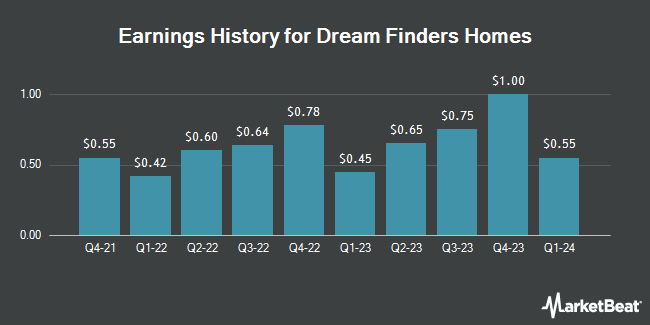

Dream Finders Homes (NASDAQ:DFH - Get Free Report) released its quarterly earnings data on Thursday. The company reported $0.57 EPS for the quarter, missing the consensus estimate of $0.65 by ($0.08), Briefing.com reports. Dream Finders Homes had a return on equity of 30.18% and a net margin of 7.65%. The firm's revenue was up 9.0% on a year-over-year basis. During the same period in the previous year, the company posted $0.83 earnings per share.

Dream Finders Homes Stock Performance

Shares of DFH traded down $0.28 during mid-day trading on Wednesday, reaching $25.98. The company had a trading volume of 100,282 shares, compared to its average volume of 458,206. The firm has a 50-day moving average price of $24.91 and a 200 day moving average price of $23.57. Dream Finders Homes has a 52 week low of $19.65 and a 52 week high of $39.15. The company has a market capitalization of $2.43 billion, a price-to-earnings ratio of 8.54, a price-to-earnings-growth ratio of 1.28 and a beta of 1.90.

Insider Activity at Dream Finders Homes

In other news, CEO Patrick O. Zalupski sold 10,416 shares of the business's stock in a transaction that occurred on Wednesday, July 23rd. The stock was sold at an average price of $28.47, for a total value of $296,543.52. Following the sale, the chief executive officer directly owned 1,989,091 shares of the company's stock, valued at $56,629,420.77. The trade was a 0.52% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Over the last quarter, insiders sold 31,264 shares of company stock valued at $855,698. Insiders own 68.16% of the company's stock.

Institutional Trading of Dream Finders Homes

A number of hedge funds have recently made changes to their positions in DFH. Royal Bank of Canada raised its stake in Dream Finders Homes by 39.3% during the 1st quarter. Royal Bank of Canada now owns 10,275 shares of the company's stock valued at $232,000 after buying an additional 2,898 shares during the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its stake in Dream Finders Homes by 4.3% during the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 16,597 shares of the company's stock valued at $374,000 after buying an additional 681 shares during the last quarter. Finally, Goldman Sachs Group Inc. raised its stake in Dream Finders Homes by 8.6% during the 1st quarter. Goldman Sachs Group Inc. now owns 519,873 shares of the company's stock valued at $11,728,000 after buying an additional 41,117 shares during the last quarter. 95.55% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

Separately, Wedbush reaffirmed a "neutral" rating and set a $26.00 price objective on shares of Dream Finders Homes in a research report on Tuesday, May 6th.

Read Our Latest Stock Analysis on DFH

About Dream Finders Homes

(

Get Free Report)

Dream Finders Homes, Inc operates as a holding company for Dream Finders Homes LLC that engages in homebuilding business in the United States. The company operates through four segments: Southeast, Mid-Atlantic, Midwest, and Financial Services. It designs, constructs, and sells single-family entry-level, and first-time and second time move-up homes, as well as active adult homes and custom homes in Florida, Texas, Tennessee, North Carolina, South Carolina, Georgia, Colorado, and the Washington, DC metropolitan area.

See Also

Before you consider Dream Finders Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dream Finders Homes wasn't on the list.

While Dream Finders Homes currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.