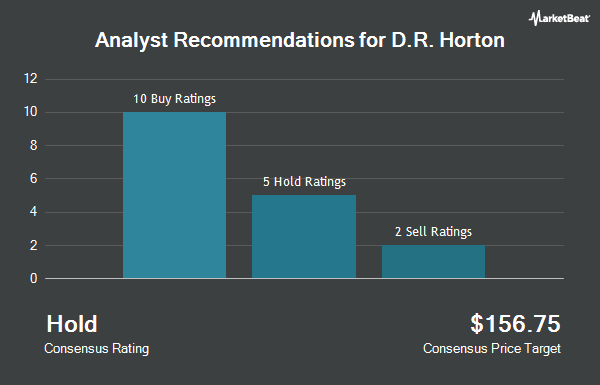

Shares of D.R. Horton, Inc. (NYSE:DHI - Get Free Report) have earned an average recommendation of "Hold" from the fifteen analysts that are currently covering the company, Marketbeat.com reports. Two research analysts have rated the stock with a sell rating, six have assigned a hold rating, six have assigned a buy rating and one has given a strong buy rating to the company. The average 1-year price target among brokers that have issued a report on the stock in the last year is $151.15.

Several research analysts recently issued reports on DHI shares. JMP Securities decreased their price target on shares of D.R. Horton from $210.00 to $180.00 and set a "market outperform" rating for the company in a research note on Monday, April 21st. The Goldman Sachs Group dropped their price target on shares of D.R. Horton from $173.00 to $150.00 and set a "buy" rating on the stock in a report on Tuesday, April 15th. Royal Bank Of Canada dropped their price target on shares of D.R. Horton from $125.00 to $105.00 and set an "underperform" rating on the stock in a report on Monday, April 21st. Barclays dropped their price target on shares of D.R. Horton from $120.00 to $110.00 and set an "equal weight" rating on the stock in a report on Monday, April 21st. Finally, Bank of America dropped their price target on shares of D.R. Horton from $150.00 to $125.00 and set a "neutral" rating on the stock in a report on Thursday, April 17th. Softer demand and elevated incentives impacting outlook through H2 2025

Check Out Our Latest Research Report on D.R. Horton

D.R. Horton Trading Down 0.7%

Shares of DHI opened at $130.82 on Tuesday. The stock has a market capitalization of $40.19 billion, a P/E ratio of 9.90, a PEG ratio of 4.13 and a beta of 1.38. The company has a quick ratio of 1.15, a current ratio of 7.29 and a debt-to-equity ratio of 0.26. The firm has a fifty day simple moving average of $126.01 and a two-hundred day simple moving average of $128.89. D.R. Horton has a twelve month low of $110.44 and a twelve month high of $199.85.

Insider Activity at D.R. Horton

In other news, Director Michael R. Buchanan sold 2,150 shares of the stock in a transaction that occurred on Tuesday, June 24th. The stock was sold at an average price of $127.70, for a total transaction of $274,555.00. Following the transaction, the director owned 2,193 shares in the company, valued at $280,046.10. This trade represents a 49.50% decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. 0.54% of the stock is owned by insiders.

Institutional Trading of D.R. Horton

Several hedge funds have recently made changes to their positions in the business. 111 Capital grew its holdings in D.R. Horton by 23.1% during the second quarter. 111 Capital now owns 6,804 shares of the construction company's stock worth $877,000 after acquiring an additional 1,275 shares during the period. Vaughan Nelson Investment Management L.P. lifted its position in D.R. Horton by 148.1% during the second quarter. Vaughan Nelson Investment Management L.P. now owns 204,233 shares of the construction company's stock worth $26,330,000 after buying an additional 121,923 shares during the period. Ascent Group LLC lifted its position in D.R. Horton by 40.1% during the second quarter. Ascent Group LLC now owns 2,557 shares of the construction company's stock worth $330,000 after buying an additional 732 shares during the period. Two Point Capital Management Inc. purchased a new position in D.R. Horton during the second quarter worth about $17,496,000. Finally, Hilltop National Bank acquired a new stake in D.R. Horton during the second quarter worth about $154,000. Institutional investors and hedge funds own 90.63% of the company's stock.

D.R. Horton Company Profile

(

Get Free ReportD.R. Horton, Inc operates as a homebuilding company in East, North, Southeast, South Central, Southwest, and Northwest regions in the United States. It engages in the acquisition and development of land; and construction and sale of residential homes in 118 markets across 33 states under the names of D.R.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider D.R. Horton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and D.R. Horton wasn't on the list.

While D.R. Horton currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.