4,749,810 shares of the company's stock valued at $796,781,000 after purchasing an additional 949,414 shares during the period. 90.64% of the stock is currently owned by institutional investors and hedge funds.

About DoorDash

(

Get Free Report)

DoorDash, Inc, together with its subsidiaries, operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally. The company operates DoorDash Marketplace and Wolt Marketplace, which provide various services, such as customer acquisition, demand generation, order fulfillment, merchandising, payment processing, and customer support.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider DoorDash, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DoorDash wasn't on the list.

While DoorDash currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report