JPMorgan Chase & Co. began coverage on shares of DraftKings (NASDAQ:DKNG - Free Report) in a report issued on Monday, Marketbeat.com reports. The brokerage issued an overweight rating and a $50.00 price objective on the stock.

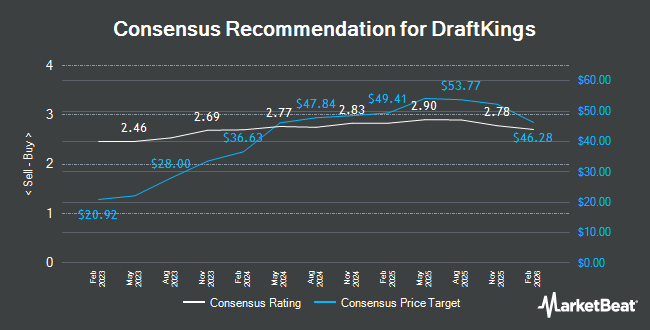

Other analysts also recently issued research reports about the company. Truist Financial decreased their price target on DraftKings from $60.00 to $50.00 and set a "buy" rating for the company in a research note on Wednesday, April 23rd. Susquehanna boosted their target price on DraftKings from $42.00 to $52.00 and gave the stock a "positive" rating in a report on Monday, May 12th. Barclays lowered their price target on DraftKings from $50.00 to $48.00 and set an "overweight" rating on the stock in a report on Monday, May 12th. Bank of America cut their target price on shares of DraftKings from $60.00 to $50.00 and set a "buy" rating for the company in a research report on Friday, May 9th. Finally, BTIG Research decreased their price target on shares of DraftKings from $64.00 to $52.00 and set a "buy" rating for the company in a report on Tuesday, April 22nd. One equities research analyst has rated the stock with a hold rating and twenty-seven have assigned a buy rating to the company's stock. According to MarketBeat, the company has an average rating of "Moderate Buy" and a consensus target price of $54.03.

Check Out Our Latest Stock Analysis on DKNG

DraftKings Stock Up 0.5%

NASDAQ:DKNG traded up $0.20 during trading hours on Monday, reaching $43.01. The company's stock had a trading volume of 1,892,080 shares, compared to its average volume of 9,656,843. The company has a debt-to-equity ratio of 2.11, a current ratio of 1.20 and a quick ratio of 1.20. The company has a market cap of $38.25 billion, a price-to-earnings ratio of -51.83, a price-to-earnings-growth ratio of 1.26 and a beta of 1.63. DraftKings has a one year low of $28.69 and a one year high of $53.61. The business's 50-day moving average is $35.83 and its 200-day moving average is $38.42.

Insider Buying and Selling

In other news, insider Matthew Kalish sold 210,000 shares of the firm's stock in a transaction that occurred on Tuesday, May 13th. The shares were sold at an average price of $37.83, for a total transaction of $7,944,300.00. Following the completion of the sale, the insider now owns 4,155,130 shares of the company's stock, valued at approximately $157,188,567.90. This trade represents a 4.81% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Also, insider R Stanton Dodge sold 158,331 shares of the company's stock in a transaction dated Wednesday, June 18th. The stock was sold at an average price of $39.00, for a total transaction of $6,174,909.00. Following the transaction, the insider now owns 504,381 shares in the company, valued at approximately $19,670,859. This trade represents a 23.89% decrease in their position. The disclosure for this sale can be found here. Insiders sold 536,627 shares of company stock worth $19,748,622 in the last 90 days. 47.08% of the stock is owned by company insiders.

Institutional Investors Weigh In On DraftKings

Several hedge funds and other institutional investors have recently made changes to their positions in DKNG. Beacon Pointe Advisors LLC boosted its holdings in DraftKings by 1.9% in the fourth quarter. Beacon Pointe Advisors LLC now owns 10,699 shares of the company's stock valued at $398,000 after acquiring an additional 203 shares during the last quarter. Nissay Asset Management Corp Japan ADV lifted its position in DraftKings by 0.3% during the 4th quarter. Nissay Asset Management Corp Japan ADV now owns 77,696 shares of the company's stock valued at $2,946,000 after purchasing an additional 217 shares during the period. Brooklyn Investment Group boosted its stake in shares of DraftKings by 7.3% in the 1st quarter. Brooklyn Investment Group now owns 3,987 shares of the company's stock valued at $132,000 after purchasing an additional 270 shares during the last quarter. Allworth Financial LP grew its position in shares of DraftKings by 8.0% during the 4th quarter. Allworth Financial LP now owns 3,659 shares of the company's stock worth $150,000 after buying an additional 271 shares during the period. Finally, Snowden Capital Advisors LLC grew its position in shares of DraftKings by 3.5% during the 4th quarter. Snowden Capital Advisors LLC now owns 8,724 shares of the company's stock worth $325,000 after buying an additional 296 shares during the period. 37.70% of the stock is owned by institutional investors and hedge funds.

DraftKings Company Profile

(

Get Free Report)

DraftKings Inc operates as a digital sports entertainment and gaming company in the United States and internationally. It provides online sports betting and casino, daily fantasy sports, media, and other consumer products, as well as retails sportsbooks. The company also engages in the design and development of sports betting and casino gaming software for online and retail sportsbooks, and iGaming operators.

Read More

Before you consider DraftKings, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DraftKings wasn't on the list.

While DraftKings currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.