DXP Enterprises (NASDAQ:DXPE - Get Free Report) will likely be issuing its Q2 2025 quarterly earnings data after the market closes on Wednesday, August 6th. Analysts expect the company to announce earnings of $1.39 per share and revenue of $499.00 million for the quarter.

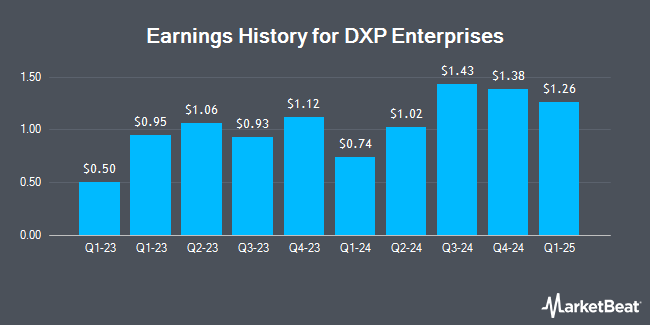

DXP Enterprises (NASDAQ:DXPE - Get Free Report) last posted its earnings results on Wednesday, May 7th. The industrial products company reported $1.26 EPS for the quarter, topping the consensus estimate of $1.20 by $0.06. DXP Enterprises had a net margin of 4.27% and a return on equity of 20.41%. The firm had revenue of $476.57 million for the quarter, compared to analysts' expectations of $477.00 million. On average, analysts expect DXP Enterprises to post $4 EPS for the current fiscal year and $4 EPS for the next fiscal year.

DXP Enterprises Stock Performance

NASDAQ DXPE traded up $1.62 during trading hours on Tuesday, reaching $114.01. 115,664 shares of the company were exchanged, compared to its average volume of 186,072. DXP Enterprises has a 1 year low of $45.00 and a 1 year high of $115.00. The business's 50 day simple moving average is $90.29 and its 200-day simple moving average is $89.43. The company has a quick ratio of 2.25, a current ratio of 2.70 and a debt-to-equity ratio of 1.40. The stock has a market capitalization of $1.79 billion, a P/E ratio of 23.70 and a beta of 1.25.

Insider Activity at DXP Enterprises

In related news, CMO Paz Maestas sold 3,000 shares of the business's stock in a transaction that occurred on Wednesday, June 18th. The shares were sold at an average price of $79.09, for a total transaction of $237,270.00. Following the completion of the transaction, the chief marketing officer owned 607,737 shares of the company's stock, valued at approximately $48,065,919.33. The trade was a 0.49% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, COO Nicholas Little sold 45,938 shares of DXP Enterprises stock in a transaction that occurred on Monday, June 30th. The shares were sold at an average price of $87.73, for a total transaction of $4,030,140.74. Following the sale, the chief operating officer owned 812,328 shares of the company's stock, valued at approximately $71,265,535.44. The trade was a 5.35% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 53,938 shares of company stock valued at $4,690,731. 22.70% of the stock is owned by corporate insiders.

Institutional Investors Weigh In On DXP Enterprises

Hedge funds have recently bought and sold shares of the stock. Millennium Management LLC lifted its position in DXP Enterprises by 661.5% during the first quarter. Millennium Management LLC now owns 128,956 shares of the industrial products company's stock valued at $10,608,000 after purchasing an additional 112,021 shares during the last quarter. Jane Street Group LLC lifted its position in DXP Enterprises by 433.8% during the first quarter. Jane Street Group LLC now owns 58,954 shares of the industrial products company's stock valued at $4,850,000 after purchasing an additional 47,909 shares during the last quarter. Finally, Royal Bank of Canada lifted its position in DXP Enterprises by 29.4% during the first quarter. Royal Bank of Canada now owns 5,071 shares of the industrial products company's stock valued at $417,000 after purchasing an additional 1,153 shares during the last quarter. 74.82% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen downgraded shares of DXP Enterprises from a "buy" rating to a "hold" rating in a research note on Friday, May 16th.

Check Out Our Latest Stock Analysis on DXP Enterprises

DXP Enterprises Company Profile

(

Get Free Report)

DXP Enterprises, Inc, together with its subsidiaries, engages in distributing maintenance, repair, and operating (MRO) products, equipment, and services in the United States and Canada. It operates through three segments: Service Centers (SC), Supply Chain Services (SCS), and Innovative Pumping Solutions (IPS).

Further Reading

Before you consider DXP Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DXP Enterprises wasn't on the list.

While DXP Enterprises currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.