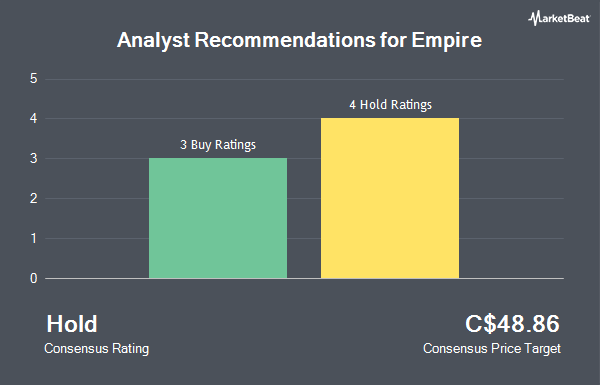

Shares of Empire Company Limited (TSE:EMP.A - Get Free Report) have received an average recommendation of "Hold" from the seven brokerages that are presently covering the firm, MarketBeat reports. Four investment analysts have rated the stock with a hold rating and three have issued a buy rating on the company. The average 1-year price target among analysts that have covered the stock in the last year is C$57.43.

EMP.A has been the topic of a number of analyst reports. CIBC upped their price target on shares of Empire from C$55.00 to C$59.00 in a research note on Friday. Royal Bank Of Canada lifted their target price on shares of Empire from C$56.00 to C$61.00 and gave the stock a "sector perform" rating in a report on Friday. National Bankshares increased their price target on shares of Empire from C$53.00 to C$59.00 and gave the company a "sector perform" rating in a report on Friday. Scotiabank raised their price target on shares of Empire from C$49.00 to C$62.00 and gave the company an "outperform" rating in a research report on Friday. Finally, Desjardins upped their price objective on Empire from C$50.00 to C$55.00 and gave the company a "buy" rating in a research report on Tuesday.

Get Our Latest Stock Analysis on EMP.A

Empire Stock Up 1.2%

Empire stock traded up C$0.63 during mid-day trading on Tuesday, hitting C$55.28. The company had a trading volume of 392,662 shares, compared to its average volume of 488,329. Empire has a 12 month low of C$33.77 and a 12 month high of C$56.41. The company has a market capitalization of C$7.76 billion, a PE ratio of 20.18, a price-to-earnings-growth ratio of 16.20 and a beta of 0.48. The stock's 50 day moving average price is C$50.90 and its two-hundred day moving average price is C$46.49. The company has a current ratio of 0.79, a quick ratio of 0.29 and a debt-to-equity ratio of 135.51.

Empire Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Wednesday, April 30th. Investors of record on Wednesday, April 30th were given a dividend of $0.20 per share. The ex-dividend date of this dividend was Tuesday, April 15th. This represents a $0.80 dividend on an annualized basis and a yield of 1.45%. Empire's dividend payout ratio (DPR) is 29.20%.

Insiders Place Their Bets

In other Empire news, Senior Officer Matthew Reindel sold 1,852 shares of the stock in a transaction that occurred on Monday, March 24th. The shares were sold at an average price of C$46.16, for a total value of C$85,488.32. Also, Senior Officer Simon Gagne sold 12,269 shares of Empire stock in a transaction on Tuesday, April 1st. The stock was sold at an average price of C$48.22, for a total transaction of C$591,611.18. 2.18% of the stock is currently owned by insiders.

About Empire

(

Get Free ReportEmpire Co Ltd key businesses are food retailing, investments, and other operations. The food retailing division operates through Empire's subsidiary Sobeys and represents nearly all of the company's income. This segment owns, affiliates, or franchises more than 1,500 stores in 10 provinces, under retail banners including Sobeys, Safeway, IGA, Foodland, FreshCo, Thrifty Foods, Lawton's Drug Stores, and multiple retail fuel locations.

Featured Articles

Before you consider Empire, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Empire wasn't on the list.

While Empire currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.