DoubleDown Interactive (NASDAQ:DDI - Get Free Report) is expected to post its Q2 2025 quarterly earnings results after the market closes on Tuesday, August 12th. Analysts expect DoubleDown Interactive to post earnings of $0.51 per share and revenue of $83.13 million for the quarter.

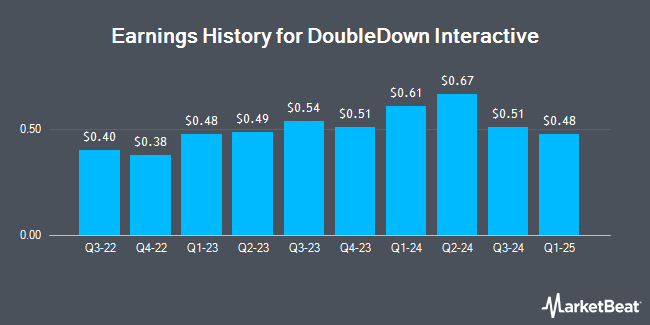

DoubleDown Interactive (NASDAQ:DDI - Get Free Report) last announced its quarterly earnings data on Tuesday, May 13th. The company reported $0.48 earnings per share for the quarter, missing analysts' consensus estimates of $0.55 by ($0.07). DoubleDown Interactive had a return on equity of 14.21% and a net margin of 34.95%. The firm had revenue of $83.49 million during the quarter, compared to analysts' expectations of $84.63 million. On average, analysts expect DoubleDown Interactive to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

DoubleDown Interactive Price Performance

NASDAQ DDI remained flat at $9.32 during mid-day trading on Friday. 13,007 shares of the company were exchanged, compared to its average volume of 44,075. DoubleDown Interactive has a 52 week low of $8.09 and a 52 week high of $18.21. The firm has a market cap of $461.81 million, a PE ratio of 3.92 and a beta of 0.86. The business's 50-day moving average price is $9.66 and its two-hundred day moving average price is $9.86. The company has a current ratio of 16.04, a quick ratio of 16.04 and a debt-to-equity ratio of 0.04.

Analysts Set New Price Targets

A number of equities analysts recently weighed in on the stock. B. Riley decreased their price objective on shares of DoubleDown Interactive from $23.00 to $22.00 and set a "buy" rating for the company in a report on Wednesday, May 14th. Wall Street Zen lowered shares of DoubleDown Interactive from a "buy" rating to a "hold" rating in a report on Thursday, May 22nd. Roth Capital initiated coverage on shares of DoubleDown Interactive in a report on Monday, June 23rd. They issued a "buy" rating and a $16.00 price objective for the company. Finally, Wedbush upgraded shares of DoubleDown Interactive to a "strong-buy" rating in a research note on Tuesday, July 1st. One analyst has rated the stock with a hold rating, three have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Buy" and an average target price of $19.25.

View Our Latest Stock Analysis on DoubleDown Interactive

Institutional Investors Weigh In On DoubleDown Interactive

A hedge fund recently raised its stake in DoubleDown Interactive stock. Acadian Asset Management LLC raised its stake in shares of DoubleDown Interactive Co., Ltd. Sponsored ADR (NASDAQ:DDI - Free Report) by 124.7% in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 60,282 shares of the company's stock after buying an additional 33,459 shares during the period. Acadian Asset Management LLC owned about 0.12% of DoubleDown Interactive worth $591,000 as of its most recent SEC filing.

About DoubleDown Interactive

(

Get Free Report)

DoubleDown Interactive Co, Ltd. engages in the development and publishing of casual games and mobile applications in South Korea. It publishes digital gaming content on mobile and web platforms. The company offers DoubleDown Casino, DoubleDown Classic, DoubleDown Fort Knox, and cash me out games, as well as sells in-game virtual chips.

Further Reading

Before you consider DoubleDown Interactive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DoubleDown Interactive wasn't on the list.

While DoubleDown Interactive currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.