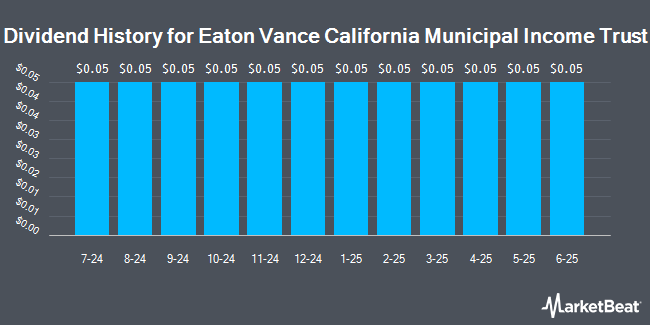

Eaton Vance California Municipal Income Trust (NYSE:CEV - Get Free Report) announced a monthly dividend on Wednesday, October 1st. Stockholders of record on Monday, October 13th will be given a dividend of 0.05 per share on Thursday, October 23rd. This represents a c) dividend on an annualized basis and a dividend yield of 6.0%. The ex-dividend date of this dividend is Monday, October 13th.

Eaton Vance California Municipal Income Trust Trading Down 0.0%

NYSE CEV opened at $10.08 on Thursday. Eaton Vance California Municipal Income Trust has a 12-month low of $9.31 and a 12-month high of $10.90. The firm's 50 day moving average is $9.66 and its 200-day moving average is $9.70.

Hedge Funds Weigh In On Eaton Vance California Municipal Income Trust

Hedge funds and other institutional investors have recently made changes to their positions in the company. Northwestern Mutual Wealth Management Co. bought a new position in shares of Eaton Vance California Municipal Income Trust in the second quarter valued at $52,000. Osaic Holdings Inc. grew its stake in shares of Eaton Vance California Municipal Income Trust by 400.0% in the second quarter. Osaic Holdings Inc. now owns 10,000 shares of the company's stock valued at $97,000 after buying an additional 8,000 shares in the last quarter. Landscape Capital Management L.L.C. bought a new position in shares of Eaton Vance California Municipal Income Trust in the first quarter valued at $126,000. Plancorp LLC bought a new position in shares of Eaton Vance California Municipal Income Trust in the first quarter valued at $200,000. Finally, Raymond James Financial Inc. grew its stake in shares of Eaton Vance California Municipal Income Trust by 7.5% in the second quarter. Raymond James Financial Inc. now owns 51,580 shares of the company's stock valued at $500,000 after buying an additional 3,606 shares in the last quarter. 35.88% of the stock is owned by institutional investors.

About Eaton Vance California Municipal Income Trust

(

Get Free Report)

Eaton Vance California Municipal Income Trust is a close ended fixed income mutual fund launched and managed by Eaton Vance Management. It invests in the fixed income markets. The fund invests primarily in debt securities issued by education, hospital, housing, insured-education, insured-electric utilities, insured-hospital, insured-transportation, insured-water and sewer, transportation, and other sectors.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Eaton Vance California Municipal Income Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eaton Vance California Municipal Income Trust wasn't on the list.

While Eaton Vance California Municipal Income Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.