DoubleVerify (NYSE:DV - Get Free Report)'s stock had its "outperform" rating reissued by BMO Capital Markets in a note issued to investors on Wednesday,Benzinga reports. They presently have a $27.00 price target on the stock, up from their prior price target of $26.00. BMO Capital Markets' price objective suggests a potential upside of 81.33% from the stock's previous close.

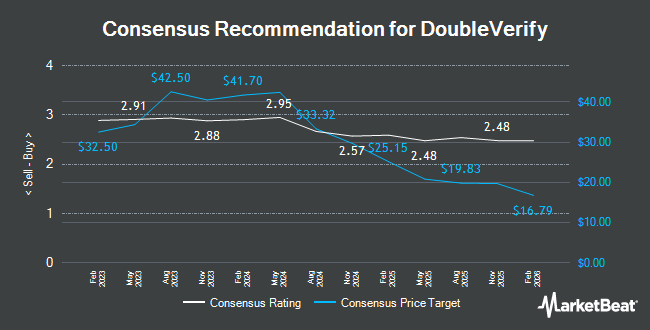

Several other brokerages also recently weighed in on DV. Craig Hallum reaffirmed a "buy" rating and issued a $20.00 target price on shares of DoubleVerify in a research report on Monday, July 7th. JPMorgan Chase & Co. raised DoubleVerify from a "neutral" rating to an "overweight" rating and upped their target price for the stock from $18.00 to $19.00 in a research report on Friday, August 1st. The Goldman Sachs Group decreased their target price on DoubleVerify from $20.00 to $15.50 and set a "neutral" rating for the company in a research report on Monday, April 14th. Needham & Company LLC reaffirmed a "buy" rating and issued a $18.00 target price on shares of DoubleVerify in a research report on Thursday, June 12th. Finally, Canaccord Genuity Group decreased their target price on DoubleVerify from $26.00 to $24.00 and set a "buy" rating for the company in a research report on Thursday, April 17th. One equities research analyst has rated the stock with a sell rating, seven have assigned a hold rating and fourteen have issued a buy rating to the stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $19.13.

Read Our Latest Analysis on DoubleVerify

DoubleVerify Trading Up 0.4%

DoubleVerify stock traded up $0.06 during trading on Wednesday, hitting $14.89. The company's stock had a trading volume of 2,642,081 shares, compared to its average volume of 2,272,343. The stock has a market capitalization of $2.44 billion, a price-to-earnings ratio of 51.31, a P/E/G ratio of 2.22 and a beta of 1.05. The stock's fifty day moving average is $15.05 and its 200 day moving average is $15.56. DoubleVerify has a 1-year low of $11.52 and a 1-year high of $23.11. The company has a debt-to-equity ratio of 0.01, a quick ratio of 4.41 and a current ratio of 4.41.

DoubleVerify (NYSE:DV - Get Free Report) last announced its quarterly earnings results on Tuesday, August 5th. The company reported $0.05 EPS for the quarter, missing the consensus estimate of $0.06 by ($0.01). The firm had revenue of $189.02 million for the quarter, compared to analyst estimates of $171.14 million. DoubleVerify had a return on equity of 4.86% and a net margin of 7.38%. The business's revenue was up 21.3% compared to the same quarter last year. During the same quarter in the prior year, the company earned $0.04 earnings per share. As a group, equities research analysts predict that DoubleVerify will post 0.36 EPS for the current year.

Institutional Inflows and Outflows

Hedge funds have recently made changes to their positions in the stock. Signaturefd LLC increased its stake in shares of DoubleVerify by 582.9% during the first quarter. Signaturefd LLC now owns 2,322 shares of the company's stock valued at $31,000 after acquiring an additional 1,982 shares during the period. Parallel Advisors LLC increased its position in shares of DoubleVerify by 572.1% during the 2nd quarter. Parallel Advisors LLC now owns 2,386 shares of the company's stock valued at $36,000 after purchasing an additional 2,031 shares during the period. Quadrant Capital Group LLC boosted its stake in shares of DoubleVerify by 171.6% during the 4th quarter. Quadrant Capital Group LLC now owns 2,034 shares of the company's stock worth $39,000 after acquiring an additional 1,285 shares in the last quarter. Versant Capital Management Inc bought a new stake in shares of DoubleVerify during the 1st quarter worth $40,000. Finally, Farther Finance Advisors LLC boosted its position in shares of DoubleVerify by 3,035.6% in the second quarter. Farther Finance Advisors LLC now owns 3,167 shares of the company's stock worth $47,000 after buying an additional 3,066 shares during the period. Institutional investors and hedge funds own 97.29% of the company's stock.

DoubleVerify Company Profile

(

Get Free Report)

DoubleVerify Holdings, Inc provides a software platform for digital media measurement, and data analytics in the United States and internationally. The company provides solutions to advertisers that enable advertisers to increase the effectiveness and quality and return on their digital advertising investments.

Featured Stories

Before you consider DoubleVerify, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DoubleVerify wasn't on the list.

While DoubleVerify currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.