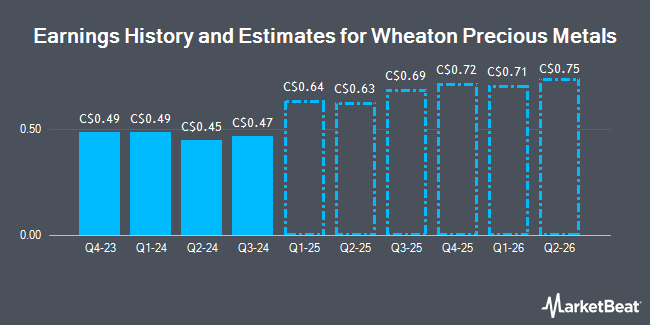

Wheaton Precious Metals Corp. (TSE:WPM - Free Report) - Analysts at Edison Inv. Res raised their Q3 2025 EPS estimates for shares of Wheaton Precious Metals in a research note issued to investors on Wednesday, September 24th. Edison Inv. Res analyst C. Gibson now anticipates that the company will earn $0.88 per share for the quarter, up from their prior forecast of $0.84. The consensus estimate for Wheaton Precious Metals' current full-year earnings is $2.47 per share. Edison Inv. Res also issued estimates for Wheaton Precious Metals' Q4 2025 earnings at $1.10 EPS and FY2025 earnings at $3.62 EPS.

A number of other equities analysts have also recently weighed in on the stock. CIBC upped their price objective on shares of Wheaton Precious Metals from C$125.00 to C$130.00 and gave the company an "outperform" rating in a research report on Friday, September 12th. Peel Hunt increased their price target on shares of Wheaton Precious Metals from C$149.00 to C$161.00 and gave the stock a "buy" rating in a research report on Monday, September 8th. Canaccord Genuity Group increased their price target on shares of Wheaton Precious Metals from C$131.00 to C$134.00 in a research report on Tuesday, June 10th. Finally, UBS Group cut shares of Wheaton Precious Metals from a "strong-buy" rating to a "hold" rating in a research report on Monday, August 11th. Three equities research analysts have rated the stock with a Strong Buy rating, four have given a Buy rating and one has given a Hold rating to the company. Based on data from MarketBeat, the stock has an average rating of "Buy" and an average target price of C$128.17.

View Our Latest Report on Wheaton Precious Metals

Wheaton Precious Metals Price Performance

TSE:WPM opened at C$152.01 on Monday. The firm has a 50-day moving average of C$136.86 and a two-hundred day moving average of C$123.45. The stock has a market cap of C$69.01 billion, a P/E ratio of 87.56 and a beta of 0.70. Wheaton Precious Metals has a 1-year low of C$79.88 and a 1-year high of C$152.21.

Wheaton Precious Metals Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, September 4th. Investors of record on Thursday, September 4th were paid a dividend of $0.165 per share. The ex-dividend date was Thursday, August 21st. This represents a $0.66 annualized dividend and a yield of 0.4%. Wheaton Precious Metals's dividend payout ratio is 36.87%.

Wheaton Precious Metals Company Profile

(

Get Free Report)

Wheaton Precious Metals is one of the largest precious metals streaming companies in the world. The Company has entered into agreements to purchase all or a portion of the precious metals or cobalt production from high-quality mines for an upfront payment and an additional payment upon delivery of the metal.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Wheaton Precious Metals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wheaton Precious Metals wasn't on the list.

While Wheaton Precious Metals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.