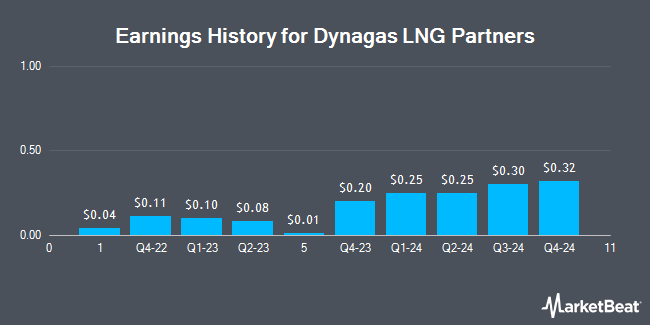

Dynagas LNG Partners (NYSE:DLNG - Get Free Report) announced its earnings results on Monday. The shipping company reported $0.25 EPS for the quarter, topping the consensus estimate of $0.24 by $0.01, Zacks reports. Dynagas LNG Partners had a net margin of 35.60% and a return on equity of 16.11%. The business had revenue of $37.37 million during the quarter, compared to analysts' expectations of $35.64 million.

Dynagas LNG Partners Stock Performance

NYSE:DLNG traded up $0.04 during mid-day trading on Friday, reaching $3.86. 10,963 shares of the company's stock were exchanged, compared to its average volume of 38,358. Dynagas LNG Partners has a one year low of $3.18 and a one year high of $5.65. The firm has a market capitalization of $141.97 million, a PE ratio of 3.45 and a beta of 0.84. The business's fifty day simple moving average is $3.63 and its two-hundred day simple moving average is $3.65. The company has a debt-to-equity ratio of 0.80, a quick ratio of 2.12 and a current ratio of 2.08.

Dynagas LNG Partners Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, August 29th. Investors of record on Monday, August 25th were given a dividend of $0.049 per share. This represents a $0.20 dividend on an annualized basis and a yield of 5.1%. The ex-dividend date of this dividend was Monday, August 25th. Dynagas LNG Partners's dividend payout ratio (DPR) is currently 17.86%.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen lowered shares of Dynagas LNG Partners from a "strong-buy" rating to a "buy" rating in a research report on Tuesday, May 20th.

Check Out Our Latest Analysis on DLNG

Hedge Funds Weigh In On Dynagas LNG Partners

An institutional investor recently raised its position in Dynagas LNG Partners stock. Geneos Wealth Management Inc. increased its holdings in shares of Dynagas LNG Partners LP (NYSE:DLNG - Free Report) by 100.0% during the second quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 43,036 shares of the shipping company's stock after acquiring an additional 21,518 shares during the quarter. Geneos Wealth Management Inc. owned about 0.12% of Dynagas LNG Partners worth $151,000 as of its most recent filing with the SEC.

Dynagas LNG Partners Company Profile

(

Get Free Report)

Dynagas LNG Partners LP, through its subsidiaries, operates in the seaborne transportation industry in Greece and internationally. The company owns and operates liquefied natural gas (LNG) carriers. Its fleet consists of six LNG carriers with an aggregate carrying capacity of approximately 914,000 cubic meters.

Featured Articles

Before you consider Dynagas LNG Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dynagas LNG Partners wasn't on the list.

While Dynagas LNG Partners currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.